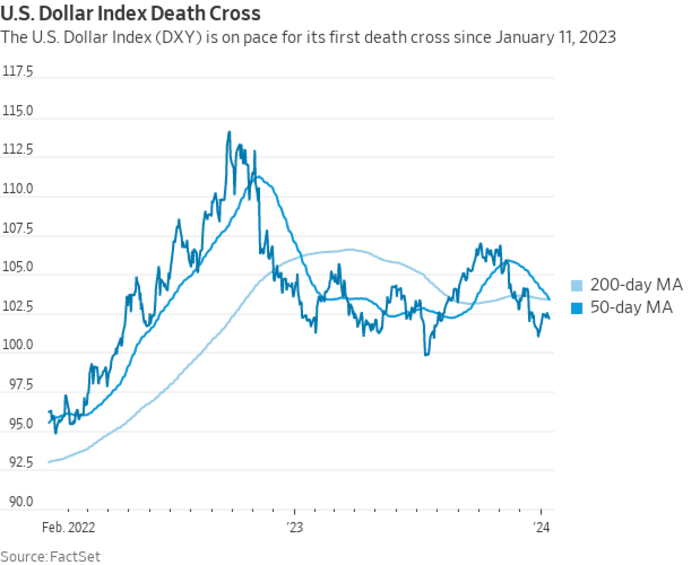

A carefully watched gauge of the U.S. greenback’s efficiency in opposition to different main currencies was on monitor Friday to undergo a “death cross” on the each day value charts — an ominous sounding technical improvement that’s usually seen as a affirmation of a detrimental change in pattern.

The ICE U.S. Dollar Index

DXY,

which tracks the forex in opposition to a basket of six main rivals, was buying and selling round 102.16 Friday morning, off 0.1% on the day however up round 0.8% for the reason that begin of the brand new yr.

The value motion has put the index’s 50-day transferring common on monitor to satisfy or slip under its 200-day transferring common close to 103.40, triggering a loss of life cross (see chart under).

Dow Jones Market Data

While loss of life crosses sound bearish, foreign exchange analysts questioned whether or not they present a lot of a sign, tending as an alternative to verify downtrends already properly beneath means. DXY noticed a so-called golden cross, which happens when the 50-day transferring common rises above the 200-day common and is considered as a constructive indicator, in late September.

Data going again to 1985 reveals that loss of life crosses do are likely to see the index fall over the following 1-, 3- and 6-month intervals. The DXY was down a median 1.2% over the next one month, 1% over three months and 0.4% over six months, in keeping with Dow Jones Market Data. It fell 60% of the time over the one and three-month intervals, and 52% of the time over six months.

A loss of life cross is normally “a relatively meaningless indicator in my books as I don’t every really find any value in it’s predictive power but you’ll likely hear it mentioned in the media,” mentioned Brad Bechtel, world head of FX at Jefferies, in a observe.

A loss of life cross is a lagging indicator that “does not necessarily mean that we won’t see the U.S. dollar rebound,” mentioned Ipek Ozkardeskaya, senior analyst at Swissquote Bank, in a observe.

“On the contrary, I believe that the dovish Fed expectations have been well ahead of themselves since the end of last year and there is room for some positive correction in the U.S. dollar,” she mentioned.

The greenback offered off sharply in December, sinking as buyers priced in expectations for round a half-dozen, quarter-point price cuts by the Federal Reserve in 2024.

Source web site: www.marketwatch.com