Visa Inc. known as out resilient spending because it logged an earnings beat for the newest quarter, however its shares had been nonetheless coming underneath strain in Thursday’s after-market motion.

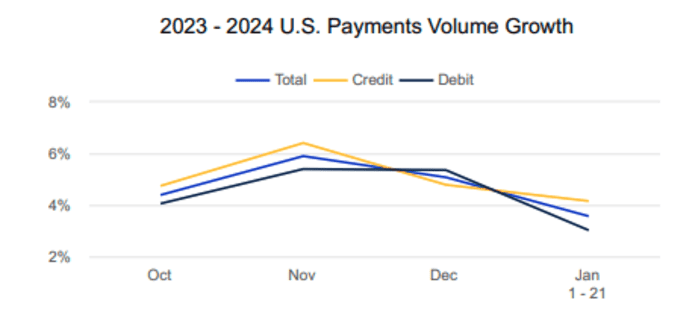

The offender? A slowdown in U.S. volumes into January, in keeping with analysts.

Mizuho analyst Dan Dolev famous that Visa’s

V,

U.S. fee volumes decelerated within the fiscal first quarter and within the first three weeks of January, a development pushed by debit transactions.

Visa

Baird analyst David Kallo stated that whereas the deceleration in January U.S. volumes and whole processed transactions was “not a huge surprise,” these traits may trigger the inventory to “pull back mildly tomorrow.”

Visa Chief Financial Officer Chris Suh stated the January U.S. traits mirrored one-off elements that weren’t indicative of broader spending points. For instance, areas like Kansas City and Dallas have seen excessive chilly temperatures which have prevented individuals from going out and spending.

“We’ve seen weather-related patterns before,” he stated. “It doesn’t give us major concern.”

As for the December-quarter quantity traits, he stated the slowdown was a matter of timing.

“Putting it all together, the step-down of about 80 basis points in total U.S. payments volume growth from Q4 to Q1 was primarily due to a less favorable mix of weekends and weekdays,” he stated on Visa’s earnings name.

“Consumer spend across all segments from low to high spend has remained relatively stable,” he continued. “Our data does not indicate any meaningful behavior change across consumer segments.”

Investors, although, nonetheless appeared involved, and shares fell practically 3% in after-hours buying and selling Thursday.

See additionally: PayPal CEO sees ‘huge monetization opportunity’ after revamp, however inventory drops

For the fiscal first quarter, Visa posted internet earnings of $4.9 billion, or $2.39 a share, in contrast with internet earnings of $4.2 billion, or $1.99 a share, within the year-prior interval. After changes, Visa earned $2.41 a share, beating the FactSet consensus view, which was for $2.34 a share.

Revenue rose to $8.63 billion from $7.94 billion, whereas analysts had been in search of $8.56 billion.

The firm noticed an 8% increase in funds quantity in the course of the newest quarter, whereas processed transactions rose by 9%.

Consumer spending has been “resilient” and “quite stable,” Suh stated.

The firm noticed a 16% increase in quantity from cross-border transactions, which happen when somebody makes a purchase order from a service provider based mostly in a distinct nation. Cross-border quantity usually is seen as a proxy for worldwide journey, although it additionally encompasses worldwide e-commerce purchases.

“Travel contunues to be a tailwind” and is “quite healthy,” Suh instructed MarketWatch.

For the fiscal second quarter, Visa expects internet income to develop at an “upper-mid” to high-single-digit fee. The firm additionally expects earnings per share to develop at a “high-teens” tempo from a yr earlier than.

The firm is sticking with its full-year forecast, which requires low-double-digit income development on an adjusted constant-dollar foundation.

Fiscal 2024 might be “a little bit of a mirror image of 2023 in the sense that our first-half revenue growth rate, even if the fundamentals are very stable…will be compressed just because of the high comparables a year ago, and we see lots of reasons why the second-half-of-the-year growth rates will accelerate,” Suh instructed MarketWatch.

The firm faces simpler comparisons within the second half of the yr, he stated, and administration expects to see favorable traits in common ticket sizes.

Check out On Watch by MarketWatch, a weekly podcast concerning the monetary news we’re all watching — and the way that’s affecting the financial system and your pockets. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and affords insights that may make it easier to make extra knowledgeable cash choices. Subscribe on Spotify and Apple.

Source web site: www.marketwatch.com