A telltale recession sign on Wall Street hasn’t been this jumpy for the reason that Volcker period some 40 years in the past.

Paul Volcker, chairman of the Federal Reserve from 1979 to 1987, relied on interest-rate hikes 4 a long time in the past to tame excessive inflation, the same problem confronted by right this moment’s Fed Chair Jerome Powell.

The U.S. authorities in each intervals was paying traders much more to borrow for 2-years than for 10 years, highlighted in latest months by 5% yields in shorter-dated Treasury securities.

See: ‘T-bill and chill’ commerce sees massive inflow from particular person traders

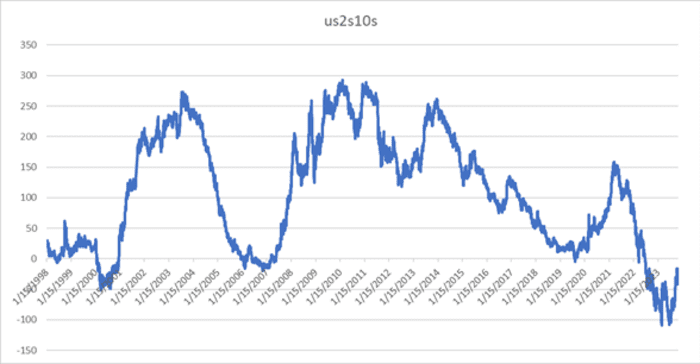

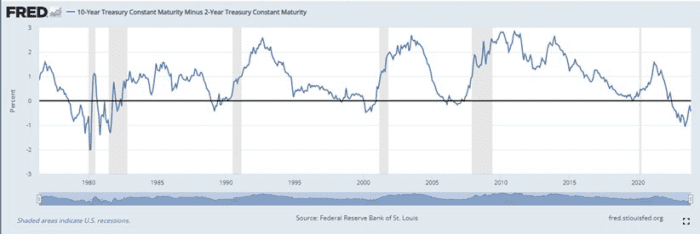

The mismatch in yields produces what Wall Street calls an “inverted yield curve” (see chart) within the Treasury market, a robust previous sign {that a} U.S. recession in all probability lurks on the horizon, albeit typically with a protracted lag.

Bond merchants haven’t been this jumpy since Paul Volcker’s Federal Reserve.

Tradeweb

While inverted yield curves could be a poor timing sign for the inventory market, this stretch of inversion has been extraordinarily unstable for bonds, with the roughly $26 trillion Treasury market performing as a rudder.

The S&P 500

SPX

and Nasdaq Composite Index

COMP

fell into correction territory in October as longer-duration bond yields made a run for the 5% mark, earlier than easing again in November. All three fairness benchmarks booked back-to-back weekly positive aspects Friday.

That notched yet one more zigzag in what has been a gut-wrenching path for the 2-year

BX:TMUBMUSD02Y

and 10-year

BX:TMUBMUSD10Y

Treasury yield curve, probably the most excessive since Volcker’s stint on the helm of the Fed, in keeping with Fed knowledge.

The hole between 2-year and 10-year Treasury yields hasn’t been this unstable for the reason that Nineteen Eighties.

Federal Reserve Bank of St. Louis

Peter Corey, co-founder and chief market strategist at Pave Finance, stated that’s as a result of the yield curve these days represents fixed-income merchants “as greyhounds racing behind a mechanical rabbit, but that rabbit has been slammed into reverse more than a few times.”

In his state of affairs, the “rabbit” signify latest feedback from the Federal Reserve about charges, inflation and the financial system, particularly since July when its coverage price hit a 22-year excessive, within the 5.25% to five.5% vary.

The Fed since July has been on pause, holding charges regular, because it watches financial and inflation knowledge play out, whereas additionally holding merchants on their toes for any clues as to its subsequent strikes.

Thierry Wizman, a world charges strategist at Macquarie, stated on Friday {that a} U.S. inflation replace Tuesday through the consumer-price index for October shall be one other milestone for the market.

“It’s likely to have a calming effect on markets, as traders weigh the prospect that a very low headline CPI result will further cool the prospect of excessive wage demands in the labor market.”

Consumer costs for September got here in hotter than forecast at a 3.7% yearly price. Powell on Thursday stated increased rates of interest is perhaps wanted to deliver inflation sustainably all the way down to the central financial institution’s 2% annual goal, the same message from his early November press convention.

See: Powell says Fed is cautious of ‘head fakes’ from inflation

However, the Fed additionally has been monitoring increased long-term Treasury yields, even signaling they’ve been doing among the Fed’s work for it, when it comes to taming inflation. Powell stated Thursday the central financial institution wasn’t at the moment foundation coverage selections on increased long-term yields.

The 10-year Treasury yield was at 4.627% on Friday, down from 5% in October, however above a 3.3% latest low in April. The 2-year yield was at 5.06% Friday, in keeping with FactSet knowledge. The curve has been inverted since final 12 months.

A extra typical path for 2-year and 10-year yields after a sustained inversion has been a “steepening,” or renormalization, of the curve, stated Corey at Pave, noting it represents merchants anticipating an financial slowdown, and Fed price cuts.

Source web site: www.marketwatch.com