Welcome to the traditionally respectable inventory month of November, which follows the longest month-to-month dropping streak (three months) for the three main indexes. It kicks off with a Fed assembly and maybe extra essential, the Treasurys breakdown of debt issuance.

Our name of the day switches gears to debate investing in doubtlessly profitable megatrends in an interview with Aspen Funds’ co-founder and chief monetary officer Bob Fraser. The 10-year outdated agency with $300 million in property beneath administration, operates like a hedge fund, doing non-public investments for prime web value people.

Fraser has been pounding the desk since June 2022 about over-hyped recession fears, a name that has to this point proved proper, and inflation that may be increased for longer. The first megatrend zeroes in on taking part in the no-recession megatrend.

“The number one way to play no recession is to get your cash to work,” he stated. And he suggests buyers have a look at inflation beaters, by way of “stocks with the ability to pass price increases on the consumer and with fixed costs,” Fraser instructed MarketWatch in an interview.

“Or even better is real estate because real estate is priced on net operating income and thus goes up with inflation,” he stated. Investors might purchase a house for Airbnb use, or simply purchase that home they’ve been holding off on, put cash in a real-estate funding belief (REIT), or take part in a personal fund like Aspen’s.

Onto the following megatrend — neighborhood strip malls. That focuses on an enormous demographic shift from cities to suburbs as extra individuals work at home and store close by at these strip facilities.

“In good locations there are almost no vacancies, rents have been increasing and they haven’t built any new ones in about 15 years,” he stated. “They’re full and we’re paying half of the replacement cost which is a recipe for making money over time…Add in some expenses and leverage with a little debt, and investors can get 14-18% total returns with 9-11% of that as cash flow.”

How to speculate? Aspen packages strip facilities into an LLC, giving buyers possession and tax advantages, however REITs like Kimco Realty

KIM,

or Regency Centers

REG,

to call a number of additionally supply publicity. SITE Centers

SITC,

earlier this week introduced plans to spin off all of its strip malls right into a publicly traded firm.

The subsequent megatrend is industrial actual property, which Fraser says ties into the some $1 trillion or extra U.S. firms spent final 12 months relocating again dwelling.

“It’s actually cheaper to build in the U.S…if you count robotics, you count shipping costs and tariffs and especially if you count energy, because America has the cheapest energy around. So what’s happening is massive. There’s not enough real estate…so one of the best places you know is large, big box industrial real estate,” he stated, including that Prologis

PLD,

is one listed firm that’s doing simply that.

“That’s a huge, huge trend and it’s not going to stop for the next 20 years. The world is over globalized and now it’s deglobalizing majorly,” he stated.

The final two megatrends are vitality and the approaching bubble in multifamily housing. As for the primary, Fraser stated they’re shopping for up oil fields because of the false perception on the market that “the world is post fossil fuels,” and with oil underdeveloped for the final seven years.

“And so we’re about to have an energy crisis and it’s going to unfold over the next three to five years… The only thing that’s going to slow it is a recession, but even if we do have a recession, we still have this declining supply curve. At some point it’s going to hit it, and we still have a problem,” he stated.

That will embody oil costs above $100 a barrel, he stated, and for common buyers oil futures and main oil firms would supply publicity.

One ultimate megatrend from Fraser is extra looming — the “multifamily meltdown,” as he cites a stat from actual property analytics agency, Newmark, pointing to just about $200 billion value of troubled multifamily loans due within the subsequent three years.

“During COVID, we saw a huge amount of liquidity flood the market and a lot of syndicators invested into multifamily, and multifamily has been kind of a gold standard for real-estate investors, because ‘people always need a place to live’ and there’s a well-known housing shortage in America. So what happened is they started bidding up the prices way too much,” he stated.

Investors ended up overpaying and utilizing variable price financing and their 3% to 4% loans are beginning to mature they usually now face 8% to 9% charges. “They can’t refinance them and what’s worse, the property values have come down, so the banks won’t lend enough money on it,” he stated.

“So I would say late 2024 or 2025 is probably a good time probably to buy apartment REITs. For us, we’re doing a distressed debt fund, so we basically will come in with debt or preferred equity and we basically go down the capital stack in these deals where we can get equity-like returns with debt-like risk. So it’s a great opportunity,” he stated.

You can learn extra concerning the Aspen’s massive megatrends — seven in complete — right here.

The markets

Stock futures

YM00,

ES00,

NQ00,

are dropping forward of the Fed choice later, with Treasury yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

regular. Gold

GC00,

is beneath some stress, together with silver

SI00,

whereas oil

CL.1,

is rising. The greenback has hit a 33-year excessive versus the yen

USDJPY,

with Japan intervention speak within the air.

Read: Time to place cash in worldwide equities as they stealth move U.S. shares?

The buzz

A Fed choice is predicted at 2 p.m., adopted by a press convention with Chairman Jerome Powell. No price hike is predicted, with all eyes on its ahead steering. The Treasury’s quarterly refunding assertion is due forward at 8:30 a.m.

Also, the ADP employment report is coming at 8:15 a.m., with job openings and the Institute for Supply Management’s manufacturing survey at 10 a.m.

DuPont

DD,

is down on a gross sales miss and weak steering and Kraft

KHC,

is up on a revenue beat and improved outlook, and CVS

CVS,

is up on an earnings beat, although decrease steering. Estee Lauder

EL,

is headed for a six-year low after a downbeat outlook.

Qualcomm

QCOM,

Etsy

ETSY,

Clorox

CLX,

and some extra outcomes are within the after-hours lineup.

WeWork

WE,

is down 42% after a report that the co-working house group plans to file for chapter safety as quickly as subsequent week.

Advanced Micro Devices

AMD,

is dropping after a weak income forecast spooked buyers.

Opinion: AMD’s daring predictions for its chips should not so far-fetched

Earnings and steering disappointment additionally hit shares of Match Group

MTCH,

Paycom

PAYC,

and Yum China Holdings

YUM,

A depressing forecast is dinging shares of Big 5 Sporting Goods

BGFV,

as nicely

Best of the net

In the Northeast, a moist autumn has grow to be an ‘apple-picking apocalypse’

Red Bull’s 31-year outdated inheritor’s first fee was a $615 million dividend.

Waystar, one of many final massive IPOs of 2023, is now delayed.

The chart

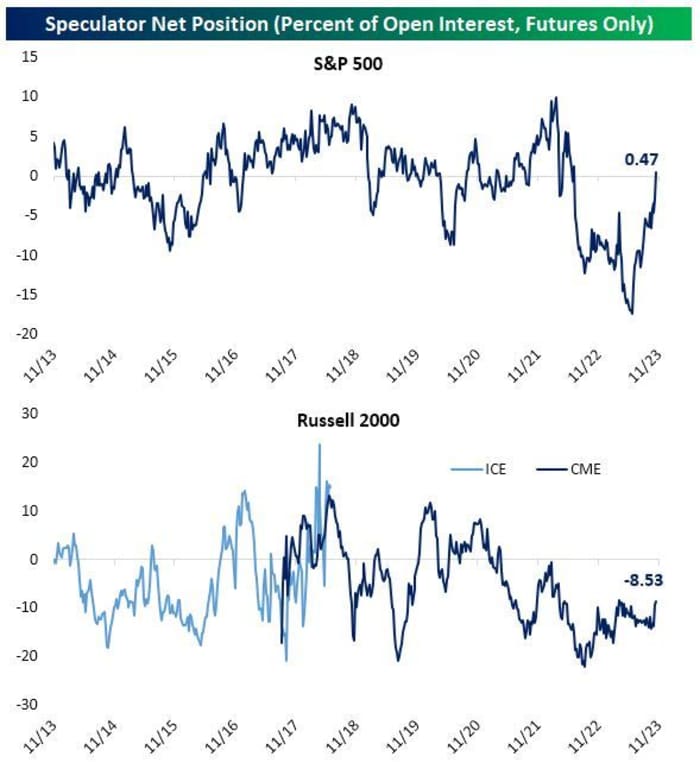

One attainable indicator of optimistic buyers? They have been slowly unwinding their bearish bets on S&P 500 futures since an enormous brief place this summer season, as famous by Bespoke.

Bespoke

“The S&P 500 is back to net long for the first time in well over a year. In fact, the streak of net short readings concluded at 70 straight weeks. That is now the longest such streak in the record of the data dating back to the late 1990,” stated Bespoke. It’s much less bullish for the Russell 2000

RUT,

which “remains in deep net short territory,” they be aware.

The tickers

These have been the top-searched tickers as of 6 a.m.:

| Ticker | Security identify |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

AMD, |

Advanced Micro Devices |

|

GME, |

GameStop |

|

MULN, |

Mullen Automotive |

|

NIO, |

NIO |

|

AAPL, |

Apple |

|

AMZN, |

Amazon.com |

|

PLTR, |

Palantir |

|

NVDA, |

Nvidia |

Random reads

Dutch authorities places ‘wild parking’ bikers on alert.

World’s best sandwich? He’s on the case.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your electronic mail field. The emailed model might be despatched out at about 7:30 a.m. Eastern.

Source web site: www.marketwatch.com