Investors participating in late summer time inventory promoting could have felt vindicated after Wednesday’s hawkish set of Fed minutes all however promised extra charge will increase, providing but another excuse to money in on this 12 months’s positive aspects.

Attempting to cheer up the bulls, Mark Newton, head of technical technique at Fundstrat, advised purchasers that inventory promoting of late has been “very orderly” and merely a “short-term pullback, which should lead to a resumption of a rally.” But he cautions that this may increasingly not occur till after the Fed’s Jackson Hole summit in late August.

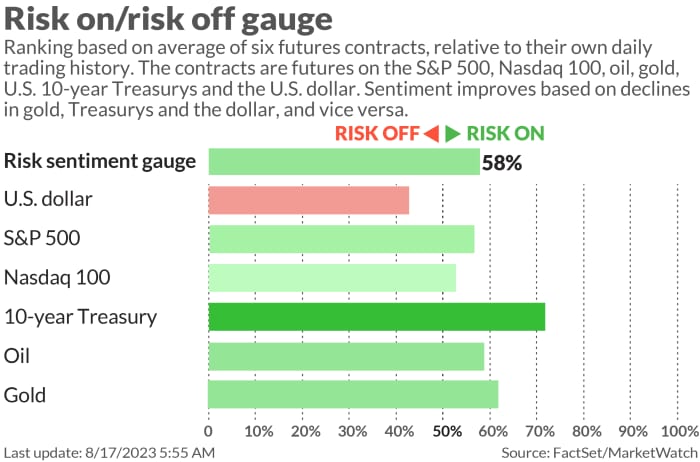

While shares had been within the grips of a rebound on Thursday, Goldman Sachs’ managing director Scott Rubner notes a “clear shift in sentiment over the past few weeks” throughout his buying and selling calls. “This is no longer a buy-the-dip market,” he says in our name of the day.

In a word to purchasers, Rubner highlighted some market happenings that have gotten him nervous. Among them, the S&P 500

SPX

closed Tuesday by way of the financial institution’s short-term commodity buying and selling advisor threshold set off of 4,462.10 for the primary time since May twenty fourth and under the S&P500 50-day shifting common of 4,475. CTAs are a bunch of hedge funds which might be guided by algorithms.

He mentioned Tuesday additionally marked an all-time excessive for volumes of choices linked to the S&P 500 with extraordinarily small lifespan, referred to as 0DTEs. As MarketWatch’s Joe Adinolfi highlighted final week, a latest surge in these “zero-day until expiration” choices has raised involved amongst some market members of a market selloff. The S&P completed 1.1% decrease on Tuesday.

What else? Rubner says so-called “top book liquidity,” which he describes as the flexibility to switch danger shortly, in S&P 500 e-mini futures has dropped by 56% over the previous two weeks.

“This is new. Investors have shifted their trading behavior from a BTD ‘Buy the dip’

market to STR ‘Sell the Rally’ market. This is a new change in tone and sentiment. This is something that I have not said often,” he writes.

The Goldman professional, who has studied movement information for twenty years, additionally frets that already jittery markets are about to face trip headwinds.

“This Friday starts the most common ‘two-weeker’ of the whole year for global Wall Street returning to trade on September 5th (post U.S. labor day holiday on 9/4),” he writes.

“This matters because there is low risk tolerance to add into any potential negative headlines,” he says, pointing to news on China and subsequent week’s Jackson Hole convention and Nvidia outcomes. “Is NVDA the most important stock world right now for market sentiment? I think so, this is a single stock microcosm of everything that went right in the first half. The mood is defense, not offence,” he says.

Rubner fears September’s seasonality gloom will get pulled ahead forward of that trip interval. He notes the median return for the S&P 500 in September since 1928 is a unfavourable 1.56%, and 1.21% for the Nasdaq 100 Index,

NDX

making it “the worst month of the year.”

The markets

Stocks

DJIA

SPX

COMP

are shifting increased, with the yield on the 10-year Treasury

BX:TMUBMUSD10Y

up barely to 4.281%. Oil costs

CL.1,

are up 1.4%, whereas China’s CSI 300

XX:000300

noticed its first constructive session in six.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Weekly jobless claims fell by 11,000 to 239,000 within the newest week, whereas the Philly Fed manufacturing survey rose to 12 in August from unfavourable 13.5 within the prior month. U.S. main financial indicators are nonetheless to return.

Walmart

WMT,

inventory is up 2% after the retail large beat forecasts and delivered an upbeat outlook, whereas luxurious group Tapestry

TPR,

is sliding as earnings lagged consensus. Ross Stores

ROST,

and Applied Materials

AMAT,

coming after the shut.

Late Wednesday, Cisco Systems

CSCO,

gave a conservative outlook that spooked some buyers, however the networking large’s shares are bouncing. Avnet

AVT,

is up 7% after upbeat outcomes from the electronic-components provider. Wolfspeed

WOLF,

is down 17% after the silicon-carbide chip firm reported widening losses that it expects to worsen.

U.Ok. protection group BAE Systems

BA,

mentioned it’s shopping for the aerospace enterprise of Ball Corp.

BALL,

for $5.5 billion. Ball shares are up.

The variety of retirement millionaires surged within the second quarter, because of bettering markets and regular contribution charges, Fidelity mentioned.

Best of the net

Housing market has hit ‘rock bottom,’ says Redfin CEO Glenn Kelman

Margot Robbie cleans up with $50 million ‘Barbie’ payday, however that doesn’t repair Hollywood’s wage hole

Hawaii officers plan to halt land gross sales in wake of lethal wildfires in Maui

The chart

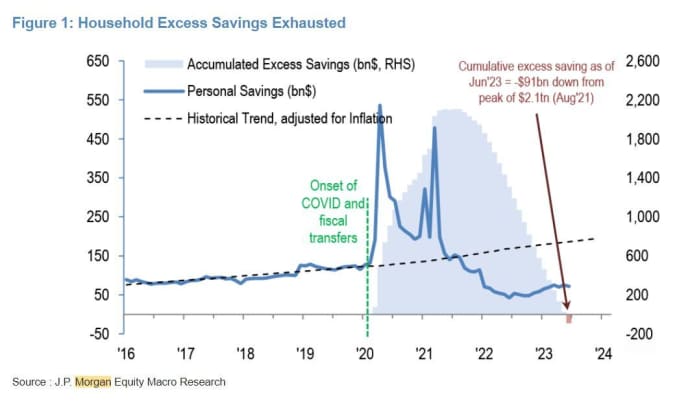

The San Francisco Fed says that U.S. households will run out of COVID-era additional financial savings, credited for serving to hold retail gross sales afloat lately, by the third quarter of 2023.

Also weighing in on when the surplus financial savings will disappear was a group led by JPMorgan’s Dubravko Lakos-Bujas, head of U.S. fairness technique, who supplied up this chart:

JP Morgan

“Currently we estimate excess household liquidity adjusted for inflation at [approximately] $1.4 trillion to fully drain by May’24 assuming a steady depletion rate,” the JPMorgan group wrote in a word on Thursday. “Our concern is whether excess liquidity will even support above-trend consumption for that long.”

The tickers

These had been the top-searched tickers as of 6 a.m. Eastern:

| Ticker | Security identify |

|

TSLA, |

Tesla |

|

AMC, |

AMC Entertainment |

|

TTOO, |

T2 Biosystems |

|

NVDA, |

Nvidia |

|

TAI, |

Talmora Diamond |

|

NIO, |

NIO |

|

EBET, |

EBET |

|

MULN, |

Mullen Automotive |

|

GME, |

GameStop |

|

AAPL, |

Apple |

Random reads

“Life-sustaining kidney function” from a pig to a human for the primary time.

‘Rats the size of crocs’ operating up and down New York’s streets.

Police rescued this poor raccoon trapped in jar

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e mail field. The emailed model will probably be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton.

Source web site: www.marketwatch.com