China’s still-floundering economic system is just one of a laundry listing of worries for international companies energetic within the nation, but most nonetheless plan on investing vital sums into their Chinese operations, based on two much-anticipated studies this week.

Uncertainty over Chinese authorities coverage, U.S.-China tensions, toughening native competitors and stress from the Biden administration to scale back reliance on China topped considerations amongst corporations surveyed within the American Chamber of Commerce in Shanghai’s annual China Business Report.

While firms’ optimism about their prospects within the nation hit an all-time low, there was a slight uptick within the share of companies that plan to extend their investments in China this 12 months, to 31% from 25% final 12 months.

“The [economic] rebound has not materialized and business sentiment has continued to deteriorate,” the chamber wrote in its report.

The findings mirrored these launched the identical day in a large report from the European Union Chamber of Commerce in China, which, alongside its listing of considerations amongst its members, included greater than 1,000 “constructive recommendations” to the Chinese authorities.

While circumstances within the nation stay difficult, forays into relocating operations away from China accelerated.

Of the 40% of American firms shifting their investments away from China, Southeast Asia ranked because the main relocation spot, with the U.S. and Mexico as the subsequent hottest selections.

See: U.S. firms trying to transfer manufacturing from China flip to India

Other metrics worsened from final 12 months.

Only 26% of companies surveyed stated China was amongst their prime three funding locations, a considerable drop from the year-earlier 40% — and the enterprise local weather in 2022 was already distressing for international corporations.

From the archives (May 2023): Foreign companies in China concern they’re being focused in a ‘campaign’ of presidency crackdowns. It’s in all probability not that straightforward.

“It took a trade war, a breakdown in geopolitical tensions, a pandemic and finally a year’s worth of zero-COVID lockdowns, but finally corporates got the message that the days of business-as-usual in China are over — and that they needed not just contingency planning but an actual pivot to ensure their global supply chains couldn’t be held hostage to whatever happens in a country half a world away,” Leland R. Miller, CEO of the China Beige Book consultancy, advised MarketWatch.

There’s additionally been diplomatic and coverage confusion from the American facet. The Biden administration has despatched a parade of high-level officers to China in latest months in makes an attempt to clean commerce and funding relations.

From the archives (July 2023): Yellen complains about China therapy of U.S. firms

Also see (June 2023): Blinken, Xi pledge to stabilize deteriorating ties, however China rebuffs important U.S. request

At the identical time, it has imposed restrictions on delicate know-how, comparable to semiconductor chips, that make a number of the Trump administration’s trade-war salvos look gentle as compared.

The chair of the U.S. House of Representatives’ committee on China is ready to fulfill with prime American chip producers to press them to additional limit China’s entry to associated know-how, Reuters reported Tuesday — a transfer that might additional disrupt planning and prospects for main corporations comparable to Nvidia

NVDA,

and Intel

INTC,

Chinese nationalism, too, has appeared able to seize on any stumbles amongst international firms and to tighten an embrace of home companies. Private Chinese telecom big Huawei just lately shocked the tech group by unveiling a telephone that purports to make use of its personal in-house chip and run at speeds aggressive with main gamers, doubtlessly circumventing U.S. restrictions. That improvement “potentially [poses a] downside risk to iPhone sales, especially in the Asia Pacific [region],” stated BofA Securities analyst Wamsi Mohan.

Chinese media trumpeted the Huawei launch, and the telephone bought out in minutes.

At the identical time, Apple took a PR beating this week after Chinese social media exploded in anger at a web-based advert that includes an “ugly caricature” of what was presumed to be a Chinese individual.

Chinese netizens stated the employee, donning a pigtail, represented a mocking throwback to “Fu Manchu” clichés. It turned out the advert truly depicted a Native American individual and had been utilized in campaigns in different areas, as properly.

Regardless, the mistaken outrage helped to additional stress on Apple shares

AAPL,

which have fallen some 13% for the reason that begin of August.

But the overriding concern amongst international corporations was uncertainty and concern of the whims of Chinese authorities coverage.

In April, Shanghai police raided and questioned workers on the U.S. consultancy Bain & Co. The incident was significantly worrisome in that it got here simply weeks after authorities closed the Beijing workplace of Mintz Group, a U.S. due-diligence firm, and detained a number of native workers, making the arbitrary crackdowns appear extra like coverage than one-off incidents.

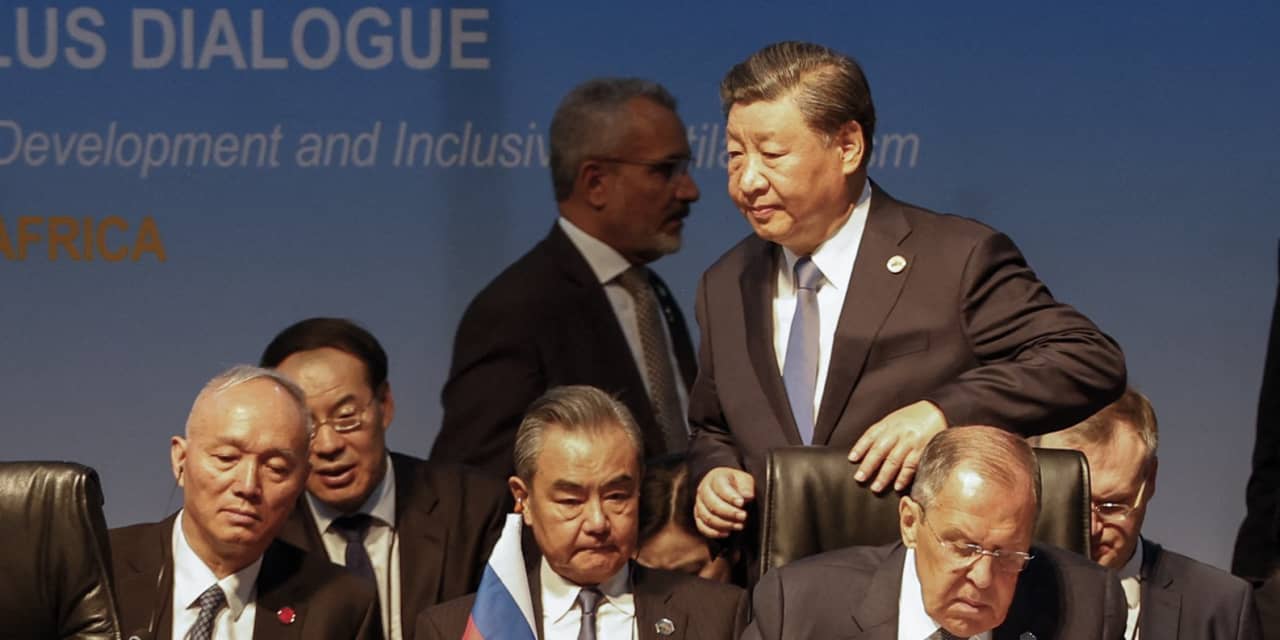

As the Chinese economic system has continued to stumble and international funding has sunk to document lows, President Xi Jinping and different prime leaders have shifted their rhetoric and tried to allay considerations amongst abroad firms.

“We will continue to vigorously promote high-level opening up and better protect the rights and interests of foreign investors per the law,” Xi stated in late June as knowledge on withering inbound funding got here in.

The subsequent month, the Commerce Ministry met with leaders of international and home drug firms in what it stated can be common roundtables to listen to considerations and concepts for cooperation with abroad gamers.

Tanner Brown covers China for MarketWatch and Barron’s.

More dispatches from Tanner Brown:

China’s economic system is struggling, and shoppers received’t open their wallets — besides to see motion pictures

China’s youth job market is a nightmare. It’s altering the face of the nation.

China’s property woes provide a window into the demise of the nation’s growth instances

China will not be solely asserting itself geopolitically however overtly questioning the U.S.’s central function on the world stage

Source web site: www.marketwatch.com