The stock-market seasonality development has performed out nearly completely within the third quarter of 2023, with each August and September residing as much as their repute as brutal months for U.S. shares. But that seasonal weak point might arrange a stock-market rally within the last quarter of the 12 months, mentioned longtime market strategists.

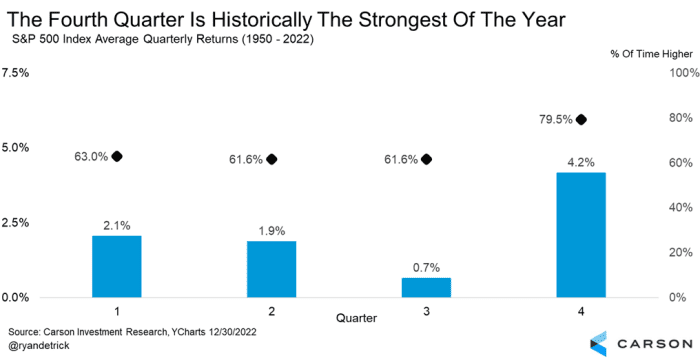

Historically, the fourth quarter has been the most effective quarter for the U.S. inventory market, with the large-cap S&P 500 index

SPX

up practically 80% relationship again to 1950 and gaining greater than 4% on common, twice as a lot as the subsequent finest quarter, mentioned Ryan Detrick, chief market strategist at Carson Group (see chart beneath).

SOURCE: CARSON INVESTMENT RESEARCH

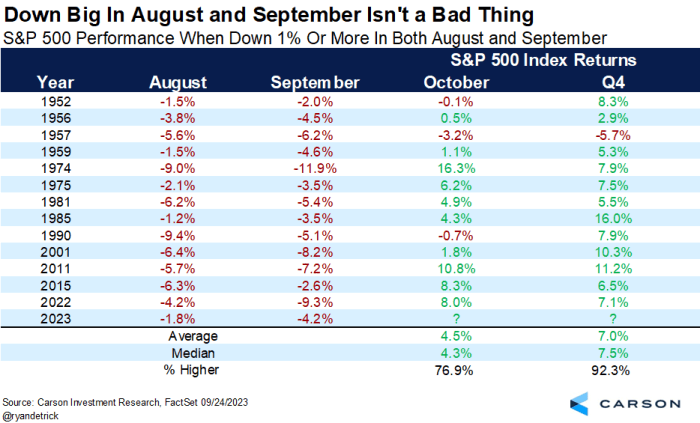

October is named a month for excessive volatility, with a few of the legendary U.S. stock-market crashes — the Panic of 1907, the Wall Street Crash of 1929 and the Black Monday in 1987 — all occurring in October. However, it’s nonetheless normally a “pretty decent month,” particularly when shares fall greater than 1% within the earlier two months, Detrick wrote in a Thursday notice.

See: Why shares are prone to be particularly unstable this October

On Friday, the S&P 500 and the Nasdaq Composite

COMP

recorded their worst month since December and their worst performing quarter thus far in 2023. All three main indexes suffered their second consecutive month of losses, in response to Dow Jones Market Data.

The newest surge in Treasury yields

BX:TMUBMUSD10Y

and the U.S. greenback

DXY

at a 10-month excessive in opposition to a basket of main currencies conspired with seasonal weak point to knock the market down in September. While bullish developments within the greenback and yields have been underway for months, the Federal Reserve’s interest-rate choice and Chair Jerome Powell’s press convention final week accelerated the rally in charges and the dollar.

In the in the meantime, U.S. vitality costs

CL00,

CL.1,

hovered above $90 a barrel in September as traders weighed tightening provides after Saudi Arabia and Russia prolonged their voluntary cuts in oil manufacturing by the tip of 2023, deepening traders’ issues that decreasing inflation to 2% is tough, and extra interest-rate hikes may be wanted.

As a consequence, the S&P 500 ended the month with a lack of 4.9%, whereas the Dow Jones Industrial Average

DJIA

fell 3.5% and the Nasdaq Composite dropped 5.8% in September. In August, the S&P 500 was off 1.8%, whereas the Dow industrials fell 2.4% and the Nasdaq declined 2.2% for the month, in response to FactSet information.

Ryan Belanger, founder and managing principal at Claro Advisors, mentioned the fourth quarter of 2023, regardless of sturdy seasonal tailwinds, may very well be weaker than the historic common as market fundamentals are pointing to a recession.

“Bond yields are at multi-decade high, while the Fed is still considering raising interest rates — it’s going to be challenging for investors to allocate significant capital to the stock market to drive those returns,” Belanger informed MarketWatch by telephone on Friday.

See: September’s U.S. stock-market rout left simply 1 winner as defensive sectors failed to offer shelter

While many traders count on seasonal weak point to proceed, Detrick of Carson Group doesn’t depend out a stock-market rally within the fourth quarter simply but.

For the final 3 times when shares had been off 1% within the earlier two months, October bounced again with a formidable achieve of 10.8%, 8.3%, and eight.0%, respectively, mentioned Detrick.

“Turning to the fourth quarter, it has been up 12 out of 13 times and up more than 7.0% on average [since 1950],” he mentioned. “In other words, when we see the seasonal August and September weakness, it is also normal to see a strong end-of-year rally.” (See chart beneath)

SOURCE: CARSON INVESTMENT RESEARCH, FACTSET

Moreover, when the S&P 500 is up between 10-20% for the 12 months heading into the usually sturdy fourth quarter, Detrick mentioned he expects “an even better fourth quarter,” up greater than 5% on common. The S&P 500 has superior over 12% thus far in 2023, in response to FactSet information.

Source web site: www.marketwatch.com