Investors need a lot of issues, however two of them stand out above all others: They need above-average long-term returns with out taking extra danger.

Fortunately, it’s not arduous to get these outcomes. First, it’s important to diversify past the acquainted and cozy S&P 500 index

SPX

; second, you want persistence to attend on your outcomes, which gained’t occur suddenly.

If you are able to do these two issues, historical past overwhelmingly exhibits the chances are stacked in your favor. If that appears too good to be true, I’m about to point out you the numbers-based proof.

Getting to the long run

The no-additional-risk zone appears to start out at 15 years out, and I’m going to undertake that for the sake of dialogue. The arduous half is getting by means of these first 15 years.

Imagine you’re a first-time investor with a sum of cash to commit on your retirement. You select a portfolio allocation with a great long-term file, and also you get began.

In the following one 12 months, two years, 5 years, considered one of three issues is more likely to occur.

- Your investments may do very effectively.

- Your investments might need a dismal time of it.

- Maybe you’ll wind up with about the identical quantity you began with.

Which one it will likely be is a matter of luck you’ll be able to neither predict nor management. If you pay plenty of consideration to your early outcomes, you’re more likely to study an unhelpful lesson.

In the primary case, you might conclude that you simply’ve received all of it found out, that investing is simple. In the second case, you may determine the market is simply too dangerous, and you’ll’t stand to see your {dollars} vanish week after week. In the third case, you may conclude that the entire thing is comparatively pointless, not less than for you.

Because surprising issues all the time occur, many buyers by no means make it to the 15-year mark.

Here’s a fast have a look at how short-term returns might be all around the map. The desk compares the S&P 500 with a four-fund technique that’s equally weighted in 4 U.S. asset lessons: large-cap mix, large-cap worth, small-cap mix, and small-cap worth.

Table 1: Range of compound annual returns, 1928-2022

| S&P 500 index | Four fund technique | |

| Two years BEST | Up 41.7% | Up 49.5% |

| Two years WORST | Down 34.8% | Down 43.7% |

| Five years BEST | Up 28.6% | Up 31.4% |

| Five years WORST | Down 12.5% | Down 20.8% |

| Ten years BEST | Up 20.1% | Up 24.4% |

| Ten years WORST | Down 1.4% | Down 2.8% |

| SOURCE: Merriman Financial Education Foundation |

That’s the dangerous news. The good news is that there’s a comparatively easy solution to get by means of this a part of the journey. It was described in 1987 by Bill Gates when he was requested how typically he checked the worth of his inventory in Microsoft

MSFT,

“About once a month,” he mentioned. “I focus on running this company. That’s something I can do something about.”

For the primary 15 years or so, Gates’s instance is value following.

All the issues that make your portfolio go up or down are primarily noise. Your job needs to be to disregard the noise and give attention to dwelling your life when you maintain including to your financial savings.

After the early years

Since 1928, after affected person buyers made it out to fifteen years, the noise and long-term losses began to fade into the background.

There have been 80 15-year intervals by means of 2022, and even within the worst of them, each the S&P 500 and the four-fund technique wound up within the black — though not by a lot. In every case, the worst 15-year compound annual progress fee was up 0.6%.

The worst 20-year intervals have been higher, although nonetheless not terrific. The S&P 500’s worst 20-year displaying was a compound annual return of three.1%; for the four-fund combo, the corresponding determine was 4.4%.

I’m specializing in the dangerous occasions proper right here as a result of buyers have to know that common long-term returns — 11% for the S&P 500 and 13.6% for the four-fund combo — are solely averages and shouldn’t be relied upon.

There’s one other piece of excellent news underlying these numbers. The worst 40-year intervals (8.9% for the S&P 500, 10.8% for the four-fund combo) occurred approach again within the Nineteen Thirties. I point out them right here as a result of horrible occasions may occur once more.

Good news in case you’re saving cash for retirement

No matter which of those methods you undertake, in case you maintain frequently including to your portfolio, issues gained’t be as dangerous as you may assume from trying on the numbers in Table 1.

For one factor, dollar-cost averaging insures that over time you purchase extra shares when costs are low and fewer when costs are increased.

For one other, your extra contributions are more likely to maintain your portfolio stability going up no matter what occurs out there.

To present this, we regarded on the 15-year interval from 1970 by means of 1984, assuming annual investments of $1,000, with the annual quantity elevated by 3% yearly. (We assumed the cash was invested as soon as a month, as in a retirement plan.)

Table 2: Portfolio progress 1970 by means of 1984, S&P 500 index vs. four-fund technique, $1,000 annual contributions rising by 3% per 12 months.

| 2 years | 5 years | 10 years | 15 years | |

| S&P 500 | $2,276 | $4,127 | $16,270 | $42,241 |

| Four funds | $2,257 | $3,909 | $24,216 | $71,900 |

| Source: Merriman Financial Education Foundation |

The first 5 years of this explicit interval have been unusually tough for fairness buyers. After that, issues shortly received higher.

After 40 years, the outcomes have been rather more spectacular. At the tip of 2009, the S&P 500 account would have been value $668,733; the four-fund account grew to $1.28 million. In every case, these numbers resulted from complete contributions of simply $75,404.

The four-fund technique clearly was the higher performer on this comparability. The motive: diversification, particularly the addition of U.S. small-cap worth shares.

Why all this issues

Investor psychology is important to attaining long-term success. If your psyche gained’t allow you to get by means of these first 15 years, you’ll by no means make it to the latter years of accelerating payoffs.

Here are three essential steps that will help you do that.

First, observe the instance set by Bill Gates.

Second, maintain frequently including cash no matter what the market is doing in the meanwhile.

Third, select a great time-tested portfolio technique and don’t second-guess your self.

I’m a data-driven man, and I assume that (like me) you need to see extra numbers.

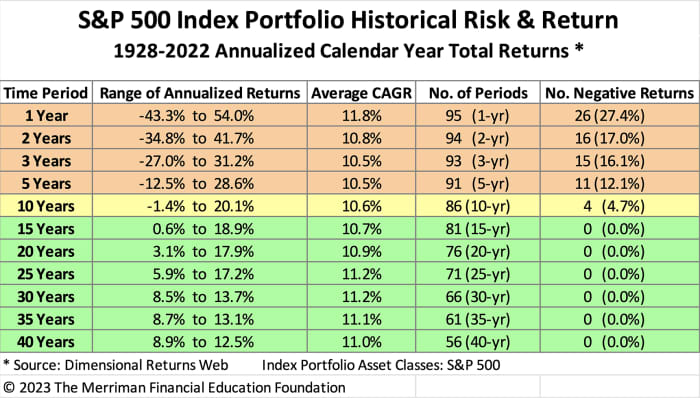

Below are two colourful tables displaying the perfect, worst, and common compound returns over time intervals starting from one to 40 years.

Yellow strains point out fewer than 10% of intervals had damaging returns; inexperienced strains point out that each one intervals have been optimistic.

To perceive the right-hand column, have a look at the highest line for the four-fund portfolio; it signifies that 28 of the 95 one-year intervals had damaging compound returns. Three strains down, you’ll see that solely eight of the 91 five-year intervals have been damaging.

There’s plenty of info in these tables, in addition to related tables for small-cap worth and a U.S. two-fund portfolio, included in my podcast, “A new way to look at the risk and return of equity asset classes.”

Richard Buck contributed to this text.

Paul Merriman and Richard Buck are the authors of ‘We’re Talking Millions! 12 Simple Ways to Supercharge Your Retirement.’

Source web site: www.marketwatch.com