More gloom from the tech sector — this time from Meta Platforms — is mixing with continued strain on Treasury yields to arrange for a troublesome session, after the Nasdaq Composite fell into correction territory on Wednesday.

Hopes are actually hanging on Amazon.com to belt out some good news after the shut. Ahead of that GDP knowledge got here in greater than anticipated, close to 5%, although that will not stave off a recession.

Our name of the day comes from a pair of cash managers who’ve been banging the desk a couple of crash brewing for this market, and are warning even louder now. They are warning buyers to get ready.

The pair are Michael Gayed, a portfolio supervisor at Tidal Financial who presents buying and selling methods by way of the Lead Lag Report, and Michael Kramer, founding father of Mott Capital Management. They posted a dialogue on Wednesday that spoke of an “imminent market crash.”

“What we’re seeing in Treasurys should make a lot of people nervous. I’ve never seen anything like it, and I’ve been following this market since the mid-90s,” mentioned Kramer, who lately mentioned how the brand new bull market was already over.

In their chat, Kramer instructed Gayed that it is sensible to see Treasury yields this excessive, given the Fed jacked up rates of interest 500 foundation factors and the market tried to get forward of the Fed every time it anticipated a charge hike. When the Fed began to “mess around with slowing rate hikes,” hinting of a pause and the market tried to second guess that as properly.

He mentioned the surge in Treasury yields could also be “near the end,” however there could also be a bit to go. Kramer additionally instructed subscribers on Wednesday that the S&P 500 decline “doesn’t look complete yet,” and 4,115 can’t be dominated out.

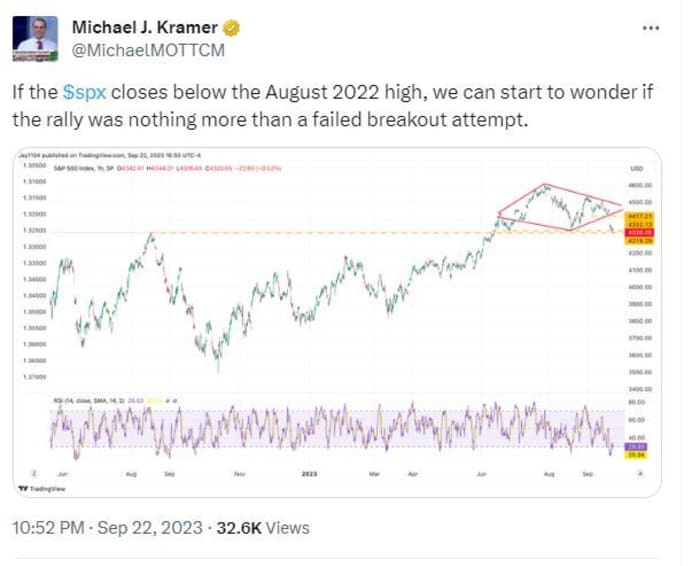

One chart Kramer has been centered on for some time is proven right here, and in follow-up feedback he tells MarketWatch that he suspects, as he has for some time, that the S&P 500 has been within the grips of an extended bear market rally, slightly than the beginning of a brand new bull market:

@MichaelMOTTCM

Where does he suppose buyers ought to be investing proper now? For these enthusiastic about bitcoin lately, Kramer sees cryptos as manner too risky, so he’s sticking to “money-market accounts, taking my 5%-ish and leaving it at that. To me that’s the best hedge against volatility. And for me, that’s the best hedge that provides me the liquidity to be able to move in and out of the market if I so choose.”

Gayed posted a number of days in the past on Seeking Alpha that the very fact many shares are underperforming is “consistent with a market crash.” He argued in January {that a} melt-up later within the yr was coming, but additionally predicted a “credit event” as a result of lagged results of the quickest charge hike cycle in historical past.

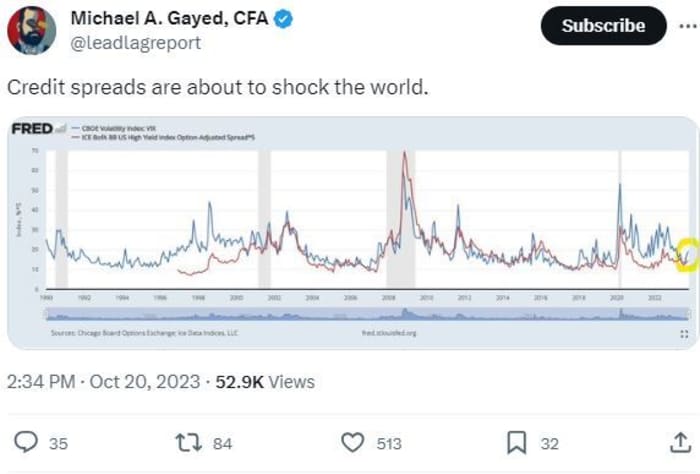

What Gayed does see, is that the Treasury selloff dangers turning into a company credit score occasion. “Credit spreads ARE starting to widen, consistent with what you see in a traditional credit event and stock market crash,” he mentioned, providing up this chart:

@LeadLagReport

So after the crash in Treasurys, Gayed is on guard for Part 2, when “credit spreads blow out and stocks collapse.” Note, that widening credit score spreads point out looming defaults.

“If I’m right, the mother of all short squeezes is still set to come in Treasurys, and people suddenly realize too late they were tricked into a narrative around AI and a ‘bull market’ that in reality made them exit liquidity,” he wrote on Seeking Alpha.

You can hearken to the 2 talk about the market troubles on YouTube.

And right here’s the final phrase by way of X from Gayed:

@leadlagreport

The market

Stocks

SPX

COMP

are principally decrease at the beginning, however losses have pared from what futures had been indicating earlier. The yield on the 10-year Treasury word

BX:TMUBMUSD10Y

eased up on that development knowledge, hovering at 4.923% and the greenback

DXY

is greater. Oil costs

CL.1,

are down over 2%.

The buzz

Third-quarter GDP rose 4.9%, which was barely stronger than forecasters anticipated, with weekly jobless claims rising 10,000 to 210,000, sturdy items leaping 4.7%, and the commerce deficit widening. At 10 a.m., pending dwelling gross sales will probably be launched.

The European Central Bank has left rates of interest unchanged as anticipated, commenting that inflation has dropped “markedly” within the area.

Meta Platforms’

META,

posted forecast-beating income, however speak of weak advert demand within the present quarter amid the Israel-Gaza struggle spooked buyers. Shares are down almost 3%. From London, Global advert firm WPP

WPP,

confirmed the gloom in that house.

Opinion: Meta’s dangerous enterprise of huge AI spending amid rocky advert market

Amazon.com

AMZN,

is the following large tech within the highlight, with outcomes due after the shut, alongside a bunch extra together with Intel

INTC,

and Chipotle

CMG,

Ahead of these, UPS

UPS,

inventory is headed for a three-year low after a income miss and outlook minimize. Southwest

LUV,

is nearing a 9-year low after income and cargo issue misses. Royal Caribbean

RCL,

is surging on an earnings beat and better outlook, due to demand for experiences.

Ford

F,

additionally experiences after the shut, and United Auto Workers introduced a tentative deal to probably finish weeks of strikes.

More late reporters: Mattel

MAT,

is down 7% after disappointing steering, Whirlpool Corp.

WHR,

is tumbling after a steering minimize and Align Technology

ALGN,

is off 20% after disappointing outcomes from the orthodontics maker.

Elsewhere, Endeavor shares

EDR,

are up 20% private-equity big Silver Lake mentioned it might take the sports activities and leisure firm non-public.

A gunman killed in Maine entered a bowling alley and bar, killing no less than 16 individuals with a manhunt underneath manner.

Best of the online

‘We’re not in Kansas anymore’: Why the 60/40 portfolio may be lifeless, and what to do now.

In sexless Hong Kong, $2,500 is dim sum cash.

Morgan Stanley ends succession battle after three-way race.

The tickers

These had been the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security title |

|

TSLA, |

Tesla |

|

META, |

Meta Platforms |

|

AMC, |

AMC Entertainment |

|

NVDA, |

Nvidia |

|

AMZN, |

Amazon.com |

|

AAPL, |

Apple |

|

GME, |

GameStop |

|

PLTR, |

Palantir Technologies |

|

MSFT, |

Microsoft |

|

MULN, |

Mullen Automotive |

Random reads

Kim Khardashian needed to take Karl Lagerfeld’s $13 million cat to the Met. Choupette wasn’t taking part in.

Hunt for alien know-how completes scan of 1.6 million star methods.

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e-mail field. The emailed model will probably be despatched out at about 7:30 a.m. Eastern.

Source web site: www.marketwatch.com