BBB Foods Inc.’s inventory rose 14% in its buying and selling debut on Friday, as Wall Street wolfed up shares of the quickly rising Mexican grocery store chain.

BBB Foods

TBBB,

opened at $19.50 a share and rose to $20.05 a share in afternoon buying and selling, for a cushty acquire over the initial-public-offering worth of $17.50 a share.

In an indication of eager curiosity forward of its debut, the BBB Foods IPO priced on the prime of its estimated vary of $16.50 to $17.50 a share.

With 33.66 million shares, the IPO generated $589 million in proceeds as one of many bigger offers to debut to date in 2024.

Banking giants JPMorgan, Morgan Stanley, BofA Securities, ScotiaBank and UBS are underwriters of the IPO.

BBB Foods is ending out a busy week for IPOs and is at the very least the second main deal to spice up its worth in an indication of investor urge for food for shares because the S&P 500

SPX

reaches 5,000 for the primary time.

Kyvernia Therapeutics Inc.

KYTX,

fell 0.7% to $29.80 on Friday in its second day of buying and selling. On Thursday, the IPO priced at $22 a share, above its elevated worth vary of $20 to $21 a share.

Ahead of its debut, the drug developer upped the dimensions of the IPO from 11.1 million shares to 14.5 million shares and hiked its estimated worth vary from its earlier stage of $17 to $19 a share, for IPO proceeds of $319 million.

Some latest IPOs haven’t fared as nicely.

Metagenomi Inc.

MGX,

priced 6.25 million shares at $15 a share for proceeds of about $94 million. The inventory debuted Friday at $10.25 a share on its first commerce and just lately modified fingers at $10.86, about 28% beneath its IPO worth.

On Thursday, luxurious ski and clothes model Perfect Moment Ltd.

PMNT,

fell in its stock-market debut.

Also this week, Fortegra Group withdrew plans to boost about $297 million in its IPO, citing “prevailing market conditions.”

One week in the past, Fractyl Health Inc.

GUTS,

priced 7.33 million shares at $15 a share for proceeds of $110 million. The inventory fell beneath its providing worth in its first day of buying and selling. On Friday, the inventory fell about 4% to $10 a share.

Also final week, Alto Neuroscience Inc.

ANRO,

priced 8.4 million shares at $16 every for proceeds of $129 million. The inventory began buying and selling on Feb. 2 and was down 12% to $16.69 on Friday.

BBB Foods books speedy income development

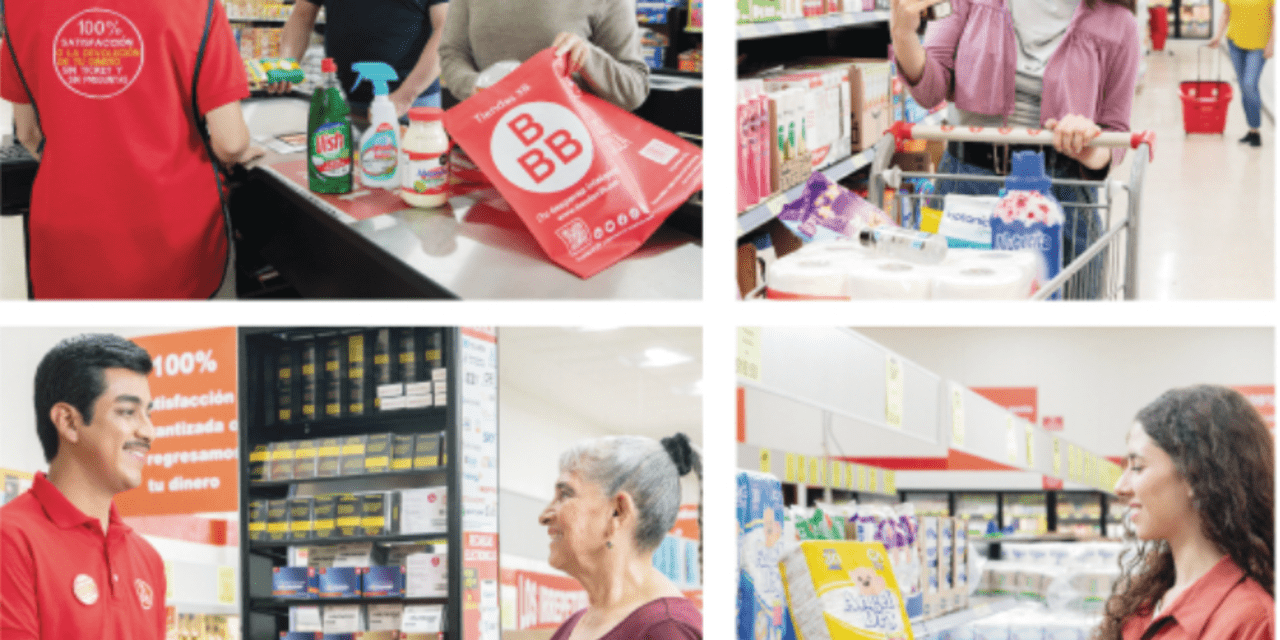

BBB Foods is providing shareholders a stake in a enterprise with a compound annual development charge of 34.4% between 2020 and 2022.

The BBB in its title stands for Bueno, Bonito y Barato, which interprets to good, good and reasonably priced.

The firm presently operates about 2,300 shops however sees market potential in Mexico for as much as 12,000 shops.

“We believe that there is a large whitespace opportunity for Tiendas 3B,” the corporate mentioned. “This opportunity will be driven by market expansion as a result of favorable demographic trends, the under-penetration of hard discount stores in the Mexican grocery market, and hard discount’s growing appeal with the Mexican consumers.”

In the 9 months that ended Sept. 30, BBB Foods reported a lack of $11.87 million on income of $1.8 billion, in contrast with a year-earlier lack of $32.1 million and income of $1.85 billion.

On Thursday, BBB Foods boosted its estimated worth vary from its earlier stage of $14.50 to $16.50 a share and elevated the dimensions of the providing to 33.66 million shares from 28.05 million shares.

The extra 5.61 million shares are all coming from present BBB Foods shareholders, together with Quilvest Capital Partners, with no proceeds earmarked for the corporate itself.

Also learn: Amer Sports inventory ends its first day of buying and selling with a 3% acquire over its discounted IPO worth

And: IPO market continues its revival with buyers seeking to Amer Sports, BrightSpring — and Reddit

Source web site: www.marketwatch.com