The “junk spread” is abnormally low proper now, and that elevates the danger of an imminent recession. The junk unfold is the distinction between the yield on company high-yield bonds and U.S. Treasurys of comparable maturities. This unfold represents the additional yield that buyers demand to compensate them for the extra threat of investing in junk bonds reasonably than Treasurys.

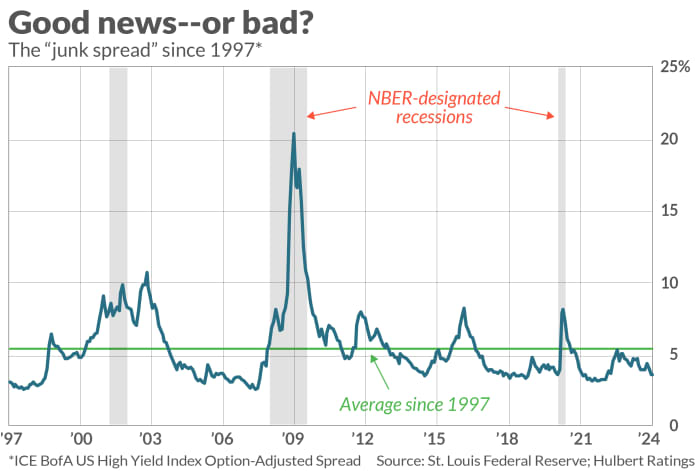

The unfold presently stands at 3.5 share factors, effectively beneath its common since 1997 of 5.4 share factors, as proven within the chart above. That means buyers consider financial threat to be abnormally low proper now, which is hardly stunning given the widespread consensus that the U.S. Federal Reserve has completely executed the proverbial comfortable touchdown.

Nevertheless, as Humphrey Neill, the daddy of contrarian evaluation, reminded us, “When everyone thinks alike, everyone is likely to be wrong.” Contrarians consider that the low present unfold represents an extra of exuberance that can right itself in coming months.

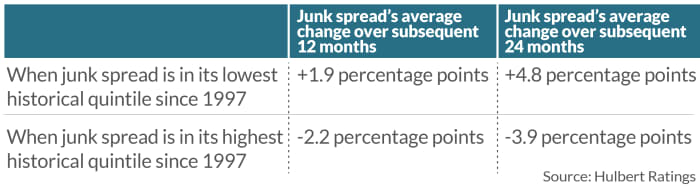

History supplies robust help for this contrarian perception, because the desk beneath reveals. The outcomes reported are based mostly on one of many market’s customary methods of measuring the unfold, the ICE BofA U.S. High-Yield Index Option-Adjusted Spread.

The variations proven within the chart are important on the 95% confidence degree that statisticians usually use when figuring out whether or not a sample is real. The junk unfold is presently within the lowest historic quintile, represented by the primary row of the chart, and that’s why contrarians conclude there’s an elevated threat of a recession. Increases within the junk unfold of 1.9 to 4.8 share factors over a one- to two-year interval wouldn’t solely replicate elevated financial threat however would additionally contribute to that enhance.

“The junk-bond spread has greater explanatory power in the one- to three-year horizon.”

An extended-term contrarian indicator

Contrarians due to this fact ought to add the junk unfold to the set of sentiment indicators on which they focus when assessing the temper of buyers. One benefit this indicator has over most others is that its best explanatory energy is for the for much longer time period. Most different sentiment indicators let you know little in regards to the market past a one- to three-month horizon. The junk-bond unfold, in distinction, has better explanatory energy within the one- to three-year horizon.

On the one hand, you would possibly take some solace from this longer explanatory horizon, because it means a recession doesn’t have to start within the subsequent a number of months. On the opposite hand, this evaluation suggests this heightened threat of a recession shouldn’t be going away quickly.

That doesn’t assure {that a} recession will happen, in fact. But it could be solely in step with contrarian principle for a recession to start simply because the market is celebrating a comfortable touchdown.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat price to be audited. He may be reached at mark@hulbertratings.com.

More: The inventory market’s ‘bad breadth’ is making even stalwart bulls nervous

Also learn: Here’s what to anticipate from shares in February after January’s large rally

Source web site: www.marketwatch.com