For all the eye paid to the highflying tech giants dubbed the Magnificent Seven, there’s one other grouping that has stored proper up with them, and with lots decrease danger.

It’s referred to as GRANOLAS, a time period coined by Goldman Sachs throughout 2020 to discuss with the most important European corporations at the moment: GSK

GSK,

Roche

ROG,

ASML

ASML,

Nestle

NESN,

Novartis

NOVN,

Novo Nordisk

NVO,

L’Oreal

OR,

LVMH

MC,

AstraZeneca

AZN,

SAP

SAP,

and Sanofi

SNY,

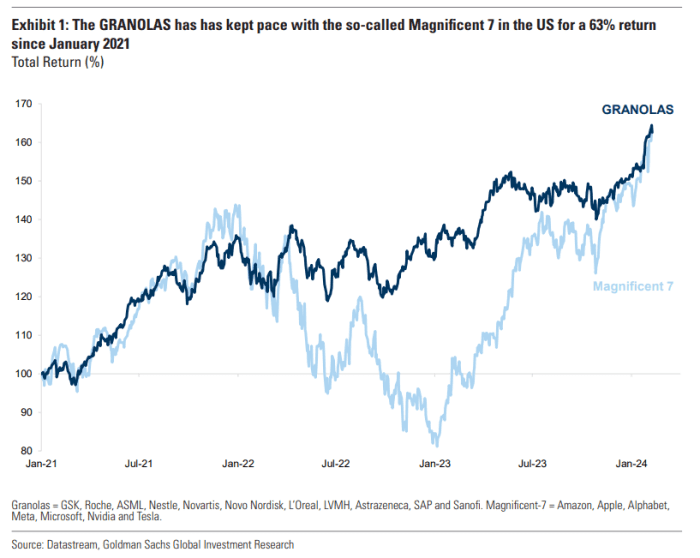

This chart exhibits, in complete return phrases since January 2021, that the GRANOLAS grouping has stored proper up with the Magnificent Seven of Amazon.com

AMZN,

Apple

AAPL,

Alphabet

GOOGL,

Meta Platforms

META,

Microsoft

MSFT,

Nvidia

NVDA,

and Tesla

TSLA,

with a 63% return, and volatility since 2018 that’s on common twice was low.

They’re lots cheaper than the Mag 7, buying and selling at 20 occasions earnings versus 30, although the GRANOLAS are costlier to the broader European market.

This grouping has had a powerful fourth quarter reporting season, led by Novo Nordisk’s success with weight-loss medicine, and ASML’s surge of microchip-equipment making machines, though L’Oreal upset partially because of its struggles in China.

“In our view, the reason why this group of stocks trades at a premium to the market is that they offer strong (and predictable) growth,” mentioned strategists led by Guillaume Jaisson.

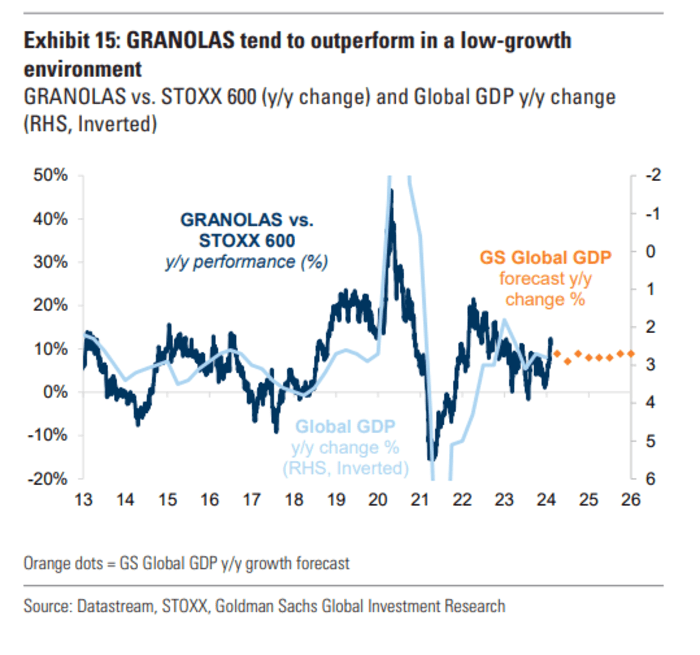

They say the time to personal the GRANOLAS is when world GDP development is under 3%, which is what the financial institution expects over the following 5 years.

Perhaps surprisingly in a world filled with exchange-traded funds, Goldman has not created a fund to commerce on its moniker, which means traders who need publicity to the theme must purchase every inventory individually.

Source web site: www.marketwatch.com