The broad U.S. inventory indexes are weighted by market capitalization, which may work out effectively throughout a bull market, as success is rewarded and index-fund buyers have rising allocations to the large-cap shares which have risen probably the most. But it may additionally focus a excessive share of your cash right into a handful of firms.

There are other ways to mitigate this threat. One is to broaden your publicity by including index funds to your portfolio that aren’t weighted strictly by market capitalization. This could be achieved with an equal-weighted index fund, and Barry Bannister, an funding strategist at Stifel, expects this strategy to outperform the S&P 500 over the following a number of months.

Another index fund that may broaden your horizons is the Invesco S&P 500 GARP exchange-traded fund

SPGP.

Nick Kalivas, Invesco’s head of issue and core fairness product technique, described the fund’s methodology and mentioned its current efficiency. GARP stands for “growth at a reasonable price.”

You could be proud of a low-cost fund that tracks the S&P 500

SPX.

After all, the common annual whole return for the $408 billion SPDR S&P 500 ETF Trust

SPY

has been 12.5% over the previous 10 years via Monday, in accordance with FactSet. For the whole 10-year interval, SPY’s return has been 225%. (All returns on this article assume dividends are reinvested and are after bills.)

But SPY is now 23.9% weighted to 5 firms: Apple Inc.

AAPL,

Microsoft Corp.

MSFT,

Amazon.com Inc.

AMZN,

Nvidia Corp.

NVDA,

and two common-share courses of Alphabet Inc.

GOOGL,

GOOG,

Apple alone makes up 7.2% of the SPY portfolio.

Another well-liked index fund, the $198 billion Invesco QQQ Trust

QQQ,

tracks the Nasdaq-100 Index, which had gotten so concentrated that its largest 5 elements made up greater than 45% of the overall earlier than the index underwent a particular rebalancing final month. Even now, the highest 5 holdings of QQQ — Apple, Microsoft, Amazon, Nvidia and Meta Platforms Inc.

META,

— make up 34.1% of the portfolio, with Apple alone at 11.2%.

Long-term buyers who’ve been thrilled with the efficiency of SPY and QQQ over time may additionally fear a few 2022-like situation, when SPY fell 18.2%, led by the S&P 500 information-technology sector, and QQQ dropped 32.6%.

If you may have been pouring cash into these or comparable cap-weighted index funds via common investments, you won’t wish to make radical strikes out of your index funds. Maybe you may transfer some cash into funds with broader publicity, or maybe you may direct new investments into different funds.

Getting again to the S&P 500 GARP ETF

SPGP,

this fund modified its technique to its present one in June 2019. The fund’s portfolio is reconstituted and rebalanced twice a 12 months, on the third Fridays of June and December. Here’s the way it has carried out over the previous three years:

FactSet

Keep in thoughts that that is solely a three-year efficiency snapshot and {that a} longer historical past wouldn’t actually be legitimate, as a result of SPGP’s technique modified in June 2019. Its outperformance towards SPY and QQQ displays its higher efficiency through the bear market of 2022. So far this 12 months, SPGP has returned 13%, trailing returns of 38% for QQQ and 17% for SPY. This partially displays QQQ’s very heavy focus to the biggest tech-oriented firms.

In an interview, Kalivas stated SPGP’s underperformance relative to SPY to this point this 12 months has resulted partially from “some of its exposure to financial stocks during the SVB and Signature Bank dislocation.” Silicon Valley Bank of San Francisco and Signature Bank of New York each failed in March.

The returns are after bills, that are 0.33% of property underneath administration yearly for SPGP, 0.095% for SPY and 0.2% for QQQ. SPGP is ranked 5 stars (the best rating) by Morningstar inside the funding data agency’s U.S. Fund Large Blend class, whereas SPY is ranked 4 stars in the identical class. QQQ has a five-star score inside Morningstar’s U.S. Fund Large Growth class.

SPGP tracks the S&P 500 GARP Index, which is maintained by S&P Dow Jones Indices. The stock-selection methodology begins with the complete S&P 500. Companies are ranked by progress scores based mostly on will increase in earnings per share and gross sales over the trailing 12 reported quarters. After narrowing the checklist to 150 firms scoring highest for progress, S&P Dow Jones Indices does additional screens based mostly on the businesses’ returns on fairness and ratios of debt to fairness and value to earnings.

After a top quality rating is assigned to every of the 150 firms, the checklist is pared to the 75 with the best high quality scores. These are then weighted by the expansion rating for the portfolio. The weighting is restricted in order that the person firm weightings will vary from 0.05% to five% and that no sector may have greater than a 40% weighting.

Here are the highest 10 holdings of SPGP:

| Company | Ticker | Industry | % of the Invesco S&P 500 GARP ETF | Forward P/E |

| Diamondback Energy Inc. |

FANG, |

Oil and Gas Production | 2.2% | 7.9 |

| Marathon Petroleum Corp. |

MPC, |

Oil Refining/ Marketing | 2.2% | 8.4 |

| CF Industries Holdings Inc. |

CF, |

Chemicals | 2.2% | 10.6 |

| Nucor Corp. |

NUE, |

Steel | 2.0% | 11.7 |

| Mosaic Co. |

MOS, |

Chemicals | 2.0% | 10.7 |

| Steel Dynamics Inc. |

STLD, |

Steel | 1.9% | 9.2 |

| Coterra Energy Inc. |

CTRA, |

Integrated Oil | 1.9% | 10.8 |

| Moderna Inc. |

MRNA, |

Biotechnology | 1.9% | #N/A |

| APA Corp. |

APA, |

Integrated Oil | 1.8% | 7.8 |

| EQT Corp. |

EQT, |

Oil and Gas Production | 1.7% | 11.3 |

| Sources: Invesco, FactSet | ||||

Click on the tickers for extra about every firm, together with enterprise profiles, financials and estimates.

Click right here for Tomi Kilgore’s detailed information to the wealth of data accessible free of charge on the MarketWatch quote web page.

At first look, we’re taking a look at a focus to power and supplies. This could also be shocking, with these sectors underperforming the broad market this 12 months. But Kalivas stated the allocation mirrored the scoring of the businesses by progress and high quality.

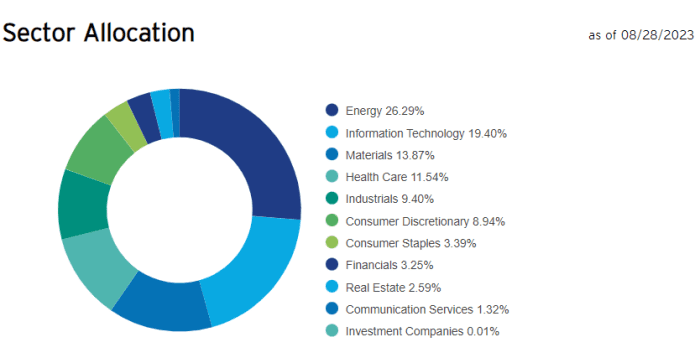

Here is the fund’s present sector allocation:

Invesco

The portfolio is “quite dynamic,” Kalivas stated. S&P Dow Jones Indices examined the methodology for the S&P 500 GARP Index going again to the Nineteen Nineties and located that energy-sector publicity would have ranged from zero to 33%. The allocation “moved around very much, depending on where the growth is,” he stated.

Even although SPGP’s methodology relies on progress, the strategy additionally brings worth to the fore. The ahead price-to-earnings ratios of the listed firms are based mostly on present inventory costs and consensus earnings estimates for the following 12 months amongst analysts polled by FactSet. The ratios are low in comparison with the weighted ahead P/E of 21.7 for the S&P 500. There isn’t any ahead P/E for Moderna Inc.

MRNA,

as a result of the consensus amongst analysts is for the corporate to ebook unfavorable earnings for 3 of its subsequent 4 quarters.

Kalivas stated SPGP can be very best for buyers “who are worried about paying too much.”

Don’t miss: Meta, Alphabet and 10 under-the-radar media shares anticipated to soar

Source web site: www.marketwatch.com