The inventory market, as measured by the S&P 500 index

SPX,

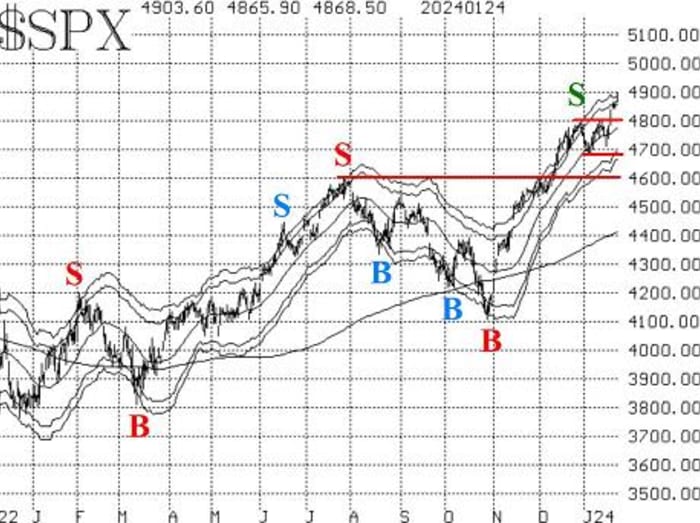

has damaged out strongly to the upside, buying and selling at new intraday and shutting highs. The breakout got here on Jan. 19, over the 4,800 stage. That now represents assist, and that assist extends right down to 4,680. There is not any classical resistance, as a result of the S&P 500 is buying and selling at new all-time highs, however it’s now encountering its +4σ “modified Bollinger Band,” which could act as a restraint of types.

The sideways motion between 4,680 and 4,800 that befell between mid-December and mid-January is essential as a launchpad for this rally. If the S&P 500 ought to commerce again beneath 4,680, that might be extraordinarily destructive.

The McMillan Volatility Band promote sign (the inexperienced “S” on the chart above) continues to be in impact, however it will likely be stopped out if the S&P 500 closes above the +4σ Band. It touched the Band on Jan. 24 however didn’t shut above it. Today, an in depth above 4,894 would cease out this promote sign. A brand new MVB promote sign may ultimately arrange if that occurs, however it will usually take a couple of days for that to happen. Note that the Band strikes every day, so it is not going to essentially keep at 4,894 for tomorrow and succeeding days.

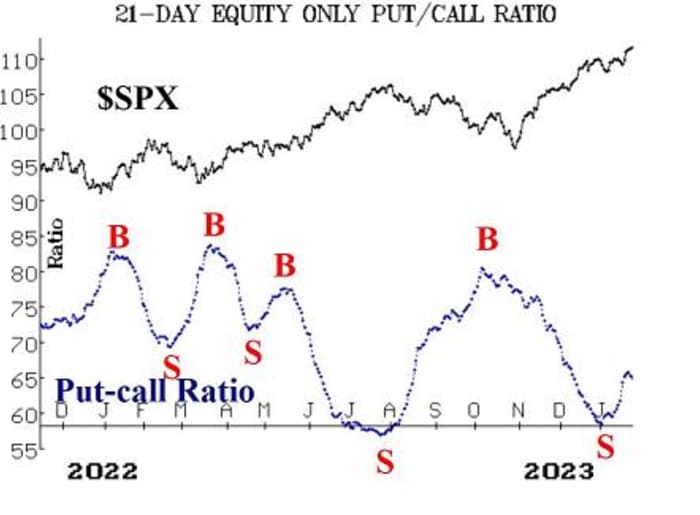

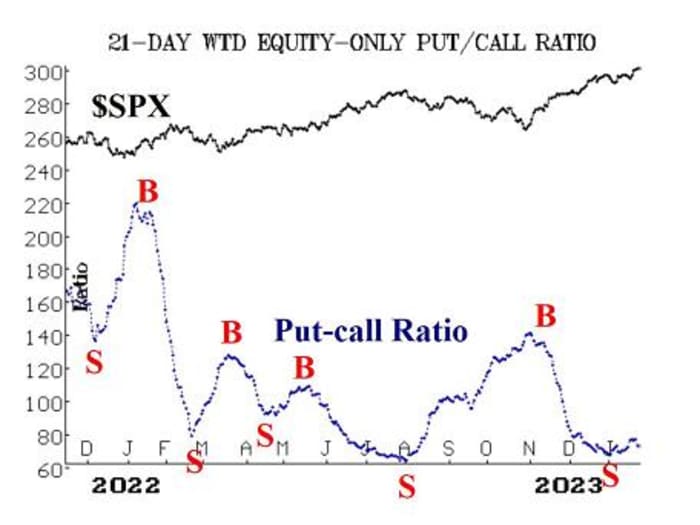

Both of the following two indicators — equity-only put-call ratios and breadth oscillators — are telling us that the typical inventory will not be having fun with the bullishness of the S&P 500 and different main indices. So, as soon as once more, the rising market is a slim one, however that has been the case for a few years, on and off, and hasn’t offered a big downside to this point.

The equity-only put-call ratios have been among the most destructive indicators. Despite curling downward previously couple of days, our computer-analysis applications nonetheless grade these charts as being on promote indicators — i.e., promote indicators for the inventory market. As lengthy as they’re rising, that’s bearish for shares. If they need to drop beneath their latest lows, they’d return to a bullish state.

Breadth has additionally not been all that nice, however each breadth oscillators are on purchase indicators at the moment.

Per week in the past, we noticed new lows on the New York Stock Exchange leap above new highs, however that state of affairs has been fully reversed, as new highs have registered greater than 100 on three of the final 4 buying and selling days, and that has returned this indicator to a purchase sign. This purchase sign would solely be stopped out if new lows on the NYSE exceed new highs for 2 consecutive days.

The CBOE Volatility Index

VX00,

VIX

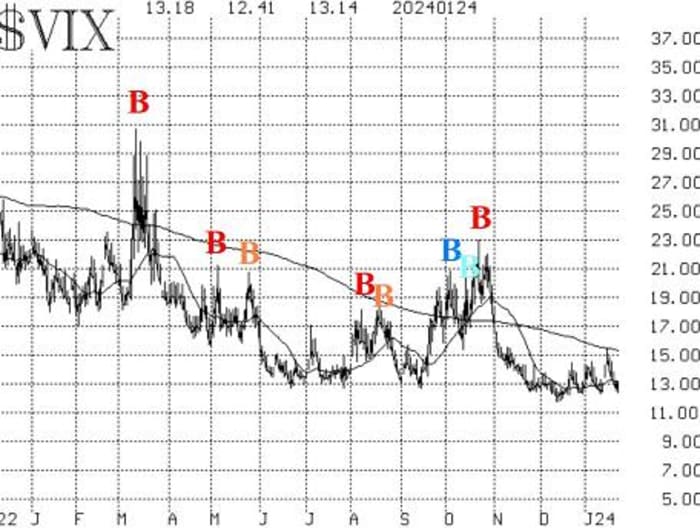

has remained in a subdued state and is buying and selling close to 13 once more. That signifies that the development of VIX purchase sign continues to be in place. It will stay that means till VIX closes above its declining 200-day transferring common, which is presently at 15.40. A low VIX will not be a bearish signal; it solely turns into worrisome for shares when VIX begins to rise sharply. That hasn’t occurred but.

The assemble of volatility derivatives stays in a bullish state for shares, because the time period constructions slope upward, and the VIX futures are buying and selling at massive premiums over VIX. The first warning signal right here can be if February VIX futures (the entrance month) have been to shut above March VIX futures. Again, that’s not occurring at the moment.

A brand new bullish seasonality begins with this Friday’s shut. It lasts for 4 days, and the system commerce that we constructed round it has a great monitor file. See the “market insight” part for full particulars on this technique’s historical past and the really helpful commerce.

Realized volatility has backed off, too. That signifies that the 20-day Historical Volatility of SPX, or HV20, has fallen again beneath 9%. That stops out the earlier promote sign and returns this indicator to a impartial state. HV20 would now need to fall beneath 8% in an effort to probably arrange a brand new promote sign at a later date.

We proceed to take care of a core bullish place, due to the optimistic nature of the S&P 500 chart. We are rolling calls up once they turn into deeply within the cash. Furthermore, we’ll proceed to commerce new confirmed indicators round that “core” place. One may need thought that new promote indicators can be largely bearish, however in reality the bearish ones are being stopped out, and new ones are largely bullish.

New advice: New highs versus new lows purchase sign

As famous above, new highs on the NYSE have numbered greater than 100 for 3 of the final 4 buying and selling days. In addition, they’ve outnumbered new lows by a big margin. That is a brand new purchase sign for this indicator.

Buy 1 SPY Feb. (16) at-the-money name

The commerce can be stopped out if new lows outnumber new highs on the NYSE for 2 consecutive days. Meanwhile, roll the SPDR S&P 500 ETF Trust

SPY

name up if it turns into 8 factors within the cash.

Market perception: January bullish seasonal commerce

Mutual funds and different establishments usually obtain an influx of money simply as a brand new yr begins. They make investments a few of that money instantly, which is why the market usually rallies within the first few buying and selling days of January. However, to some extent, they method the tip of the month with a part of that money nonetheless sitting on the books. They don’t usually need to present an excessively massive money stability on the finish of the month, in order that they make investments the remainder of the accessible money close to the tip of January.

Historically, costs are likely to rally starting on the shut of the 18th buying and selling day of January and persevering with for 4 days. Originally, this seasonal buying and selling system had a five-day holding interval, however the fifth day has been too risky, so we shortened our holding interval a number of years in the past to 4 days.

In the previous 38 years, this technique has produced 30 winners and eight losers, when measured when it comes to S&P 500 costs. The common acquire is 1.1% for the 4 days — actually respectable. In some instances, it has been way more. The final two years have been very robust. In 2022, regardless of the start of a bear market, the January seasonal noticed the S&P 500 rise by 6.1%, and final yr it was up 2.7%.

We have regarded for a correlation between what had beforehand occurred in January, as much as that 18th buying and selling day, however there’s no robust proof that the S&P 500 efficiency previous to the 18th buying and selling day has a lot affect on what occurs after it. The establishments are just about going to splurge it doesn’t matter what.

At the shut of buying and selling on Friday, the 18th buying and selling day of January, purchase 2 SPY Feb. (9) at-the-money calls.

Roll the calls up in the event that they turn into 6 factors within the cash. Sell all the calls on the closing of buying and selling 4 days later, on Thursday, Feb. 1.

Follow-up motion

All stops are psychological closing stops except in any other case famous.

We are utilizing a “standard” rolling process for our SPY spreads: In any vertical bull or bear unfold, if the underlying hits the quick strike, then roll the whole unfold. That can be roll up within the case of a name bull unfold or roll down within the case of a bear put unfold. Stay in the identical expiration and maintain the gap between the strikes the identical except in any other case instructed.

Long 4 XLP

XLP

Feb. (16) 72 calls: The cease stays at 71.20.

Long 1 SPY Feb. (16) 485 name: This place was initially a protracted straddle. It was rolled up, and the places have been bought. The calls have been rolled up a number of extra occasions, together with most not too long ago on Jan. 22, when SPY traded at 485. This is, in essence, our “core” bullish place. Roll the calls up each time they turn into a minimum of 8 factors within the cash.

Long 4 UNM March (15) 45 calls: We will maintain this place so long as the weighted put-call ratio of Unum Group

UNM,

stays on a purchase sign.

Long 1 SPY Feb. (16) 480 calls: This name was purchased consistent with the Cumulative Volume Breadth (CVB) purchase sign. The CVB purchase sign predicted that SPX would commerce at a brand new all-time excessive, which it not too long ago did. The calls have been bought on Jan. 22 since new highs have been attained.

Long 0 ESPR Feb. (16) 3 calls: These calls have been stopped out on Jan. 18, when Esperion Therapeutics Inc.

ESPR,

closed beneath 2.25.

Long 2 DIS June (21) 90 places: Sell these places, because the weighted put-call ratio of DIS

DIS,

is not on a promote sign.

Long 1 SPY Feb. (16) 469 put and Short 1 SPY Feb. (16) 449 put: Was purchased consistent with the McMillan Volatility Band promote sign. It will attain its goal if S&P 500 trades on the -4σ Band, and it will likely be stopped out if the S&P 500 closes above the +4σ Band. Today, that might be an in depth above 4,894. The Band strikes every day, so it is not going to essentially keep at 4,894 for tomorrow and succeeding days.

Long 1 SPY Feb. (16) 469 put and Short 1 SPY Feb. (16) 449 put: Was purchased consistent with the HV20 promote sign. This unfold needs to be bought, since HV20 has fallen again to 9%, which stops out the commerce.

Long 1 SPY Feb. (16) 469 put and Short 1 SPY Feb. (16) 449 put: Was purchased as a result of the so-called Santa Claus rally failed this yr. The unfold was stopped out when the S&P 500 closed above 4,800 for 2 consecutive days, ending on Jan. 22.

Long 1 QQQ Feb. (2) 409 put and Long 1 QQQ Feb. (2) 413 put: Sell the primary Invesco QQQ Trust Series I

QQQ

put that turns into 20 factors within the cash, and roll the opposite down when and if it turns into 20 factors within the cash. Sell all of the remaining places on the shut of buying and selling on the 18th buying and selling day of January — this Friday.

Long 1 SPY Feb. (16) 476 put and Long 1 SPY Feb. (16) 484 calls: In line with earlier directions, the decision was rolled up when it grew to become 8 factors within the cash. Sell the put now and proceed to roll up each time the decision is 8 factors within the cash.

Long 3 TLT

TLT

May (19) 95 put: We will maintain so long as the put-call ratio promote sign is in place for Treasury bonds.

Send inquiries to lmcmillan@optionstrategist.com.

Lawrence G. McMillan is president of McMillan Analysis, a registered funding and commodity buying and selling advisor. McMillan could maintain positions in securities really helpful on this report, each personally and in consumer accounts. He is an skilled dealer and cash supervisor and is the creator of the best-selling e book, Options as a Strategic Investment. www.optionstrategist.com

©McMillan Analysis Corporation is registered with the SEC as an funding advisor and with the CFTC as a commodity buying and selling advisor. The info on this e-newsletter has been fastidiously compiled from sources believed to be dependable, however accuracy and completeness usually are not assured. The officers or administrators of McMillan Analysis Corporation, or accounts managed by such individuals could have positions within the securities really helpful within the advisory.

Source web site: www.marketwatch.com