Did a gaggle of merchants in quickly expiring choices just lately drag the S&P 500 decrease within the closing hour of buying and selling? Or has the affect of this booming nook of the choices world been exaggerated?

A crew of equity-derivative strategists at Bank of America

BAC,

Global Research assume it’s the latter. In a analysis report shared with purchasers on Tuesday, the crew argued that the affect of rising zero-day, or “0DTE,” volumes has been extra benign than many on Wall Street imagine.

0DTEs stand for zero days to expiration. They are choice contracts sometimes linked to the S&P 500 or an S&P 500-tracking exchange-traded fund, just like the SPDR S&P 500 Trust

SPY,

which have 24 hours or much less till they expire.

Analysts at Goldman Sachs Group

GS,

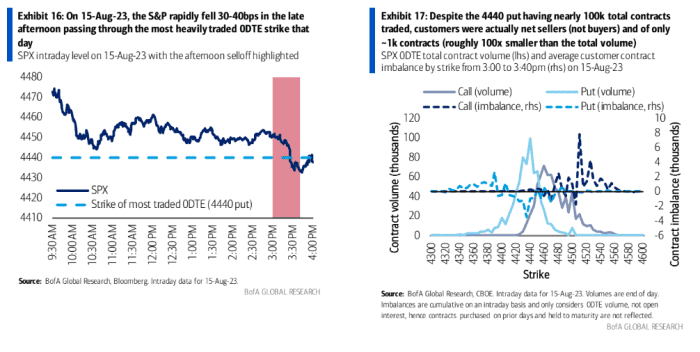

Nomura and different banks homed in on worth motion in shares on Aug. 15, when the S&P 500 shed roughly 0.4% in a 20-minute interval that additionally noticed a flurry of buying and selling in 0DTEs. The S&P 500 closed 1.2.% decrease for the session, its largest every day share drop in about two weeks, in line with FactSet information.

Their thesis is {that a} wave of places with a strike worth round 4,440 moved into the cash, forcing market-makers to hedge their positions by promoting shares and futures.

See: ‘This is no longer a buy-the-dip market.’ Why this Goldman Sachs veteran is fearful concerning the inventory market.

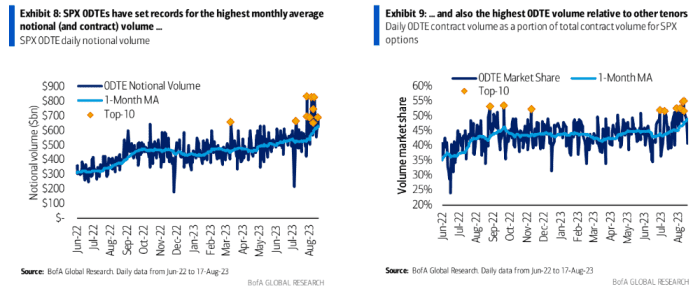

But a crew of analysts at BofA has a special interpretation of what occurred. To make certain, they acknowledged that 0DTE buying and selling quantity has grown dramatically in August to document highs. According to the crew, eight of the ten highest notional-volume days for S&P 500-linked 0DTEs occurred up to now 30 days.

The debate comes as traders endure a punishing month of August in shares and bonds, sparked partly by a selloff in long-dated Treasurys that noticed the 10-year yield

BX:TMUBMUSD10Y

contact its highest since 2007.

Through Friday, choices on the verge of expiration had been on observe to see their busiest month ever when it comes to notional quantity traded. They additionally had been on observe to see data when it comes to the variety of contracts traded, in addition to their share of whole buying and selling quantity in S&P 500-linked choices.

Zero-day choices of their present type are pretty new. But buying and selling in these choices has boomed since final 12 months when the CME Group and Cboe Global Markets, two main U.S. derivatives exchanges, launched weekly choices on sure indexes and ETFs with expirations day by day of the buying and selling week.

BANK OF AMERICA

Options give homeowners the proper, however not the duty, to purchase or promote a given safety at an agreed-upon worth on or earlier than an agreed-upon expiration date. Puts carry the choice to promote, whereas calls carry the choice to purchase.

While the BofA crew thinks 0DTEs have the potential to drive intraday instability in markets, a view that’s shared by many on Wall Street, they questioned the notion that zero-day choice put consumers had been chargeable for what occurred on Aug. 15.

Data cited by a number of Wall Street strategists confirmed roughly 100,000 0DTE put choices with a strike at 4,440 modified palms after 3 p.m. Eastern. However, BofA’s evaluation concluded that buy-side merchants had been web sellers of those contracts, not web consumers, as different analysts have concluded.

BANK OF AMERICA

Therefore, the crew surmised that hedging by market makers, which different analysts have blamed for the sharp transfer decrease within the S&P 500, didn’t have a lot of an affect, suggesting the late-day decline was doubtless pushed by different components like rising Treasury yields or buying and selling by systematic quant funds.

“…[T]he impact 0DTEs may have had last week was clearly greatly overstated. Instead, other factors such as systematic quant flows…and the renewed impact of higher rates on equities may have been more relevant,” the crew mentioned.

See: Trading in dangerous ‘0DTE’ inventory choices hits document and will spark a stock-market selloff, strategists say

To make certain, analyzing option-market move information isn’t an actual science, leaving some room for interpretation as analysts attempt to discern whether or not a given commerce concerned a buy-side dealer shopping for calls or places from a market maker, or one thing else, in line with Brent Kochuba, founding father of SpotGamma, a supplier of information and analytics for the derivatives market.

U.S. shares have fallen for the reason that begin of August, with the S&P 500

SPX

down 4.4% by Tuesday’s shut, in line with FactSet information. The Nasdaq Composite

COMP

has fallen by 5.9%, whereas the Dow Jones Industrial Average

DJIA

is down 3.6%.

Source web site: www.marketwatch.com