Although it’s nonetheless roughly 9 months away, buyers are already paying as much as shield their portfolios from any market-rattling fallout from the November U.S. presidential election, options-market strategists mentioned.

October futures tied to the Cboe Volatility Index

VIX

have lately risen above 20, indicating elevated demand for S&P 500-linked choices expiring the next month. The election will happen Nov. 5, and is predicted to function a rematch between President Joe Biden and former President Donald Trump.

Although the spot Vix stays notably subdued, the rise within the October Vix futures has triggered the unfold between the September and October contracts to widen to 2.8, the widest month-over-month unfold presently baked in to the Vix futures curve.

Derivatives market consultants who spoke with MarketWatch described this as an indication that merchants are bracing for wild swings in markets in November. The swings might are available both path, though volatility usually rises extra rapidly when shares are falling.

“Markets are going to be moving around a lot, and it doesn’t have to be down,” mentioned Rocky Fishman, founding father of derivatives-market analysis agency Asym 500. “This tells us that there’s a wider range of outcomes for the market at that point in time, and it could be a wide range in both directions.”

Call and put choices tied to the S&P 500 are sometimes utilized by buyers to hedge their portfolios, with buyers both locking in beneficial properties by promoting calls, or defending their draw back by shopping for places. To ensure, choices can be utilized for the aim of hypothesis as nicely.

When implied volatility rises, it usually makes choices costlier.

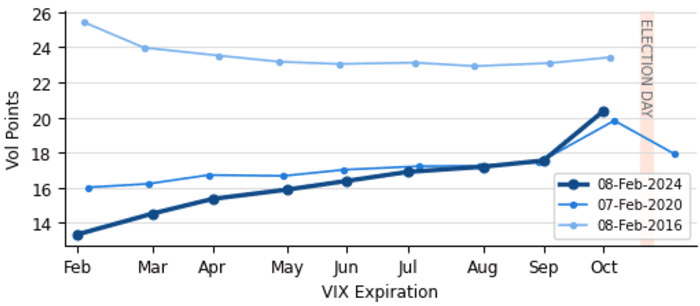

To ensure, elevated demand months forward of the presidential vote isn’t distinctive to 2024. Demand for choices has elevated forward of every of the final 4 elections, in response to Danny Kirsch, head of the choices desk at Piper Sandler & Co. Although demand seemed to be choosing up earlier this yr than throughout election years previous.

“There’s historically a premium for volatility around the election, this year it’s being priced in a little bit earlier, and I think that’s a function of the nominees being known much earlier, and the uncertainty around policy related to Trump,” he mentioned.

As Fishman illustrated within the chart beneath, buyers additionally lined as much as purchase portfolio insurance coverage 9 months forward of the 2020 vote.

ASYM 500

Just like with the spot Vix, the worth of Vix futures is set by buying and selling exercise in S&P 500 choices set to run out the next month.

The 20 stage is critical for the so-called worry gauge, merchants say, as a result of it roughly coincides with the long-term common of the index relationship again to its creation within the early Nineteen Nineties. Above 20, merchants are mentioned to be betting on markets being extra risky than their long-term common.

The stage of implied volatility being priced into the October Vix contract additionally appears notable in comparison with the subdued stage of the spot Vix, which stood at 12.9 as of Friday. The index has languished beneath 15 for 62 straight classes, the longest streak since a 66-day stretch that ended Oct. 5, 2018, in response to Dow Jones Market Data.

The Vix climbed early Monday, rising to 13.52, as U.S. shares swung into the inexperienced after opening decrease. The S&P 500

SPX

was up 9.14 factors, or 0.2%, at 5,035.70, whereas the Dow Jones Industrial Average

DJIA

gained 106 factors, or 0.3%, at 38,778. The Nasdaq Composite

COMP

rose 0.3% to 16,036.

Fishman blamed the legacy of the dual election-related shocks of 2016 — the Brexit vote within the U.Okay., and former President Donald Trump’s victory over Democrat Hillary Clinton — for driving buyers’ demand for hedges to this point forward of the November vote.

“I think it’s in response to all of the volatility we had [around elections] in 2016 that markets started pricing it in,” Fishman mentioned.

Source web site: www.marketwatch.com