Inflation merchants are positioning for a barely bigger-than-expected blip larger within the annual headline price of Thursday’s shopper worth report for December, one which shouldn’t matter a lot to the general downward trajectory of worth positive aspects this 12 months.

As of Tuesday, derivatives-like devices referred to as fixings had been buying and selling round ranges that indicate December’s annual headline CPI price will are available in at 3.3%, up from 3.1% in November and barely above the three.2% stage anticipated by economists. Fixings merchants are made up of a few of the monetary market’s finest minds on inflation, with a file of getting presaged the 2021-2022 run-up in costs.

Two elements more likely to contribute to a considerably larger annual headline CPI inflation price in December relative to November are airfares and the price of car insurance coverage, that are anticipated to indicate short-lived bumps, mentioned dealer Gang Hu of New York hedge fund WinShore Capital Partners.

Still, there’s “nothing to challenge” the market’s general considering that U.S. inflation is about to fall towards the Federal Reserve’s 2% goal all through this 12 months — buttressing the case for 2024 price cuts by the central financial institution.

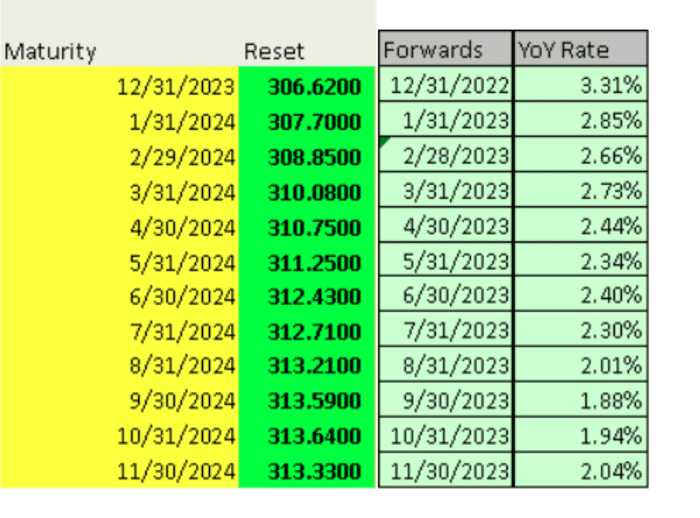

Market-implied ranges for year-over-year headline inflation charges derived from CPI studies for December 2023 by way of November 2024. The first column displays the month and 12 months for every year-over-year price. The forwards column reveals the year-earlier start line for the year-over-year price.

Bloomberg

“It’s the first inflation report of the year and investors are going to definitely pay attention to it,” mentioned economist Lauren Henderson of Stifel, Nicolaus & Co. in Chicago. “It also comes ahead of the FOMC [Federal Open Market Committee] rate decision later this month, so Fed officials themselves will be looking at it.”

If the report is available in as anticipated, “that could solidify the Fed’s expectations for three rate cuts this year,” she mentioned by way of telephone on Tuesday. However, “if we see some unexpected upside, that could dial back investors’ expectations for rate cuts as soon as March. And rate cuts could begin in the second half of the year.”

Fed officers try to mood the market’s expectations for as many as six or seven price cuts this 12 months, beginning in March. On Monday, Atlanta Fed President Raphael Bostic mentioned two quarter-point price cuts are more likely to be wanted by year-end, versus the three cuts telegraphed by policymakers in December. Meanwhile, Fed Gov. Michelle Bowman mentioned that whereas inflation may maintain falling with out extra price hikes, easing monetary circumstances might trigger a reacceleration of worth positive aspects.

Accurately predicting the trail of inflation issues due to the widespread view that it’s within the closing mile. However, monetary markets proceed to cost in way more price cuts than Fed officers have signaled — creating the potential want to tug again on these expectations for the fed funds price goal, which at the moment sits between 5.25%-5.5%.

One loophole within the forecasts of fixings’ merchants is the absence of payrolls knowledge like December’s, which confirmed an unexpectedly stable 216,000 new jobs created and stronger-than-expected wage progress. Wages are “the one remaining ember that could reignite inflation,” mentioned Brent Schutte, chief funding officer of Milwaukee-based Northwestern Mutual Wealth Management Co., which oversaw $255.7 billion as of the top of September.

Read: Financial markets could also be overlooking ‘one remaining ember’ that might reignite inflation

Fixings merchants “don’t know how or find it hard to make a connection between payrolls and CPI,” Hu mentioned by way of telephone. “The relationship between payrolls and CPI changes over time and is unstable. Therefore, traders lean toward something more concrete like car insurance, oil prices, or owners’ equivalent rent for the lack of anything else.”

Traders count on the month-to-month core CPI price, which strips out meals and power, to return in at 0.3% for December, based on Hu, citing his personal private calculations. That’s in step with economists’ expectations and unchanged from the prior month.

In addition, the market’s implied stage for the core CPI price is 2.5% over the subsequent 12 months, together with December’s knowledge, he mentioned.

On Tuesday, Treasury yields ended little modified forward of December’s CPI report, with the benchmark 10-year price

BX:TMUBMUSD10Y

staying above 4%. U.S. shares

DJIA

SPX

COMP

closed principally decrease.

Source web site: www.marketwatch.com