Struggling Swiss banking large Credit Suisse has reportedly agreed to be purchased by its arch-rival UBS at a reduction to Friday’s shut value, after seeing a wave of buyer deposits exit the financial institution.

UBS

UBS,

will purchase Credit Suisse

CS,

for greater than $2 billion in an all-stock deal, the Financial Times reported, citing individuals with direct information of the transaction. Bloomberg News reported the identical deal phrases.

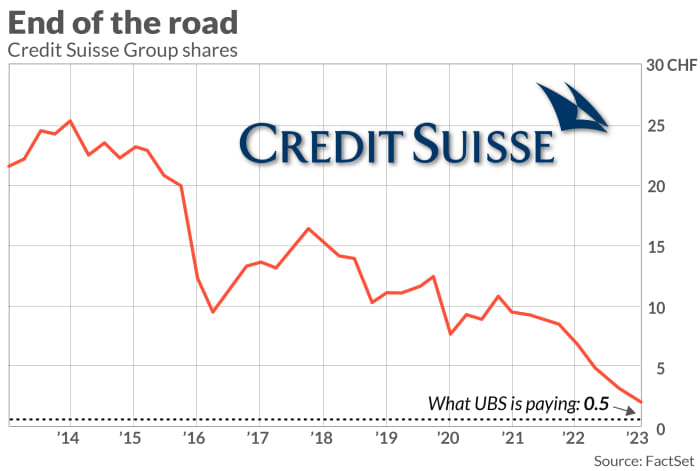

The 0.50 francs per share UBS is providing, in inventory, compares to Credit Suisse’s

CSGN,

closing value of 1.86 francs on Friday. The FT mentioned UBS initially bid simply 0.25 francs per share.

Separately, The Wall Street Journal reported the Swiss National Bank supplied UBS a roughly $100 billion liquidity to soak up Credit Suisse. That comes after SNB final week agreed to mortgage Credit Suisse 50 billion francs.

The Federal Reserve has been working with its Swiss counterpart on the deal, as each banks have main operations within the U.S.

Credit Suisse’s downfall occurred simply days after the collapse of U.S. banks SVB Financial and Signature Bank. While Credit Suisse, in addition to Swiss authorities, mentioned they didn’t have the identical sorts of issues, additionally they noticed prospects depart. After rich shoppers withdrew roughly $100 billion from Credit Suisse within the fourth quarter, they once more started to see huge outflows final week, the FT reported.

Credit Suisse has misplaced cash for 5 consecutive quarters, reeling from losses to household workplace Archegos in addition to having to freeze $10 billion of provide chain funds bought by means of the financial institution that have been managed by Greensill Capital.

Source web site: www.marketwatch.com