Almost all dividend-paying massive U.S. firms elevated their payouts or saved them regular within the the third quarter, delivering a 4.5% enhance in money distributed that trumped the worldwide development.

In its newest quarterly report on the world’s 1,200 greatest public companies by market worth, U.Ok.-based fund supervisor Janus Henderson stated 98% of U.S. firms surveyed didn’t trim their dividends, in comparison with 89% worldwide.

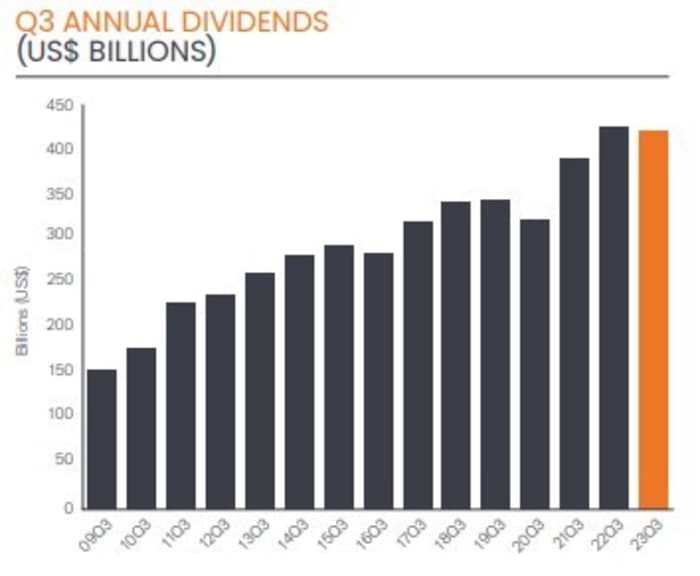

The tempo of U.S. dividend development slowed for an eighth consecutive quarter amid concern about financial prospects after the Federal Reserve seemed to damp inflation by way of greater rates of interest. But with $146.6 billion paid out in simply the third quarter, the U.S. remains to be in line to submit a report payout for 2023, in accordance with Janus Henderson.

Source: Janus Henderson. Global dividends

Microsoft

MSFT,

and Oracle

ORCL,

alone contributed 20% of the $3 billion enhance in U.S. third quarter dividends, whereas the restoration of payouts from Southwest Airlines

LUV,

Las Vegas Sands

LVS,

and Delta Airlines

DAL,

after pandemic-induced interruptions contributed about 15% of the rise.

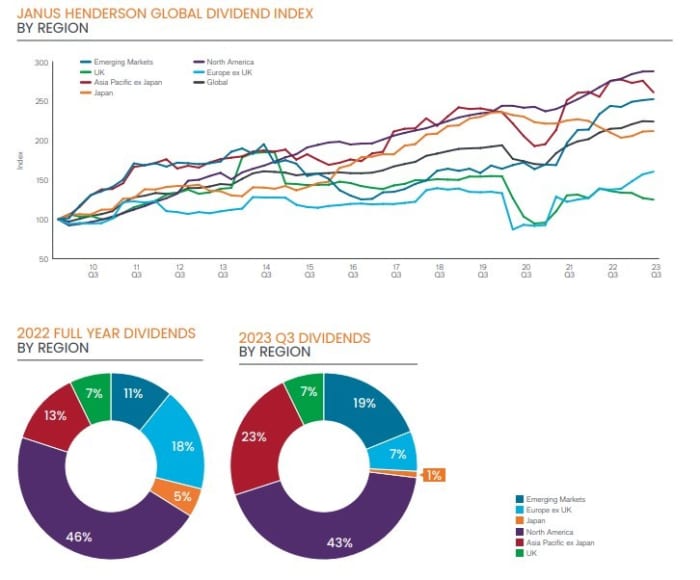

However, the worldwide dividend complete fell 0.9% within the third quarter to $421.9 billion as quite a lot of sources teams trimmed their payouts. Cuts within the mining sector had been 4 instances bigger than in some other sector, with dividends falling 36.9% on an underlying foundation, the survey confirmed. More than half the mining firms diminished their distributions year-on-year.

The two greatest reductions got here from Brazil’s power large Petrobras

PETR4,

PBR,

and Australian miner BHP

BHP,

BHP,

Source: Janus Henderson

Such cuts had been offset by sturdy banking dividends in most components of the world — up 9.3% on an underlying foundation — and by rising payouts throughout a variety of different sectors, particularly utilities and automobile producers.

“Apparent weakness in Q3’s global dividends is not a cause for concern, given the large impact a handful of companies made,” stated Ben Lofthouse, head of worldwide fairness revenue at Janus Henderson. “In fact, the level and quality of growth look better this year than seemed likely a few months ago as payouts have become less reliant on one-off special dividends and volatile exchange rates.”

And he added: “It is quite common and well-understood by investors that commodity dividends will rise and fall with the cycle, however, so this weakness does not suggest wider malaise.”

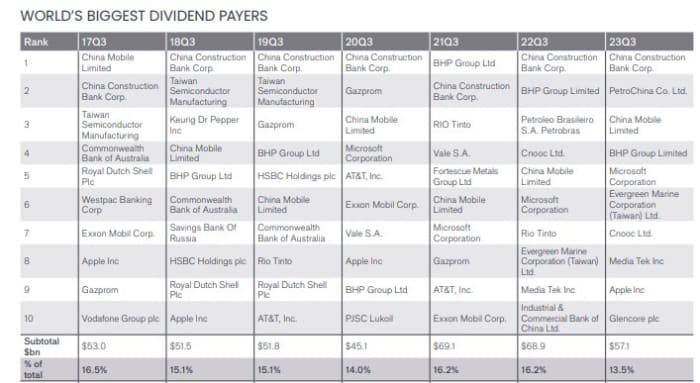

China’s firms confirmed their largesse, elevating payouts 7.8% on an underlying foundation to a report $38.2bn. The greatest optimistic influence was made by PetroChina

857,

which greater than doubled its dividend year-on-year to $6.5bn, making it the second largest payer on the earth within the third quarter,

Top payer was China Construction Bank, with compatriot China Mobile coming in third.

Source: Janus Henderson.

Source web site: www.marketwatch.com