While the media would have buyers give attention to brief headline-grabbing cycles reminiscent of political elections, central financial institution actions, and financial expansions and contractions, some buyers — together with our group at funding supervisor Alger — consider the ups and downs of such cycles are principally noise, serving as a distraction for long-term buyers.

Wealth creation is pushed by innovation, which will increase productiveness, raises gross home product and finally boosts dwelling requirements. Innovative services that present actual worth to companies and shoppers by making them extra environment friendly, more healthy, or happier, ought to discover robust demand. These improvements reward buyers over time, regardless of elections and whether or not rates of interest are rising or falling.

In its 60-year historical past, Alger has invested via many recessions and progress scares, in addition to durations of such exuberance that capital was extraordinarily low-cost and plentiful. Looking again on the ups and downs, two essential classes stand out:

- Research reveals that innovation has grown via all types of financial volatility.

- Strong aggressive benefits usually translate into expanded market shares, significantly in difficult financial instances.

In brief, buyers ought to contemplate investing in equities of progressive firms that aggressively seize market share with a view to compound worth irrespective of the macroeconomic surroundings.

Innovation is resilient

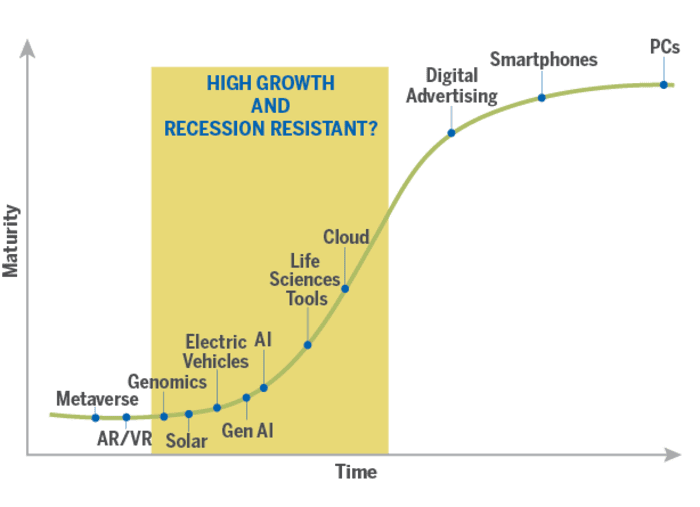

Productivity-enhancing applied sciences have a historical past of rising via each good and unhealthy financial instances. For instance, private pc use elevated via the recession of the early Nineteen Nineties whereas digital promoting and smartphones grew via the Global Financial Crisis. These applied sciences grew via adversity as a result of they have been early of their adoption cycle.

Today, these explicit industries are mature and extra cyclical, as proven within the chart under. However, the chart additionally reveals newer applied sciences, reminiscent of synthetic intelligence (AI), which are simply developing the so-called “S” curve. As a outcome, these newer applied sciences usually tend to garner an rising share of enterprise or client spending and as such, develop via varied financial environments.

Source: Alger

Artificial intelligence

Bill Gates has mentioned that synthetic intelligence “is every bit as important as the PC, as the internet.” AI is a mega-theme that may influence enterprise and investing for years to return. Through routine area analysis, Alger lately spoke with a multi-billion-dollar cloud service advisor who shared that know-how options, reminiscent of AI, might find yourself feeling like “need-to-haves” due to the very important enterprise significance of digital transformation and the idea that firms will use these instruments to cut back prices.

The adoption of this know-how will persist regardless of the tempo of financial progress. Finding beneficiaries of this pattern can generate robust returns for buyers. Below are some doubtlessly engaging investments within the AI area.

We discuss with the businesses that present the infrastructure for AI companies as “enablers.” Some of a very powerful elements of the AI infrastructure are semiconductors. These chips present the business with the processing energy that’s seeing hovering demand.

Consider that one of many principal determinants for the intelligence of generative AI applications, like ChatGPT, is the quantity of coaching that they endure. That coaching is doubling roughly each 4 months, a lot sooner than the 2 years that Moore’s Law has precisely forecasted the variety of transistors can be crammed onto pc chips. This distinction in velocity is so huge {that a} six-inch plant rising at Moore’s Law could be 16-feet tall in a decade, whereas if it grew on the velocity of AI, it might attain the moon.

Some of the main chip suppliers to the AI business with progressive applied sciences embody Nvidia

NVDA,

Marvell Technology

MRVL,

and Advanced Micro Devices

AMD,

The immense computational calls for of AI require the event of groundbreaking chip and server architectures, which collectively drive larger energy consumption per server cupboard inside the big knowledge facilities that home the brains of those programs, resulting in larger electrical energy consumption. According to Schneider Electric

SU,

AI energy utilization will enhance greater than 30% yearly, leading to a cumulative enhance of 4 instances the present utilization over the subsequent 5 years, as measured in gigawatts.

However, larger energy densities in AI duties result in extreme warmth era, posing cooling challenges for knowledge facilities. Today, firms like Vertiv Holdings

VRT,

not solely resolve this overheating problem however doubtlessly enhance value and vitality effectivity.

As knowledge facilities increase to satisfy the rising demand for AI, lack of transmission and distribution of energy may show to be a key subject. This might necessitate grid modernization, doubtlessly benefiting energy administration and electrical companies firms that work with utilities and business clients. Companies like Eaton

ETN,

a diversified international energy administration firm, are working arduous to satisfy rising electrical energy demand and within the course of might generate engaging returns for shareholders.

Driven by knowledge

“If AI is a rocket ship, data is the fuel. ”

In immediately’s economic system, knowledge is the brand new oil — an important uncooked materials for digital transformation. To automate and make software program work for us, we want our knowledge digitized and arranged. Artificial intelligence is especially depending on good knowledge. If AI is a rocket ship, knowledge is the gas. Unstructured knowledge reminiscent of textual content messages, emails, social media, webpages and enterprise paperwork all should be accessible by software program applications like generative AI.

One firm that helps companies retailer and arrange their unstructured knowledge in a database administration system is MongoDB

MDB,

Gartner estimates the information administration market might develop 17% yearly from 2023 to 2027, making this a beautiful funding space.

Prepare for all prospects

Alger believes buyers ought to purpose to place portfolios for a variety of financial outcomes by investing in firms that may achieve market share inside the economic system. Companies that allow AI reminiscent of chip makers, energy administration firms and database suppliers could also be good examples of firms which are offering progressive services to clients world wide. They can develop via good and unhealthy financial environments, permitting buyers to disregard the noise and give attention to long-term wealth creation.

Brad Neuman is Alger’s director of market technique . As of Oct. 31, 2023 (Alger’s most up-to-date reporting date), the agency had positions in MongoDB, Nvidia, Marvell, Advanced Micro Devices, Schneider Electric, Vertiv and Eaton.

More: Intel’s new AI chips for the PC can be broadly used, however will not be essentially the most helpful

Plus: Whether it quantities to an precise recession is unsure, however the U.S. is headed for a gentle patch, economists say

Source web site: www.marketwatch.com