Well, the worst day of the yr for the inventory market was adopted by, principally nothing. Neither day had a lot in the best way of recent basic data, and on Thursday inventory futures are greater. Animal spirits are as vital as laborious logic generally.

Thursday additionally noticed the discharge of the Credit Suisse Global Investment Returns yearbook, produced by monetary historians Elroy Dimson, Paul Marsh and Mike Staunton. It has the document of returns from equities, bonds, money and currencies for 35 nations, stretching again to 1900. There can also be information overlaying a complete of 90 nations, together with the latest addition, Bosnia and Herzegovina, with information going again to 2011.

First, to the numbers: Over the final 123 years, international equities have returned an annualized return, adjusted for inflation, of 5%; that’s higher than the 1.7% actual return for bonds, and the 0.4% return for Treasury payments. The finest nation for inflation-adjusted annualized stock-market returns in U.S. greenback phrases since 1900 has been Australia, with a return of 6.43%, although the U.S. is simply behind at 6.38%. Equities have outperformed bonds, payments and inflation in all 35 nations the place the researchers have information for 123 years.

Dimson/Marsh/Staunton

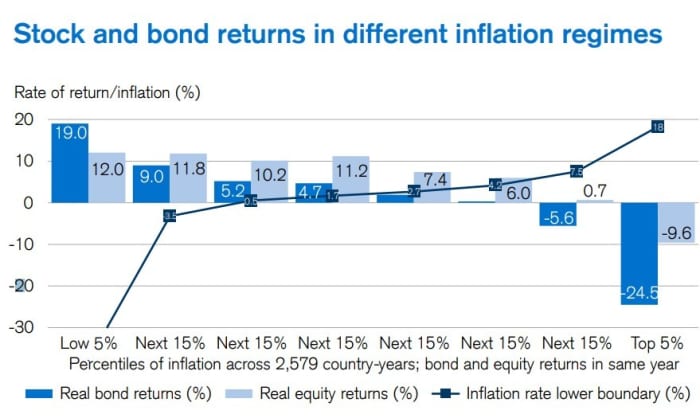

On the day’s topic du jour, they stated that when inflation goes above 8%, it takes a number of years to return to focus on, citing latest analysis. Equities don’t present a hedge in opposition to inflation, as they discovered and as 2022 returns confirmed. And traditionally, the returns on shares and bonds have been a lot decrease throughout mountain climbing cycles than easing cycles.

The researchers additionally studied commodities: commodities have had a low correlation with equities and a detrimental correlation with bonds, and supplied a hedge in opposition to inflation, however they notice the investable market dimension is kind of small, making massive allocation will increase troublesome.

Dimson/Marsh/Staunton

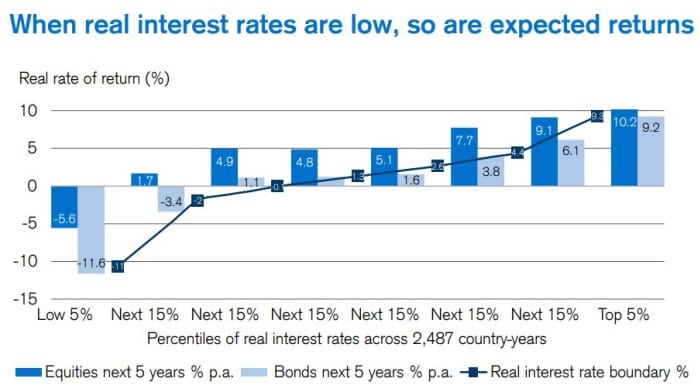

Onto the long run — they estimate the fairness danger premium to payments will likely be round 3.5%, which is decrease than the historic determine of 4.6%. But that also means fairness buyers ought to double their cash relative to short-term authorities payments in 20 years. They notice that in interested by future returns, actual returns are usually higher in occasions of upper rates of interest than decrease charges, citing information over a formidable 2,487 country-years .

Dimson/Marsh/Staunton

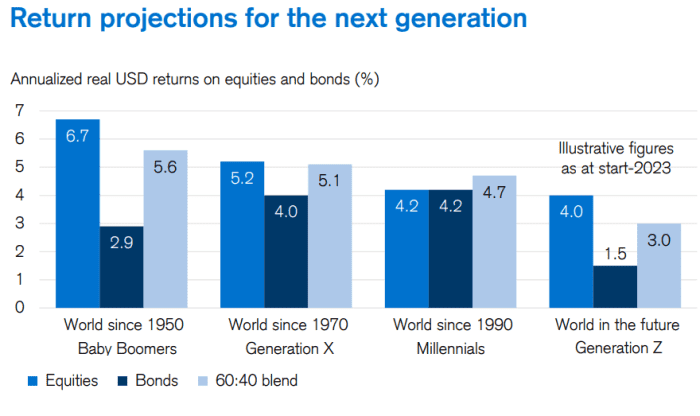

They venture that for Generation Z will see roughly the identical return in shares as millennials have, however a lot worse bond returns. Baby boomers, Marsh instructed a journalist on a name, “just got lucky. I don’t think we will ever return to that.”

The market

U.S. inventory futures

ES00

NQ00

had been pointing to a stronger begin. The yield on the 10-year Treasury

BX:TMUBMUSD10Y

edged as much as 3.94%.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Nvidia

NVDA

shares surged 8% in premarket motion because the graphics chipmaker forecast first-quarter income above Wall Street expectations and laid out the way it goals to revenue from alternatives in synthetic intelligence.

Unity Software

U

shares slumped after the game-engine firm forecast income beneath estimates.

Etsy

ETSY

shares surged 8% on better-than-forecast income from the humanities e-commerce website, although present quarter gross sales are projected to be consistent with estimates. EBay

EBAY

shares. nonetheless, slipped 4% because it reported decline in quantity. Electric car maker Lucid

LCID

dropped after a supply forecast properly beneath estimates.

The financial calendar contains weekly jobless claims and the primary revision to fourth-quarter GDP numbers, whereas Atlanta Fed President Raphael Bostic and San Francisco Fed President Mary Daly are set to ship remarks. Treasury Secretary Janet Yellen, in India for the G-20 finance minister assembly, stated the worldwide financial system is in a greater place than it was only a few months in the past.

Best of the net

Employee doubts are rising about Taiwan Semiconductor Manufacturing Co.’ s

TSM

enlargement into Arizona.

Even Russia’s international minister was stunned by the choice to invade Ukraine, and a lot of the cupboard was stored in the dead of night, in line with nameless accounts from Russian officers.

Deutsche Bank

DB

officers attended conferences inside Jeffrey Epstein’s residence when victims had been current, attorneys for survivors allege. Deutsche Bank says the lawsuit ought to be thrown out.

Top tickers

Here had been essentially the most lively inventory market tickers as of 6 a.m. Eastern.

| Ticker | Security title |

| TSLA | Tesla |

| NVDA | Nvidia |

| AMC | AMC Entertainment |

| BBBY | Bed Bath & Beyond |

| GME | GameStop |

| AAPL | Apple |

| BABA | Alibaba |

| NIO | Nio |

| APE | AMC Entertainment preferreds |

| AMZN | Amazon.com |

Random reads

These pictures produced by the James Webb Space Telescope are so uncommon they’re being dubbed universe breakers, as a result of the galaxies had been so large at an early stage of the universe.

“Veg-xit” — Brits take care of a scarcity of fruit and veggies.

This 11-year-old woman is coming into “semi retirement” after making a lot cash from promoting fidget spinners and bows that she purchased a Mercedes-Benz GI.

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your electronic mail field. The emailed model will likely be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

Source web site: www.marketwatch.com