Bond yields had been little modified early Wednesday as merchants waited for minutes from the Federal Reserve’s finish of January assembly to be revealed.

What’s occurring

-

The yield on the 2-year Treasury

BX:TMUBMUSD02Y

dipped 2.9 foundation factors to 4.589%. Yields transfer in the other way to costs. -

The yield on the 10-year Treasury

BX:TMUBMUSD10Y

fell lower than 1 foundation level to 4.274%. -

The yield on the 30-year Treasury

BX:TMUBMUSD30Y

was unchanged at 4.543%.

What’s driving markets

Investors had been eschewing daring bets forward of the discharge at 2 p.m. Eastern of the minutes from the Federal Reserve’s coverage assembly that concluded on Jan. 31.

Benchmark 10-year Treasury yields have in current weeks moved towards the highest of a three-month vary of roughly 3.8% to 4.3% after firmer-than-expected inflation and jobs information inspired Fed officers to point price cuts had been unlikely to start in March.

Analysts count on the brand new minutes to replicate that stance.

There are also quite a few Fed officers talking on Wednesday, together with Atlanta Fed President Raphael Bostic who will ship opening remarks at 8 a.m. Eastern, Richmond Fed President Tom Barkin who can be interviewed on SiriusXM radio at 9:10 a.m., and Fed Gov. Michelle Bowman who will make feedback at 1 p.m.

Markets are pricing in a 93.5% likelihood that the Fed will go away rates of interest unchanged at a spread of 5.25% to five.50% after its subsequent assembly on March twentieth, based on the CME FedWatch instrument.

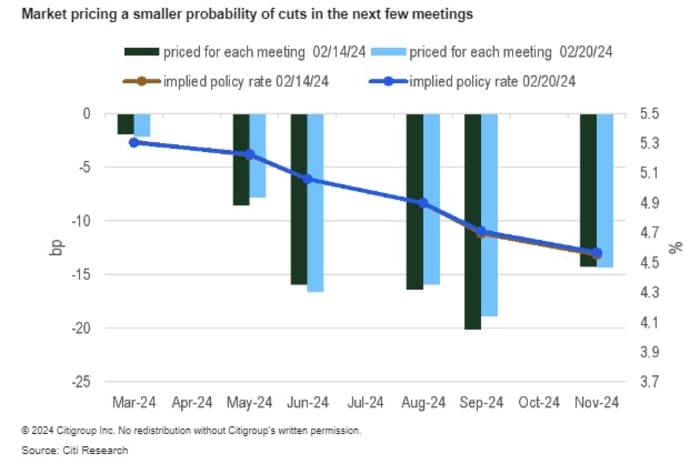

The probabilities of at the least a 25 foundation level price minimize by the next assembly in May is priced at 37.2%, down from 84.7% a month in the past. The central financial institution is predicted to take its Fed funds price goal again right down to round 4.5% by December 2024, based on 30-day Fed Funds futures.

The Treasury will public sale $16 billion of 20-year notes at 1 p.m.

Source: Citi

What are analysts saying

“We continue to expect the first 25 basis point Fed rate cut in June, similar to what markets are pricing,” stated the economics crew at Citi led by Andrew Hollenhorst.

They stated sturdy jobs and elevated inflation make it tough to justify reducing charges earlier than then, and that stance can be mirrored within the minutes. Eventually, nonetheless, decrease year-on-year core PCE readings could also be sufficient to persuade Fed officers to chop, even when exercise holds up.

Source web site: www.marketwatch.com