Investors all the time face contradictory forces within the inventory market, and this restoration yr of 2023 has been marked by a “bad news is good news” mentality, with sentiment directed towards an eventual decline in rates of interest. For traders who grew used to raised returns within the U.S. in the course of the lengthy bull market that ended final yr, the most effective path ahead could also be one that’s extra unfold out geographically.

Nicole Kornitzer manages the Buffalo International Fund

BUFIX,

which has a five-star score (the best score) from Morningstar in its “foreign large growth” class. The fund has $594 million in property below administration.

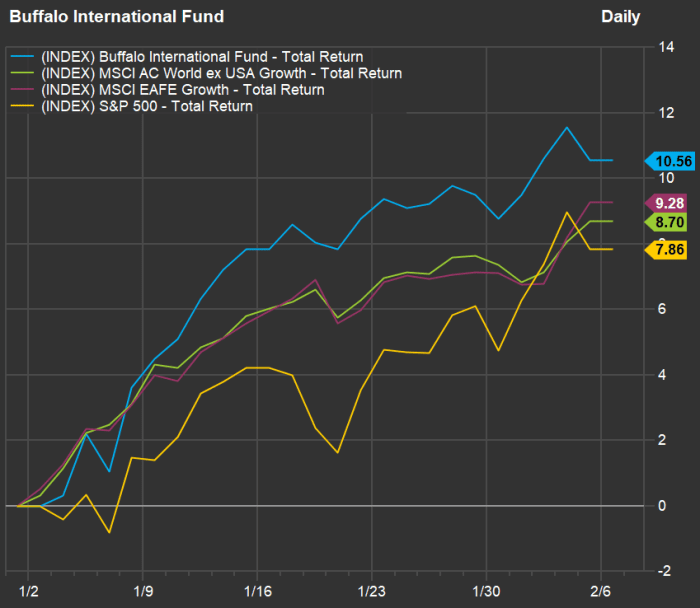

Here’s a have a look at how the Buffalo International Fund has carried out this yr via Feb. 3, in opposition to two broad non-U.S. indexes and the S&P 500:

FactSet

(All index and inventory returns on this article embody reinvested dividends.)

Kornitzer described the fund as “index agnostic,” but in addition stated it might be helpful to take a look at the MSCI EAFE Growth Index, which incorporates large-cap and midcap corporations in developed markets outdoors the U.S. and Canada; and the MSCI ACWI ex USA Growth Index, which incorporates rising markets (EM), for comparability.

The Buffalo International Fund, is especially targeted on developed markets outdoors the U.S. Stocks listed outdoors the U.S. have been main a worldwide restoration for costs this yr. Many U.S. traders would possibly suppose their index funds are diversified sufficient, however having some publicity to shares listed outdoors the U.S. would possibly result in higher general efficiency, particularly as central banks proceed to push again in opposition to inflation and international provide markets proceed their lengthy restoration.

Kornitzer stated its publicity to EM is often not above 8% and is capped at 10%, so the fund would possibly underperform throughout instances of specific energy for EM.

Kornitzer Capital Management, the funding adviser for the Buffalo Funds, is headquartered in Mission, Kan. Founded in 1989 by Kornitzer’s father, John C. Kornitzer, KCM is liable for about $6.5 billion in property below administration.

Growth with “moats”

Kornitzer stated the fund appears for shares which might be attractively priced for long-term development, specializing in corporations which have “strong moats.” This means pricing energy or robust relationships with prospects to guard in opposition to financial downturns.

For tech-oriented corporations, she additionally emphasised the “stickiness” of a enterprise — that’s, how tough it may be for a company buyer to change to a competing expertise and retrain its employees. She additionally careworn the significance of analysis and improvement, for the businesses she invests in to keep up these benefits.

Here are some examples of shares Kornitzer favors now:

STMicroelectronics

STMicroelectronics N.V.

FR:STM

STM

is predicated in Geneva and makes circuits for auto and smartphone producers, in addition to different industrial prospects. The inventory has been on fairly a tear in 2023, returning 36% to this point, following a 15% decline final yr.

Kornitzer stated STM has a bonus in silicon carbides, which she calls “the next tech in semiconductors” that’s being adopted already by makers of electrical autos, together with Tesla Inc.

TSLA,

certainly one of STM’s prospects. She stated the corporate’s gross sales of silicon carbides totaled about $700 million in 2022 and have been anticipated to extend to about $1 billion in 2023. She added that STM’s administration expects to seize a 3rd of the silicon carbide market because it expanded to annual gross sales of about $10 billion by 2030.

Nicole Kornitzer, portfolio supervisor of the Buffalo International Fund.

Kornitzer Capital Management

Kornitzer known as the semiconductor business “wonderful,” as a result of the usage of chips in electrical autos “will be a multiple” of what’s used at the moment for vehicles and vans with inside combustion engines.

She additionally stated that STM is buying and selling at a ahead price-to-earnings ratio of 13, primarily based on the consensus 2024 earnings estimate amongst analysts polled by Bloomberg. This is “at the low end of historic multiples,” she stated, in all probability reflecting the weak point in smartphone gross sales. But over time, she likes the inventory for improved free-cash movement because the silicon carbide market expands, and shorter-term, because the telephone market recovers.

Renesas

Kornitzer known as Renesas Electronics Corp.

JP:6723

of Japan

RNECY

“a real bargain,” with a ahead price-to-earnings ratio of 8, primarily based on the Bloomberg consensus earnings estimate for 2024.

She preferred Renesas long-term due to the corporate’s enlargement of its semiconductor choices past microcontroller chips to incorporate energy administration as effectively, to be able to supply “an integrated power solution” that improved revenue margins and the flexibility to retain prospects.

LVMH Moet Hennessy Louis Vuitton SE

LVMH Moet Hennessy Louis Vuitton SE

FR:MC

had a risky 2022, with shares sliding as a lot as 31% via mid-June, earlier than recovering to finish the yr with a ten% decline. So far in 2023, the inventory is up 23%.

Kornitzer preferred the corporate as a long-term play on the rising variety of prosperous folks world wide. When requested a few doable decline in luxurious purchases throughout a time of financial uncertainty, she stated LVMH would proceed to have pricing energy due to the demand for its manufacturers, which embody Tiffany, Christian Dior, Fendi and lots of others, noting its “ability, in the face of a downturn, to cut costs.”

“LVMH is very good at keeping their brands on top. And they generate free-cash flow to continue buying brands,” she stated, including that the corporate’s buy of Tiffany has ended up effectively, as a result of they “elevated it” and improved its revenue margins.

Merk KGaA

According to Kornitzer, all three divisions of Merk

XE:MRK

are “backed by nice, long-term secular growth trends.” The divisions are pharmaceutical: drugs to deal with most cancers, a number of sclerosis and infertility; life sciences, which makes gear used to make biopharmaceuticals; and efficiency supplies, which makes chemical substances used within the semiconductor business.

She stated monetary comparisons in 2022 have been tough due to diminished income tied to the Covid-19 pandemic, in addition to the stress within the semiconductor business.

Looking forward, she stated she expects enchancment, with “new pipeline products for health care” on the finish of the yr. This means she expects earnings estimates to be too low heading into 2024. Upward revisions from analysts can help larger share costs.

Hexagon

Hexagon AB

SE:HEXA

of Sweden supplies companies and gear utilized in high-tech manufacturing. Some of the developments the corporate is tied to incorporate the usage of synthetic intelligence for manufacturing high quality management.

According to Kornitzer, about 40% of the corporate’s income is recurring, and continuous acquisitions of software program companies that may be built-in into its companies “have improved margins over time,” whereas stabilizing the enterprise and growing money movement.

Top holdings

Here are the biggest 10 holdings (out of 80) of the Buffalo International Fund as of Dec. 31:

| Company | Ticker | Country | % of portfolio |

| Linde PLC | XE:LIN | U.Okay. | 2.8% |

| Aon PLC Class A | AON | Ireland | 2.4% |

| Merk KGaA | XE:MRK | Germany | 2.3% |

| Schneider Electric SE | FR:SU | France | 2.2% |

| Ashtead Group PLC ADR | ASHTY | U.Okay. | 2.1% |

| Hexagon AB Class B | SE:HEXA | Sweden | 2.0% |

| ICICI Bank Ltd. ADR | IBN | India | 2.0% |

| Taiwan Semiconductor Manufacturing Co. Ltd. ADR | TSM | Taiwan | 2.0% |

| Thales SA | THLEF | France | 2.0% |

| AstraZeneca PLC | AZNCF | U.Okay. | 1.8% |

| Source: FactSet | |||

Click the tickers for extra about every firm.

Read: Tomi Kilgore’s detailed information to the wealth of knowledge obtainable free of charge on the MarketWatch quote web page.

Most of the shares on the listing have the native tickers the place they’re listed. Linde PLC

XE:LIN

LIN

can be delisted from the Frankfurt inventory trade on Feb. 27 due to an organization reorganization, however the inventory will proceed to be traded on the New York Stock Exchange below the ticker LIN.

Read: Large-cap shares with excessive worldwide publicity outperform domestics on optimism about non-U.S. equities

Source web site: www.marketwatch.com