Hello! This is MarketWatch reporter Isabel Wang bringing you this week’s ETF Wrap. In this week’s version, we take a look at ETF methods which have exploded in reputation in 2023, and whether or not they may proceed to achieve momentum within the yr forward.

Please ship suggestions or suggestions to isabel.wang@marketwatch.com or to christine.idzelis@marketwatch.com. You also can observe me on X at @Isabelxwang and discover Christine at @CIdzelis.

Sign up right here for our weekly ETF Wrap.

U.S. exchange-traded funds have had a robust 2023, attracting round $580 billion in web inflows with belongings climbing to a document $8.1 trillion as of December 27, in keeping with FactSet knowledge.

ETFs monitoring the large-cap benchmark S&P 500 index

SPX,

which has risen 24.6% this yr, have seen the strongest web inflows in 2023 among the many almost 700 funds MarketWatch tracks, in keeping with FactSet knowledge.

The SPDR S&P 500 ETF Trust

SPY,

the world’s largest and oldest ETF with $493 billion belongings below administration, has recorded the most important web inflows of over $47 billion this yr so far, adopted by the Vanguard S&P 500 ETF’s

VOO

$41 billion and the iShares Core S&P 500 ETF’s

IVV

$36 billion over the identical interval, in keeping with FactSet knowledge.

In phrases of year-to-date efficiency, technology-related inventory funds have proven a exceptional turnaround in 2023 after dealing with a tumultuous bear market the yr earlier than. Some of the ETFs monitoring the tech-heavy Nasdaq 100 index

NDX

in addition to semiconductor shares are on tempo to complete 2023 with positive aspects of greater than 50%, because of the rise of the “Magnificent Seven” shares.

The Fidelity Blue-Chip Growth ETF

FBCG

has jumped 58.7% in 2023 to turn out to be the best-performing U.S. fund, excluding ETNs and leveraged merchandise, in keeping with FactSet knowledge. The WisdomTree U.S. Quality Growth Fund

QGRW

is up 56.2% this yr, whereas the Invesco QQQ Trust Series I

QQQ

has risen 55.6% in 2023. Gains in all of those funds have been fueled by an enormous rally in mega-cap expertise shares similar to Apple Inc.

AAPL,

and Nvidia Corp.

NVDA,

which have surged 49% and 239% this yr, respectively, in keeping with FactSet knowledge.

Will these ETF methods proceed to thrive in 2024? Will others emerge to ship larger returns subsequent yr? Here’s how one CFRA ETF analyst sees issues shaping up within the new yr.

Tech-driven progress ETFs will proceed to face out in 2024

The current sturdy efficiency of expertise and growth-driven ETFs is more likely to proceed in 2024, though with increased volatility, in keeping with Aniket Ullal, senior vice chairman and head of ETF knowledge and analytics at CFRA.

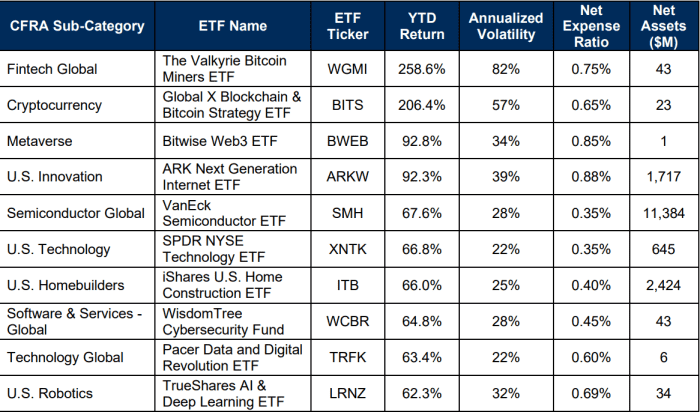

The desk under summarizes the perfect performing ETF sub-categories in 2023, excluding leveraged and inverse ETFs. The finest ETF sectors have featured tech- and growth-related themes like fintech, cryptocurrency, semiconductors, software program and the metaverse. “These themes are very likely to continue to have a strong year in 2024,” stated Ullal.

SOURCE: CFRA ETF DATABASE, DATA AS OF DECEMBER 18, 2023

One concern for traders is whether or not ETFs linked to expertise sectors can proceed to understand in 2024. But CFRA’s analysts assume that among the largest tech companies have sturdy steadiness sheets and money flows, so they need to be “safe havens” with “a growth tilt” subsequent yr.

“Despite the AI-driven current run-up, the tech sector continues to be rising into its a number of, and ETFs just like the Technology Select Sector SPDR Fund

XLK

don’t but have frothy multiples,” Ullal stated in a Friday consumer observe.

See: ‘Magnificent Seven’ up for an additional bull run? What to count on from expertise shares in 2024.

Meanwhile, the huge quantities of money parked at U.S. money-market funds might additionally preserve the bull-market rally chugging alongside subsequent yr.

As of December 20, there was nonetheless $5.9 trillion sitting in U.S. money-market funds, in keeping with knowledge compiled by the Investment Company Institute. But given the stock-market rally in 2023 and the “likely pivot” to interest-rate cuts subsequent yr by the Federal Reserve, Ullal and his crew see traders transferring cash out of cash-like devices and migrating again to 60/40 portfolios by rising their fairness publicity subsequent yr, he wrote.

Continued progress in options-based ETFs

ETFs utilizing options-based methods, similar to covered-call ETFs or defined-outcome ETFs, have exploded in reputation in 2023. They have “long-term staying power” in sustaining investor curiosity within the yr forward, stated Ullal.

Specifically, the most important U.S. covered-call ETF, the $31 billion JPMorgan Equity Premium Income ETF

JEPI,

has seen $13 billion in web inflows up to now this yr and is among the many top-five funds attracting essentially the most capital in 2023, in keeping with FactSet knowledge.

A covered-call ETF, or an option-income ETF, is a fund that makes use of an choices technique referred to as covered-call writing to generate earnings by means of gathering premiums. In a covered-call commerce, traders promote a name choice on an asset they maintain, which supplies the client of the choice the suitable, not the duty, to buy the asset from them at a specified “strike” worth on or earlier than a sure date.

When the value of the asset goes down and doesn’t attain the “strike” worth earlier than the expiration date, the decision choice will expire as consumers stroll away, however traders might nonetheless preserve the premium as their payout.

That’s why the covered-call technique often performs nicely in a sideways or uneven market atmosphere, as a result of traders will probably be compensated for giving up the upside in shares with a better choices premium.

More on covered-call ETF: This sort of ETF is designed to hedge towards volatility and assist traders navigate a stormy inventory market

Ullal attributed the rising reputation of options-based ETFs to the success of JEPI in addition to ETF companies relentlessly increasing their covered-call and buffer-ETF suites in 2023, regardless that these methods are likely to underperform in a quickly rising inventory market.

“The flows are probably moderate [in 2024] relative to what we’ve seen so far, but I don’t think the flows will be negative or this category will go away,” Ullal stated in a follow-up interview with MarketWatch on Thursday. “What’s happening is there are investors who are willing to trade off or sacrifice some [stock] performance for income or downside protection.”

With that backdrop, Ullal sees options-based ETF methods persevering with to develop in 2024, although they are going to be put to the check if the present bull-market pattern continues.

Also see: An ETF that may’t go down? This new ‘buffer’ fund is designed to offer 100% safety towards stock-market losses

Emerging-markets ETFs with out China-related drag

ETF traders could need to “unbundle” their emerging-market publicity by reconsidering China-related belongings of their ETF portfolios, in keeping with Ullal.

Having a excessive publicity to China in emerging-market holdings was difficult for ETF traders in 2023, as China considerably underperformed different rising markets this yr resulting from a slower-than-anticipated post-Covid financial restoration, weak point within the nation’s property sector and geopolitical tensions with the U.S., Ullal stated.

China publicity in two of the preferred emerging-market ETFs, the Vanguard FTSE Emerging Markets ETF

VWO

and the iShares Core MSCI Emerging Markets ETF

IEMG,

stands at 31% and 24.4%, respectively, in keeping with FactSet knowledge. In flip, VWO has risen 8.3% this yr, whereas IEMG has climbed 10.7% in 2023.

Meanwhile, the SPDR S&P China ETF

GXC

has slumped 12.8% yr so far, per FactSet knowledge. But the iShares MSCI Emerging Markets ex China ETF

EMXC,

which has no China publicity, has superior 18.9% over the identical interval.

One choice for traders can be to calibrate their publicity by combining emerging-market ex-China ETFs like EMXC with China-focused ETFs, Ullal stated.

Alternatively, traders might assemble the EM sleeve of their portfolios with country-specific ETFs, or use lively ETFs just like the KraneShares Dynamic Emerging Markets Strategy ETF

KEM,

as that fund’s China publicity is dynamically adjusted primarily based on basic, valuation, and technical alerts, he added.

Rising demand and competitors in lively bond ETF class

The U.S. fixed-income ETF sector is dominated by funds passively monitoring Treasury bonds just like the 10-year Treasury observe

BX:TMUBMUSD10Y,

which has seen declining yields these days as discussions across the Fed’s interest-rate path, and a attainable pivot to price cuts, proceed to take heart stage heading into 2024.

But MarketWatch reported final week that demand for lively bond ETFs has picked up, with Vanguard launching two new lively bond funds earlier this month. The need for lively bond ETFs among the many agency’s shoppers has grown considerably over the previous two years, John Croke, Vanguard’s head of lively fixed-income product administration, advised MarketWatch.

Meanwhile, the companies that dominate the listed and lively bond ETF classes are totally different, Ullal famous. In the listed bond ETF class, Vanguard competes with conventional rivals BlackRock and State Street, whereas within the lively bond ETF class the place it’s now increasing its footprint, Vanguard is competing with managers like JPMorgan, First Trust and PIMCO.

“This competition will put pressure on the incumbent players, but will be good for investors, and will be an important trend to watch in the next year,” stated Ullal.

As traditional, right here’s your take a look at the top- and bottom-performing ETFs over the previous week by means of Wednesday, in keeping with FactSet knowledge.

The good…

| Top Performers | %Performance |

|

AdvisorShares Pure U.S. Cannabis ETF MSOS |

12.7 |

|

Amplify Transformational Data Sharing ETF BLOK |

10.5 |

|

SPDR S&P Biotech ETF XBI |

9.9 |

|

ARK Genomic Revolution ETF ARKG |

8.3 |

|

ARK Innovation ETF ARKK |

6.4 |

| Source: FactSet knowledge by means of Wednesday, Dec 27. Start date Dec 21. Excludes ETNs and leveraged merchandise. Includes NYSE-, Nasdaq- and Cboe-traded ETFs of $500 million or larger. | |

…and the dangerous

| Bottom Performers | %Performance |

|

iMGP DBi Managed Futures Strategy ETF DBMF |

-2.9 |

|

Vanguard Total International Bond ETF BNDX |

-2.2 |

|

iShares 20+ Year Treasury Bond BuyWrite Strategy ETF TLTW |

-2.1 |

|

VanEck BDC Income ETF BIZD |

-1.2 |

|

Vanguard Short-Term Inflation-Protected Securities ETF VTIP |

-1.2 |

| Source: FactSet knowledge | |

New ETFs

- TCW Group filed to transform its TCW Artificial Intelligence Equity Fund TGFTX into the TCW Artificial Intelligence ETF, and is looking for to transform its TCW New America Premier Equities Fund TGUSX into the TCW Compounders ETF, in keeping with the fund’s prospectus filed with the Securities and Exchange Commission on Tuesday.

Weekly ETF Reads

Source web site: www.marketwatch.com