The factor that can make corporations decrease costs is that if customers cease complaining about paying extra for the issues they want and wish, and truly begin refusing to purchase them.

As the U.S. company earnings-reporting season progresses, with earnings from main retailers Walmart Inc.

WMT,

Target Corp.

TGT,

and Home Depot Inc.

HD,

on faucet subsequent week, buyers can get a ground-floor view of how client demand might have been harm, or not, by greater costs, and what the businesses plan to do, or not do, about it.

This dynamic of how customers regulate their spending habits when costs change is referred to by economists as the worth elasticity of demand.

“ For companies to cut prices, ‘you have to have the consumer go on strike, and they’re not there yet.’”

Those who belief corporations will select to ratchet down costs on their very own, or no less than not increase them as a result of the rise in enter prices has been slowing, haven’t been listening to what the various corporations have instructed analysts on their post-earnings-report convention calls.

Read: U.S. inflation eases once more, PCE reveals. Prices rise at slowest tempo in nearly two years.

Kraft Heinz Co.

KHC,

acknowledged after its second-quarter report that its comparatively greater costs have harm demand, however not by sufficient for the meals and condiments firm to contemplate slicing costs.

Colgate-Palmolive Co.

CL,

stated it is going to proceed to lift costs, at the same time as inflation slows and promoting quantity declines, because the consumer-products firm continues to be laser targeted on boosting margins and income.

And whereas PepsiCo Inc.

PEP,

was anxious that elasticities would improve, given how its lower-income clients have been being significantly pressured by inflation, the beverage and snack large reported sturdy outcomes because it witnessed “better elasticities” in many of the markets through which it operated.

“Obviously, there is still carryover pricing, and I don’t think we’ll do anything different than our normal cycles on pricing in the balance of the year,” PepsiCo Chief Financial Officer Hugh Johnston instructed analysts, in line with an AlphaSense transcript.

Basically, as MarketWatch has reported, so-called greedflation is alive and properly.

Jamie Cox, managing associate for Harris Financial Group, stated so long as the job market stays sturdy, as it’s now, company greed will proceed to repay.

“If something is more expensive, and you have a job, you’ll complain about it, but you won’t substitute it for something cheaper,” Cox stated. For corporations to chop costs, “you have to have the consumer go on strike, and they’re not there yet,” Cox added.

“ ‘At some point, people are going to say, “All right — enough.” ’ ”

The purpose elasticity is so necessary within the present setting is that, so long as customers proceed to pay the upper costs corporations are charging, inflation will stay stubbornly excessive, making it, in flip, extra probably that the Federal Reserve will proceed to lift rates of interest or, on the very least, not decrease them.

But the longer rates of interest keep excessive sufficient to crimp financial progress, the extra probably the inventory market will reverse decrease as recession fears rise.

“At some point, people are going to say, ‘All right — enough,’ ” stated Paul Nolte, senior wealth supervisor and market strategist at Murphy & Sylvest Wealth Management. “But we just haven’t seen that yet.”

What is elasticity?

Economists use the time period “price elasticity of demand” to seek advice from the way in which through which customers regulate their spending habits when costs change.

“Elasticity tries to measure how much more producers will want to produce if prices rise, and how much more consumers will want to buy if prices fall,” defined Bill Adams, chief economist at Comerica.

Elasticity usually is determined by the kind of product an organization sells.

For instance, consumer-discretionary-goods corporations that promote services that folks need will usually expertise better worth elasticity than consumer-staples corporations that promote issues that folks want, similar to groceries and pharmaceuticals.

But even for wants, customers usually nonetheless have a alternative, as inexpensive generic, or private-label, options could also be accessible.

Andre Schulten, chief monetary officer of consumer-staples maker Procter & Gamble Co.

PG,

which not too long ago beat earnings expectations because it continued to lift costs, telling analysts that, whereas there was “some trading into private label,” the general market share of private-label merchandise was unchanged for the yr.

As Harris Financial’s Cox stated, customers could also be complaining about greater costs, however they aren’t but determined sufficient to cease shopping for.

The Federal Reserve’s newest Beige Book financial survey acknowledged that enterprise contacts in some districts had noticed a “reluctance” to lift costs as customers appeared to have grown extra delicate to costs, however different districts reported “solid demand” allowed corporations to keep up costs and profitability.

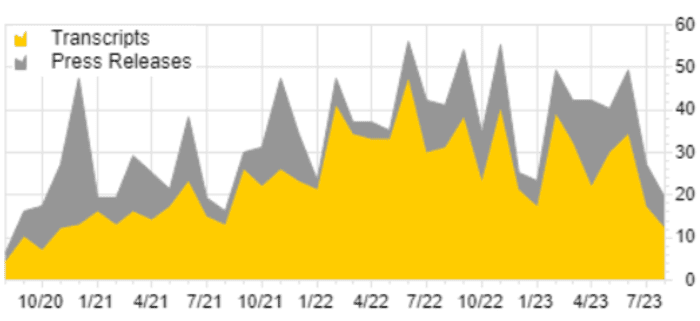

That’s probably why corporations and analysts have change into much less involved about worth elasticity. Based on a FactSet evaluation, mentions of the phrase “elasticity” in press releases and convention calls of S&P 500 corporations

SPX

elevated as inflation and rates of interest began surging in early 2022 by means of the tip of the yr.

With inflation developments softening this yr, the Fed took a short pause in elevating charges in June, serving to gasoline additional stock-market positive aspects, earlier than elevating charges once more in July.

Mentions of the phrase elasticity in earnings press releases and conference-call transcripts of S&P 500 corporations.

FactSet

As the chart reveals, “elasticity” popped up in additional than 55% of earnings releases and convention calls in mid-2022, however with the second-quarter 2023 earnings-reporting season greater than half over, mentions had dropped to about 20%.

Perhaps that can choose up, as retailers, particularly these catering to lower-income clients — recall the PepsiCo remark — assess the demand affect of continued worth will increase.

Meanwhile, the branded-foods firm Conagra Brands Inc.

CAG,

whose wide-ranging meals manufacturers together with Birds Eye, Duncan Hines, Hunt’s, Orville Redenbacher’s and Slim Jim, have been beginning to see the emergence of a distinct dynamic.

Chief Executive Sean Connolly stated customers have been shifting habits in some classes as costs remained excessive. Rather than commerce all the way down to lower-priced options, he observed some customers shopping for fewer objects general, “more of a hunkering down than a trading down.”

That’s precisely the type of client habits that’s wanted, if corporations are to cease feeding into the greedflation phenomenon and to start out pulling again on costs.

Source web site: www.marketwatch.com