So a lot for the inflation scare! The inventory market’s dive after Tuesday’s U.S. client costs report got here in hotter-than-expected has been swiftly recouped. Friday may see the S&P 500 index safe its twelfth document excessive of the yr.

Benchmark Treasury yields of 4.27% could also be close to to the top quality wherein they’ve been vacillating because the begin of December — as hopes for an imminent Federal Reserve rate of interest reduce are dashed — however fairness buyers appear to be relaxed about that.

As Adam Turnquist, chief technical strategist at LPL Financial explains: “Market expectations and Federal Reserve monetary policy projections have become closer aligned, alleviating a source of market volatility. Furthermore, better-than-expected economic data has been a driving force of the market’s repricing of rate cuts, reducing the likelihood of a hard-landing scenario.”

But are merchants changing into too sanguine, as tends to be their wont at occasions of inventory market ebullience?

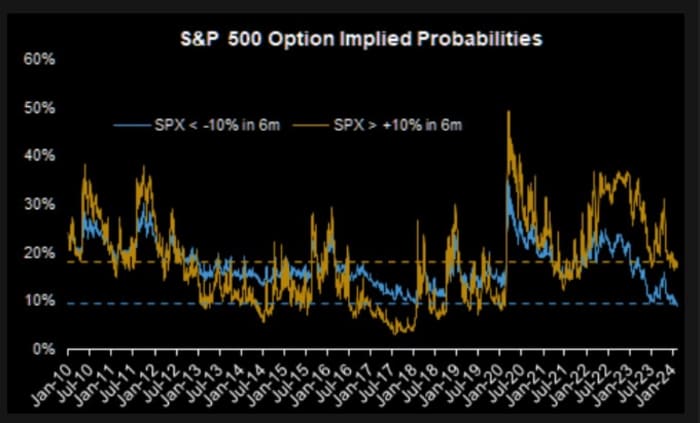

Consider the chart under, courtesy of the The Market Ear.com. It illustrates option-derived implied possibilities of the S&P 500 falling 10% or extra over the subsequent six months or rising by that measure over the identical interval. As the blue line exhibits , the implied likelihood of a giant fall is simply 9%, manner under the common because the 2008 monetary disaster of 17.5%. In essence, this could imply merchants don’t suppose a slide is close to and/or buyers don’t really feel they should pay as much as defend their portfolios.

This is a part of a pattern that sees merchants promoting volatility. And it’s worrying Sevens Report’s Tom Essaye.

An necessary motive why the S&P 500 dropped 1.4% on Tuesday, in keeping with Essaye, was an an overcrowded quick aspect of the choices market, which exacerbated the promoting.

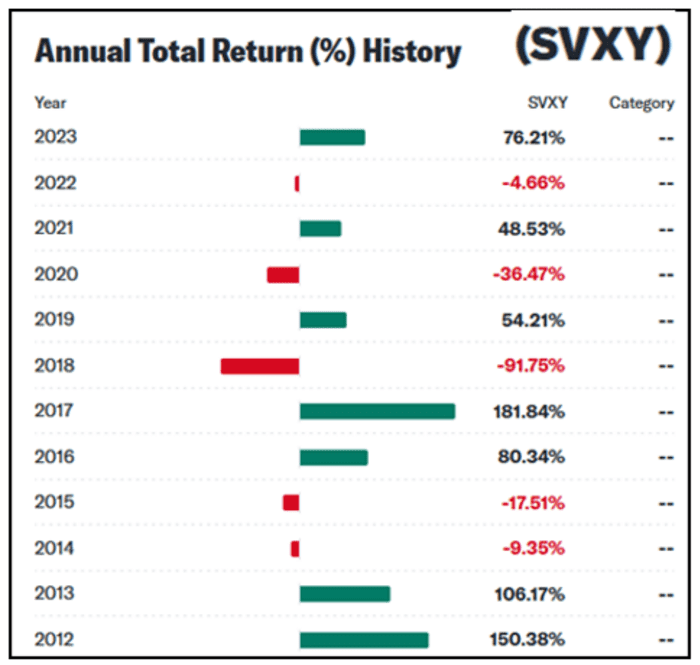

The motion, says Essaye, “was reminiscent of the 2018 ‘Volmageddon’ event that ultimately resulted in several ‘short-volatility’ ETF’s being forced to liquidate as volatility exploded higher amid a more than 10% drop in the S&P 500 in just two weeks.”

To recap, the quick volatility commerce grew to become highly regarded after 2010 when a steadily rising inventory market saved volatility low. Traders may frequently promote out of the cash name choices or CBOE VIX futures and watch the derivatives worth decline into expiry.

Source: Sevens Report

Demand for exchanged traded funds that exploited this technique, similar to ProShares Short VIX Short-Term Futures ETF

SVXY,

surged within the mid-2010s. As the desk above exhibits, the SVXY jumped 80% in 2016 and 182% in 2017. But as famous above, a brisk fall for the inventory market in 2018 brought about a pointy quick squeeze in low-volatility bets, at one level inflicting the CBOE VIX to leap 450% and leaving the SVXY nursing losses of 92% for that yr.

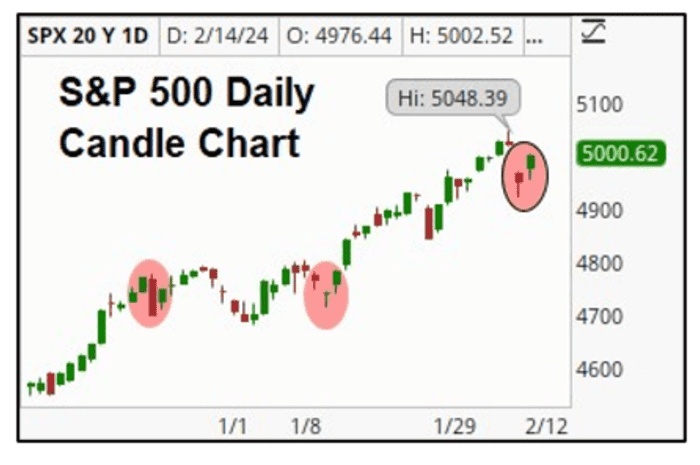

“Fast forward to late 2023 and early 2024 and we are once again seeing similar, volatile price action into certain derivatives expirations, namely the monthly VIX futures expirations,” says Essaye. The chart under exhibits the sharp gap-down sell-offs for the S&P 500 into every of the final three VIX expirations.

Source: Sevens Report

Essaye accepts that thus far upticks in volatility haven’t been a giant deal because the inventory market sell-offs have been quick lived, with losses rapidly recovered.

“But based on the magnitude of the move in VIX futures on Tuesday, there is an increasing threat that the rising level of greed in the ‘short-volatility’ trade, similar to what we saw in 2018, could result in an air-pocket drawdown of 5% or more in the S&P 500,” he concludes.

Markets

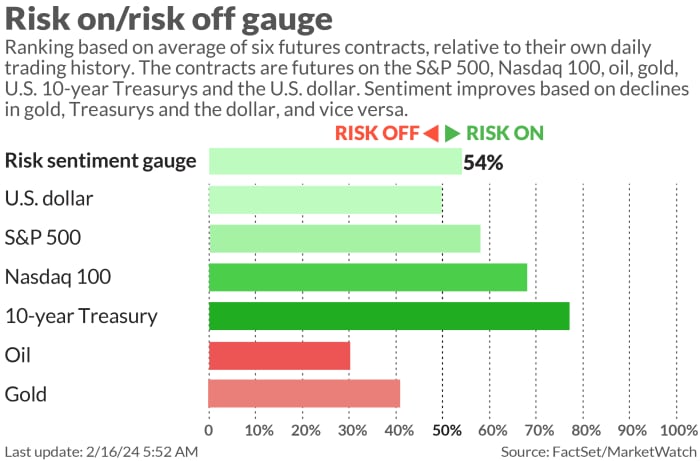

U.S. stock-index futures

ES00,

YM00,

NQ00,

got here off early highs after the PPI report as benchmark Treasury

BX:TMUBMUSD10Y

yields rose. The greenback

DXY

was firmer, whereas oil costs

CL.1,

slipped and gold

GC00,

traded round $2,000 an oz..

| Key asset efficiency | Last | 5d | 1m | YTD | 1y |

| S&P 500 | 5,029.73 | 0.64% | 5.20% | 5.45% | 22.96% |

| Nasdaq Composite | 15,906.17 | 0.71% | 5.65% | 5.96% | 34.16% |

| 10 yr Treasury | 4.265 | 9.79 | 13.42 | 38.45 | 44.39 |

| Gold | 2,017.80 | -1.03% | -0.69% | -2.61% | 8.99% |

| Oil | 77.39 | 1.03% | 5.39% | 8.50% | 1.08% |

| Data: MarketWatch. Treasury yields change expressed in foundation factors | |||||

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

The U.S. January producer value index rose 0.3% month-on-month, greater than economists forecasts of 0.1% and above December’s 0.1%. decline.

The preliminary February client sentiment survey will likely be launched at 10 a.m.

Fed Vice Chair for Supervision Michael Barr will make feedback at 9:10 a.m. and San Francisco Fed President Mary Daly is because of communicate at 12:10 p.m.

Coinbase Global shares

COIN,

had been up 14% in Friday’s premarket motion as a result of the crypto-trading platform made a revenue within the fourth quarter.

An earnings beat and optimistic steering pushed Applied Materials

AMAT,

replenish 12%. But shares in Roku

ROKU,

had been down 15% after earnings that contained a cautious outlook.

U.S. markets will likely be closed on Monday for Presidents’ Day.

Best of the net

China revives socialist concepts to repair its real-estate disaster.

‘I tried out an Apple Vision Pro. It frightened me.’

S&P 500 chart remains to be bullish — whilst stronger headwinds hit the market.

The chart

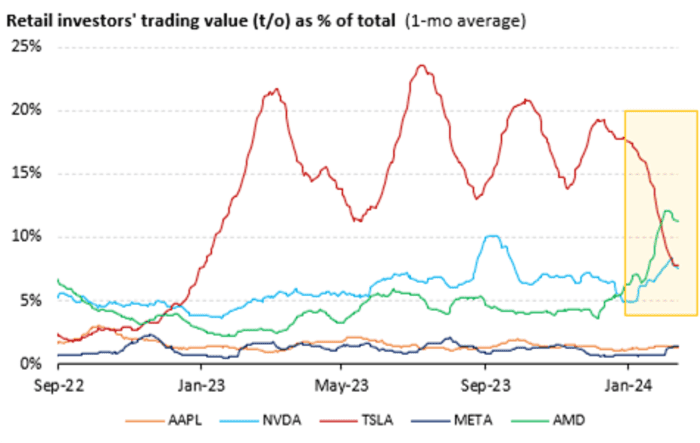

Retail buyers seem like falling out of affection with Tesla

TSLA,

The chart under from Vanda Research exhibits retail buying and selling of Tesla as a share of whole traded worth has declined to pre-2023 ranges. Within the large-cap area, consideration has turned to semiconductor performs, with exercise in Nvidia

NVDA,

and Advanced Micro Devices

AMD,

surging.

Top tickers

Here had been essentially the most lively stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security title |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

SMCI, |

Super Micro Computer |

|

COIN, |

Coinbase Global |

|

AAPL, |

Apple |

|

NIO, |

NIO ADR |

|

AMC, |

AMC Entertainment |

|

PLTR, |

Palantir Technologies |

|

ARM, |

Arm Holdings ADR |

|

AMZN, |

Amazon.com |

Random reads

Your AI girlfriend simply needs your information.

The unimaginable rescue of Ralphie the cat.

Paul McCartney reunited with guitar stolen 51 years in the past.

Need to Know begins early and is up to date till the opening bell, however enroll right here to get it delivered as soon as to your e mail field. The emailed model will likely be despatched out at about 7:30 a.m. Eastern.

Check out On Watch by MarketWatch, a weekly podcast concerning the monetary news we’re all watching – and the way that’s affecting the financial system and your pockets. MarketWatch’s Jeremy Owens trains his eye on what’s driving markets and affords insights that can assist you to make extra knowledgeable cash selections. Subscribe on Spotify and Apple.

Source web site: www.marketwatch.com