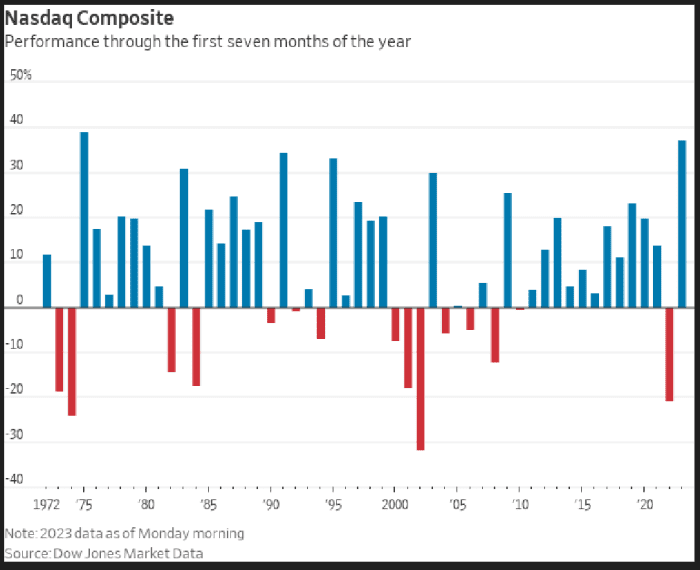

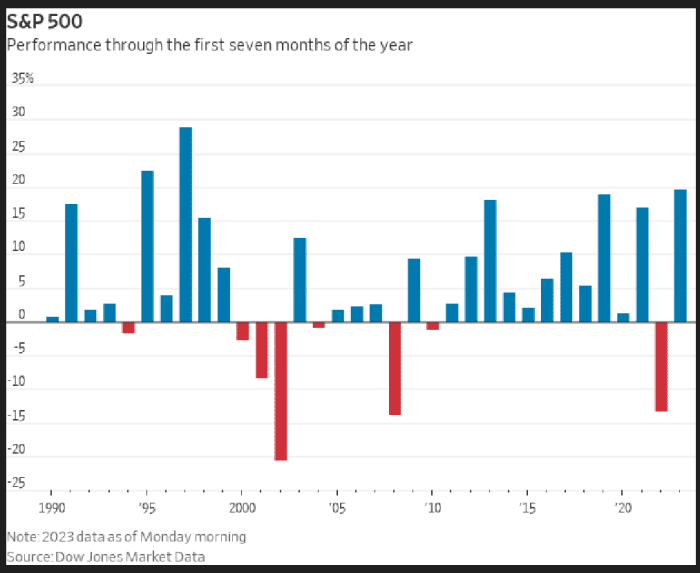

U.S. shares have been on a tear this 12 months, with the S&P 500 and Nasdaq Composite on observe for his or her strongest first seven months of a 12 months in many years, in response to Dow Jones Market Data.

On the ultimate day of July, the S&P 500

SPX,

is on observe for a 3% month-to-month achieve that will increase its year-to-date rise to round 19.4%, in response to FactSet knowledge, eventually test. The Nasdaq Composite

COMP,

is heading for a 3.9% advance this month, bringing the technology-heavy index’s large good points up to now this 12 months to nearly 37%.

On Monday morning, the Nasdaq was on observe for its greatest first seven months of a 12 months since 1975 when the index surged 39.1% over that stretch, in response to Dow Jones Market Data. The Nasdaq went on to surrender a few of these good points in 1975, however nonetheless completed the 12 months up nearly 30%, FactSet knowledge present.

DOW JONES MARKET DATA AS OF MONDAY MORNING JULY 31, 2023

The S&P 500 was on tempo Monday morning for its greatest efficiency by way of the primary seven months of a 12 months since 1997, when it gained 28.8% by way of July, in response to Dow Jones Market Data. The index rose 31% in all of 1997, FactSet knowledge present.

DOW JONES MARKET DATA AS OF MONDAY MORNING JULY 31, 2023

U.S. shares have been hovering this 12 months after struggling huge losses in 2022 because the Federal Reserve aggressively raised rates of interest to fight excessive inflation. The price of residing within the U.S. stays elevated, however it’s been easing even because the economic system continues to increase and the Fed slows its fee hikes in 2023.

Read: Citigroup raises S&P 500 goal for 2023 on elevated probabilities of ‘soft landing’

Meanwhile, the company bond market has been signaling confidence this month in firm money flows, flashing a “green light” for additional inventory good points this 12 months, in response to DataTrek.

While Big Tech shares have fueled the S&P 500’s good points up to now in 2023, there have been indicators of the stock-market rally broadening.

Equity and quant strategists at Bank of America stated earlier this month in a BofA Global Research be aware that they anticipated June’s broadening of the rally to proceed within the second half of 2023. That’s after simply 25% of shares outperformed the S&P 500 within the first six months of 2023, marking the narrowest first-half breadth ever, they stated within the be aware.

Also see: The ‘narrow breadth’ refrain has fallen silent. What broadening participation in stock-market rally means for traders.

Source web site: www.marketwatch.com