Nvidia’s spectacular development is difficult to quantify generally.

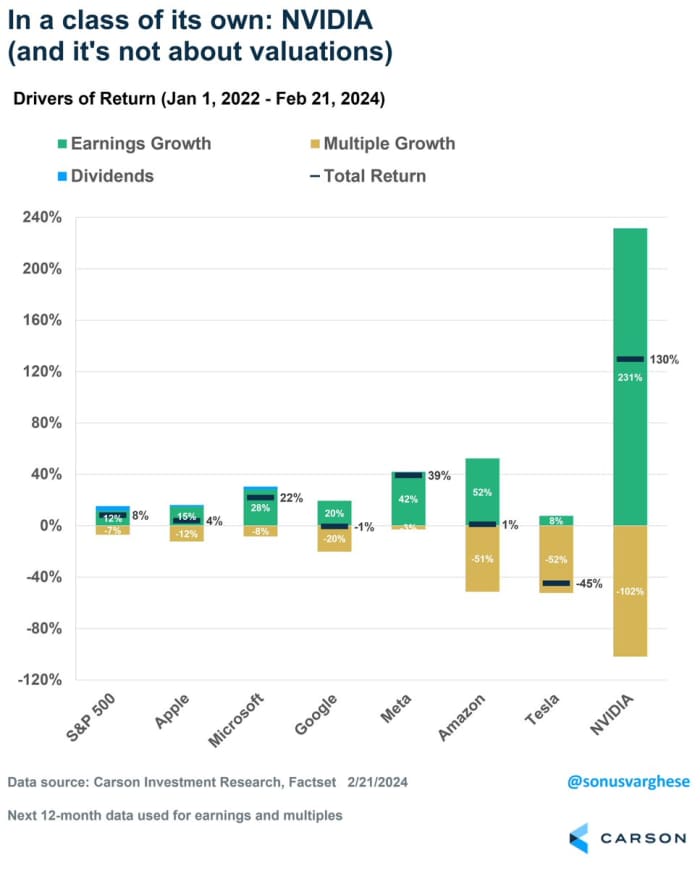

But this chart, from Sonu Varghese, international macro strategist on the Carson Group, helps put issues in perspective.

It’s exhibits how Nvidia’s

NVDA,

earnings — or, to be extra exact, analyst expectations of its earnings in 12 months’ time — have soared properly past its inventory value, main truly to a 102-point a number of contraction over the past two-plus years.

That’s to not say Nvidia is essentially low cost, Varghese stated in a message on the social media service X.

“There’s a runway here. Of course, how long can they can keep printing profits like this … that’s the question,” he stated. “There’s operating leverage too, with profits rising while sales growing. So margins increasing.”

As MarketWatch’s Therese Poletti factors out, Nvidia’s margins within the chip house are solely surpassed by ARM Holdings

ARM,

the microchip designer.

Nvidia inventory surged 16% to $785.38 on Thursday after the microchip maker beat income expectations for the fourth quarter by about $2 billion, and likewise projected first-quarter gross sales that on the midpoint are practically $2 billion increased.

Nvidia is now forward of each Amazon.com

AMZN,

and Alphabet

GOOGL,

by market cap.

Over the final 52 weeks, Nvidia’s inventory has climbed 237.2%.

Source web site: www.marketwatch.com