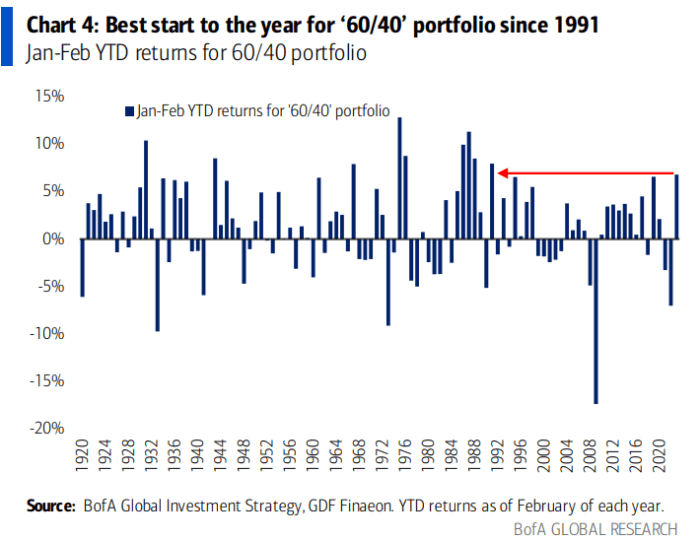

The conventional funding portfolio allocation of 60% to shares and 40% to bonds is off to the very best begin to a 12 months in additional than 30 years after collapsing in 2022, based on BofA Global Research.

The commonplace 60/40 portfolio has gained 6.8% to date this 12 months, stated analysts at BofA Global Research, citing EPFR Global knowledge in a weekly notice. The allocation is getting off to the strongest begin to a 12 months since 1991, after delivering one in every of its worst years in historical past (see chart under).

SOURCE: BOFA GLOBAL RESEARCH

See: Bond investing 101: What to know because the Fed sticks to its inflation battle

The 60/40 portfolio has lengthy been revered as a trusty guidepost for buyers with a average threat tolerance. By holding 60% of their portfolios in equities and 40% in bonds, buyers might have the very best of each worlds: traditionally, the place in bonds might present some cushion for buyers when the inventory market takes a success.

But this technique didn’t pack the identical punch in 2022 because the Federal Reserve’s tight stance of financial coverage in an effort to tame the very best inflation in many years battered each the inventory and bond markets, offering robust headwinds to the principles of thumb in investing.

BofA stated in October that moderately than producing its 9% common return, the 60/40 technique delivered a minus 30% return within the first ten months of 2022, marking its worst stretch because the aftermath of the Great Depression in 1929.

The Bloomberg U.S. Aggregate Bond Index, the broadest home measure of the core fixed-income market and which incorporates Treasurys, company mortgage-backed securities and investment-grade company debt, booked a 13% loss in 2022.

Meanwhile, all three main benchmarks within the inventory market suffered their worst 12 months since 2008. The Dow Jones Industrial Average

DJIA,

dropped 8.8%, whereas the S&P 500

SPX,

tumbled 19.4% and the technology-heavy Nasdaq Composite

COMP,

plunged 33.1%.

See: Traditional 60/40 technique could begin to work once more for buyers, however ‘tightening cycles can be scary,’ Goldman exec says

However, each U.S. equities and bonds have rallied in 2023, with buyers more and more assured the Federal Reserve will “pivot” away from its restrictive coverage stance within the close to future and should even reduce rates of interest by the top of this 12 months.

The BofA knowledge confirmed bonds noticed inflows for the previous six weeks. “We believe bonds will have a tough decade but they will post positive returns in 2023,” stated Michael Hartnett, chief funding strategist at BofA Global Research. “What’s the best thing about stocks in 2023? Bonds.”

The yield on the 2-year Treasury notice

TMUBMUSD02Y,

was at 4.511% on Friday afternoon, climbing from 4.507% on Thursday, a stage that marked the yield’s highest end since Nov. 22, based on Dow Jones Market Data. The 10-year Treasury notice yield

TMUBMUSD10Y,

rose 6.1 foundation factors to three.743% from 3.682% Thursday.

See: Top Wall St. economist says ‘no landing’ state of affairs might set off one other tech-led stock-market selloff

In the meantime, the U.S. inventory market has been usually upbeat however extraordinarily risky in 2023 as noisy financial knowledge generates lingering considerations concerning the state of the financial system. The S&P 500 gained 6.5% this 12 months, whereas the Dow industrials superior 2.2% and the Nasdaq jumped 12%, thanks partially to sturdy tech earnings.

Hartnett stated it’s very “tempting” to see final Friday’s “blockbuster” January nonfarm payroll knowledge as indicating an financial slowdown might be averted or not less than delayed, however the January inflation report which is due out subsequent Tuesday, can be “vital” to look at for clear instructions on when the Fed will pivot in its financial coverage marketing campaign.

U.S. shares ended largely larger on Friday with the Dow gaining 169 factors, or 0.5%, to 33,869. The S&P 500 rose 0.2, to complete at 4,090, whereas the Nasdaq dropped almost 71 factors, or 0.6%. For the week, the large-cap index was off 1.1%, posting its worst week in almost two months. The Dow industrials was off 0.2% and the Nasdaq slumped 2.4%.

Source web site: www.marketwatch.com