There’s a variety of analysts who say shares, within the tech sector particularly, have priced in an excessive amount of enthusiasm this 12 months. Count Josh Wolfe, co-founder and managing associate of Lux Capital, amongst them. Through Thursday, the S&P 500

SPX,

is up 5% this 12 months, and the tech-heavy Nasdaq Composite

COMP,

has gained 11%.

In its quarterly letter to traders that Wolfe posted on Twitter, the agency warns that traders won’t be correctly discounting the intense dangers of huge misallocation and extra indebtedness.

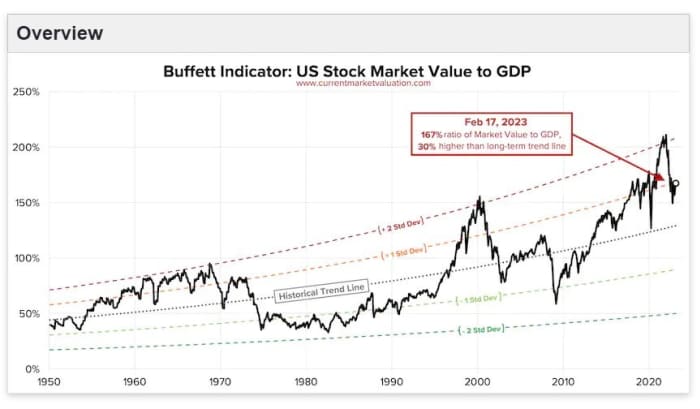

The fund factors out that the ratio between S&P 500 market cap and GDP — a easy ratio made well-known by Warren Buffett — might need 30% or extra to fall to be able to revert to pattern. The cyclically adjusted price-to-earnings ratio is at 29 instances, which additionally must fall 30% to return to its historic pattern. The 2-year to 10-year unfold is inverted, and sitting on the highest ranges for the reason that Nineteen Eighties.

CurrentMarketValuation.com

The fund says this heralds the hangover from the surplus lately. “Rising rates means falling price-earnings multiples, falling tech spending and thus falling earnings. Unsurprisingly, labor is the logical and first target for cost-cutting to cushion the double blow of falling ratios (P/E) and rationing (customer spending),” fund writes.

Also learn: More than 107,000 tech-sector staff have misplaced their jobs for the reason that begin of 2023

Their view is what has hit tech is coming for others. “While blue-collar work has seen high demand, it may be a trailing indicator from post-COVID reopenings when middle-and-upper-class demand exceeded labor supply. As layoffs metastasize from white to blue, the pain in the next two years will be disproportiontely felt by the worst off amongst us, sowing the sweeds for social unrest,” the fund says.

From an funding perspective, pursuits emerge out of conflicts, and proper now the battleground is rising in synthetic intelligence. The large tech giants like Amazon

AMZN,

Microsoft

MSFT,

and Alphabet’s Google

GOOGL,

need to monetize their computing energy, however given the prices to coach a foundational AI mannequin, Lux sees a shift amongst entrepreneurs and builders to a decentralized community, akin to what has been constructed within the crypto frenzy.

“The supply of highly advanced computational clusters once used for bitcoin mining is being repurposed toward the new demand for training open-source AI models,” the agency says, including it’s invested in a key participant “that will come out of stealth soon.”

Lux is also an investor in Hugging Face, which hosts AI fashions; RunwayML, a machine-learning device for artists; and MosaicML, which gives infrastructure and software program instruments for machine studying.

One bellwether for the place the world is headed: Chinese President Xi Jinping, the fund says. As vp below Hu Jintao, XI signaled assist for build up tech behemoths in e-commerce, social media, cell, funds, edtech, supply and logistics — and now’s sanctioned exhausting sciences and deep tech: biotech, aerospace, protection, area, satellittes and semiconductors. Xi has ushered in a spotlight from Made in China to invented in China, “and global capital will be wise to competitively follow his hints.”

Source web site: www.marketwatch.com