What do Interactive Brokers Group Inc., American Express Co. and First Citizens BancShares Inc. have in widespread?

They are all anticipated to extend their earnings extra shortly than the S&P 500

SPX

and all commerce at a lot decrease valuations, relative to anticipated earnings.

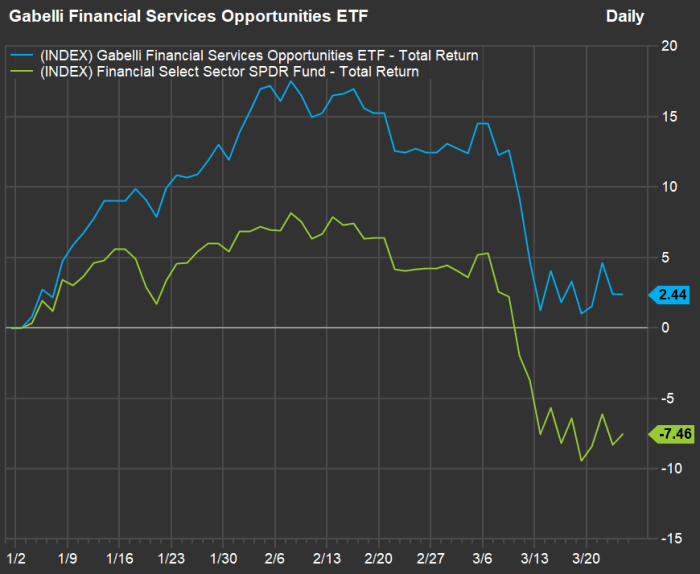

Macrae Sykes manages the Gabelli Financial Services Opportunities ETF

GABF,

which has carried out properly this 12 months in contrast with its benchmark, the S&P Financials sector, which is tracked by the Financial Select SPDR ETF

XLF

:

FactSet

During an interview, Sykes mentioned how he expects the broad monetary sector to be affected by adjustments following the present turmoil within the banking business. He additionally named the three corporations, above, as engaging shares proper now. First, let’s have a look at their anticipated earnings efficiency and ahead price-to-earnings ratios, based mostly on consensus estimates amongst analysts polled by FactSet:

| Company or ETF | Ticker | Estimated 2022 EPS | Estimated 2023 EPS | Estimated 2024 EPS | Two-year estimated EPS CAGR | Forward P/E |

| Interactive Brokers Group Inc. Class A | IBKR | $4.06 | $5.70 | $5.83 | 19.8% | 14.1 |

| American Express Co. | AXP | $9.86 | $11.17 | $12.66 | 13.3% | 14.4 |

| First Citizens BancShares Inc. Class A | FCNCA | $72.34 | $91.15 | $97.10 | 15.9% | 6.4 |

| Financial Select Sector SPDR Fund | XLF | $2.44 | $2.47 | $2.77 | 6.5% | 12.6 |

| SPDR S&P 500 ETF Trust | SPY | $21.86 | $22.18 | $24.80 | 6.5% | 17.6 |

| Source: FactSet | ||||||

Click on the tickers for extra about every firm or ETF.

Read Tomi Kilgore’s detailed information to the wealth of data obtainable free of charge on the MarketWatch quote web page.

The earnings-per-share figures for 2022 are labeled as estimates as a result of a number of the corporations held by the ETFs have fiscal years that don’t match the calendar.

The Gabelli Financial Services Opportunity ETF was established in May of final 12 months. It is actively managed and semitransparent. This implies that not like most ETFs it doesn’t disclose its holdings daily. The holdings are listed quarterly, though the fund’s internet asset worth (the worth of its holdings divided by the variety of shares) is disclosed every day.

The ETF is concentrated on capturing long-term progress tied to the persevering with wealth switch within the U.S. from the child boomer era to youthful folks and the rising want for asset administration and cost processing companies.

Sykes stated the regulatory response to the present banking disaster would possibly embody new checks for liquidity, with questions over how far down new guidelines would possibly go, relating to banks’ asset sizes.

Read: Elizabeth Warren proposes nixing 2018 rollback of banking guidelines: ‘We now have evidence of what happens when you ease up.’

He additionally expects the present issues to spur consolidation and a motion of much more deposits to the most important banks, due to the “franchise/safety premium.”

Sykes additionally stated: “The financials universe is much bigger than just banks –– so there are other ways to find equity returns.”

He mentioned three monetary corporations:

Interactive Brokers Group

IBKR

was the fourth largest holding of GABF as of Dec. 31. Sykes stated the corporate’s monetary place could be very robust, with $12 billion in capital and its personal investments concentrated in short-duration U.S. Treasury securities. He expects IBKR to extend its income and earnings by 20% this 12 months, with a 70% working margin — a degree he stated was much like these of software program corporations.

IBKR offers brokerage companies to people, with full service for specialised purchasers, equivalent to hedge funds.

Sykes touted the corporate’s “incredible” aggressive benefit: “Schwab and Fidelity offer foreign trading and custody, but Interactive Brokers has a broader access to global exchange trading,” he stated.

American Express

AXP

was GABF’s sixth largest funding as of Dec. 31. Some traders won’t notice it’s a financial institution holding firm. It was included on this listing of the ten giant U.S. banks with one of the best 15-year earnings efficiency, based mostly on returns on common belongings.

Sykes referred to as American Express play on the generational wealth transition. “They are getting the biggest share of millennials,” he stated, calling these newer clients “big spenders, loyal, with more velocity,” and certain to make use of their playing cards at “a lot more touch points” than older clients.

He additionally stated 80% of the corporate’s price income comes from cost charges. Those are primarily annual charges for cost playing cards, that are paid off in full on the finish of every month. AXP can be rising its bank card lending enterprise.

“A business able to do 20%+ return on equity on a consistent basis is extraordinary,” Sykes stated, whereas declaring that Berkshire Hathaway Inc.

BRK

has a 20% stake within the firm’s widespread shares. According to FactSet, AXP’s returns on fairness have averaged 26.6% over the previous 10 years and 25.5% for 15 years. The firm’s 2022 ROE was 31.8%, in accordance with FactSet. These are very excessive figures in contrast with banks which have enterprise fashions that rely extra on curiosity revenue and fewer than price income, which made up 77% of AXP’s complete income in 2022.

First Citizens Bancshares Inc.

FCNCA

of Raleigh, N.C., was included on this current listing of banks buying and selling at or under tangible guide worth. It has been broadly reported that the financial institution has made a bid with the Federal Deposit Insurance Corp. for the failed Silicon Valley Bank, though First Citizens hasn’t commented in regards to the matter publicly.

Shares of New York Community Bancorp

NYCB

shot up after it bought deposits, 40 branches and a closely discounted mortgage portfolio from the failed Signature Bank of New York in a cope with the FDIC.

First Citizens wasn’t included in GABF’s Dec. 31 holdings listing, however Sykes stated the inventory is now attractively priced simply above tangible guide worth and that it’s “is a very well run bank, with a history of integrating [acquisitions] over time.”

Sykes referred to as the NYCB/FDIC deal “very clever,” and stated that even when First Citizens isn’t profitable in it FDIC bid, “with the depressed multiple and the opportunity to increase earnings, you may have a double benefit — multiple expansion and higher earnings.”

Top holdings of the Gabelli Financial Services Opportunities ETF

As of Dec, 31, the most important holding of GABF was Berkshire Hathaway. Sykes will host a panel dialogue in the course of the Gabelli Funds Annual Value Investing Conference in Omaha, Neb., on May 5 in regards to the firm, earlier than Berkshire’s annual assembly on May 6. Here’s final 12 months’s panel dialogue:

Here are the ETF’s prime 10 holdings (out of 38) as of Dec. 31:

| Company | Ticker | % of portfolio internet belongings |

| Berkshire Hathaway Inc. Class B | BRK | 8.6% |

| FTAI Aviation Ltd. | FTAI | 5.6% |

| Wells Fargo & Company | WFC | 4.8% |

| Interactive Brokers Group, Inc. Class A | IBKR | 4.6% |

| Blackstone Inc. | BX | 4.6% |

| American Express Company | AXP | 4.5% |

| Focus Financial Partners, Inc. Class A | FOCS | 4.3% |

| Blue Owl Capital, Inc. Class A | OWL | 4.1% |

| Bank of America Corp | BAC | 4.0% |

| JPMorgan Chase & Co. | JPM | 3.9% |

Source web site: www.marketwatch.com