Ahead of main tech earnings, Meta outcomes are able to gentle up the Nasdaq Composite

COMP

for Thursday. The S&P 500

SPX

can be pointing to features as buyers take a glass-half full view of the Fed assembly.

Worried that buyers are within the clutches of one other Fed misinterpret is the founding father of LaDucTrading.com, Samantha LaDuc. “The market is not pricing either higher terminal rate or growth slowdown or recession. One or more of these assumptions is wrong. My bet: Fed goes higher for long. They don’t cut in 2023, unless they have a reason to,” she says.

MarketWatch final spoke to LaDuc, who focuses on timing main market inflections, final May when she predicted the S&P 500 would end 2022 round 3,800 — it completed at 3,859. Another name she nailed was her early 2022 warning of a coming “tech wreck,” predicting a 20% Nasdaq hunch in 2022 — it ended the 12 months down 33%.

In our name of the day, LaDuc says money is the place to be and that buyers are “being paid to wait. They’re getting very favorable 4.5% on their sitting cash.”

Even although the greenback has misplaced 8% within the final 12 weeks, “the money you put in money-market funds is earning 4.5% right now, whereas before it was earning 0.4% or 0.5%,” she stated in a Wednesday interview.

“So the Fed hiking has motivated a kind of paid-to-wait while the market stabilizes. I don’t think Treasurys are a safe bet for this year. I really can see no outperformance in bonds, and I think equities have more risk to the downside than upside,” stated LaDuc.

She’s particularly apprehensive about tech, saying the Nasdaq probably has one leg down left to go earlier than the selloff is throughout.

She explains that analysts are predicting an earnings recession by way of the fourth quarter of 2023, and never an financial recession. “They literally expect Q4 to pop up about 10% in earnings because of favorable comps— comparisons for the prior year.

“The problem with that is that the earnings analysis does not in any way, shape or form consider a recession, and it absolutely assumes moderate growth,” says LaDuc. “So we still have Goldilocks all priced in equities and priced into earnings.”

A development to worth rotation has been a key prediction for LaDuc since July 2020 when she began to name for “things over paper,” predicting a shift to oversold commodities, cyclicals and large-cap worth performs with charges bottoming.

While that rotation “absolutely outperformed” in each 2021 and 2022, she says it would commerce much less nicely this 12 months as a result of inflation expectations have come down.

The backside line? Rather than purchase that inventory market dip, buyers ought to brief the rip greater, she says.

Her final statement is tied to gold

GC00

— and she or he says she’s not a gold bug, however that her pattern indicators at the moment are “firing” for the dear metallic for the primary time in years.

Gold is usually a robust name as a result of it needs to be “timed perfectly” and usually isn’t an outperformer, aside from a Nineteen Seventies journey greater as an inflation hedge. What has modified is that final 12 months central banks purchased essentially the most gold final 12 months since 1967.

“It’s the lack of counterparty risk that is driving the central bank desire for more control of gold that bears watching right now,” stated LaDuc.

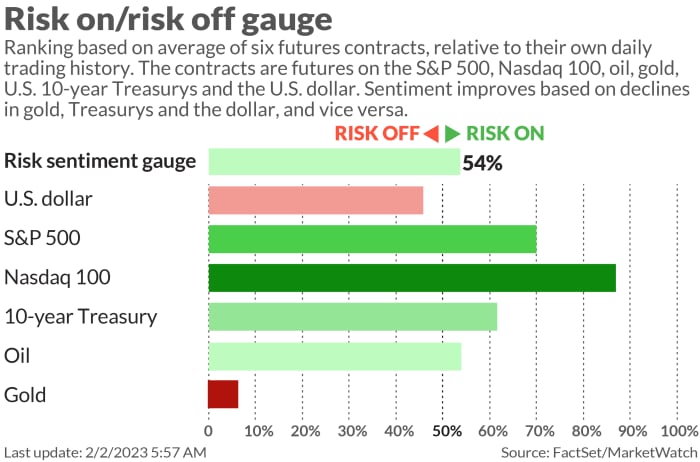

The markets

Nasdaq-100 futures

NQ00

are surging on Meta boat-lifting and S&P 500 futures

ES00

are additionally greater. Bonds

BX:TMUBMUSD10Y

are regular, oil

CL

is flat, with gold

GC00,

silver

SI00

and different metals

HG00

PL00

PA00

up.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Meta shares

META

are up 19% in premarket buying and selling after the Facebook mum or dad missed earnings, however gave upbeat 2023 income steering and promised extra buybacks.

Opinion: Zuckerberg and Intel are transport the proceeds from their layoffs straight to Wall Street

And massive names will report after the bell — Apple

AAPL,

Alphabet

GOOGL

and Amazon.com

AMZN,

Ford

F,

Gilead

GILD,

Starbucks

SBUX

and Qualcomm

QCOM.

Also forward of the open, Merck

MRK,

Honeywell

HON,

Bristol Myers

BMY

and Eli Lilly are reporting.

Baidu inventory

BIDU

HK:9888

is greater after climbing in Hong Kong and late Thursday within the U.S. on news BlackRock raised its stake within the Chinese internet-search big to six.6% at finish of 2022.

Adani Group corporations continued to tumble hours after the Indian conglomerate canceled a $2.5 billion share sale, as fallout from a scathing report from U.S. brief vendor Hindenburg Report continues to take toll.

Weekly jobless claims are due at 8:30 a.m. ET and manufacturing unit orders are coming at 10 a.m.

Best of the online

‘The Last of Us’ in actual life? Rising temperatures could also be spreading fungal infections, analysis says

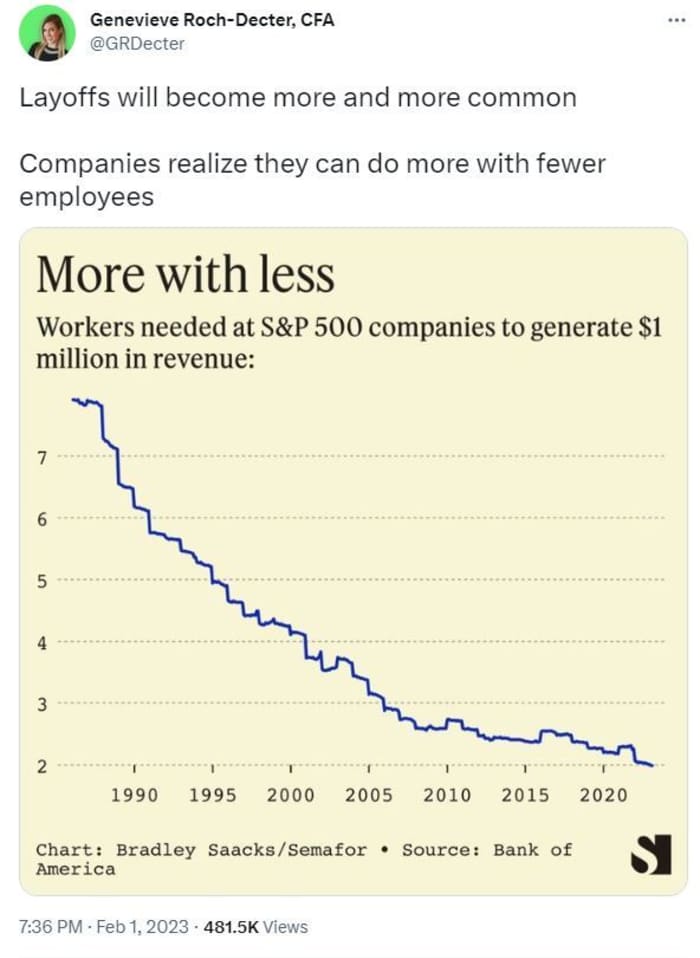

The chart

Get used to corporations shedding employees?

@GRDecter

The tickers

These have been the top-searched tickers on MarketWatch as of 6 a.m. Eastern:

| Ticker | Security title |

| TSLA | Tesla |

| META | Meta Platforms |

| BBBY | Bed Bath & Beyond |

| AMC | AMC Entertainment |

| GME | GameStop |

| APE | AMC Entertainment Holdings most popular shares |

| AMZN | Amaazon.com |

| CVNA | Carvana |

| AAPL | Apple |

| NIO | NIO |

Random reads

Reporter’s deadpan ode to surviving gloomy February goes viral.

With no extra king…Australia strips Charles III off its banknotes

How Punxsutawney Phil is usually a inventory market indicator

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your electronic mail field. The emailed model will likely be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

Source web site: www.marketwatch.com