Oil has seen a number of ups and downs within the final two years, however following the outbreak of wars between Russia and Ukraine in 2022, and Israel and Hamas final 12 months, costs have additionally caught to a decent buying and selling vary after short-lived bouts of volatility.

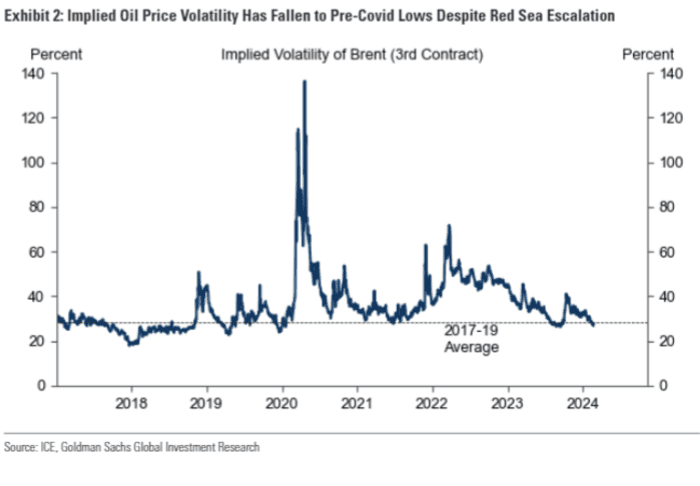

The “muted” swings in world benchmark oil costs, regardless of wars within the Middle East and Eastern Europe, replicate a modest geopolitical threat premium and the “stabilizing forces of elevated spare capacity and the OPEC put,” mentioned analysts at Goldman Sachs, in a word dated Sunday. The OPEC put refers back to the capability of the Organization of the Petroleum Exporting Countries to position a ground below costs by making changes to manufacturing.

Volatility in Brent oil costs has calmed in latest months.

ICE, Goldman Sachs Global Investment Research

They additionally attributed the muted worth volatility to the “near balance between growth of non-OPEC supply and demand, which both remain robust.”

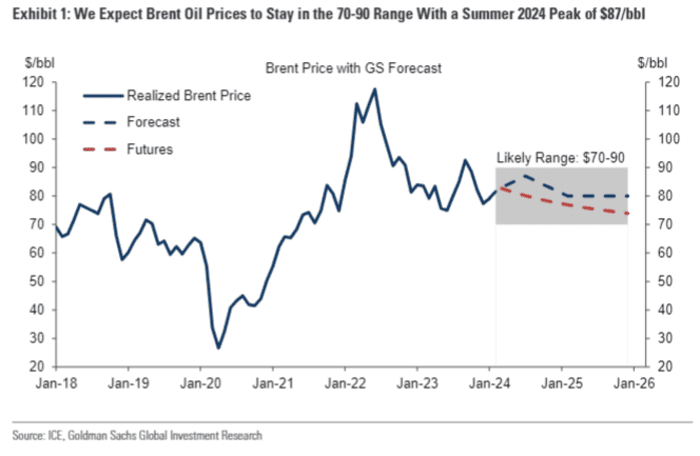

Brent oil costs have traded inside a roughly $20-a-barrel vary since mid-2022, and extra lately, a fair tighter $10 vary for the reason that begin of this 12 months, however the potential for a worth breakout in both route — below the fitting circumstances — stays.

Stuck in a spread

So far this 12 months, Brent crude costs

BRN00,

BRNJ24,

have edged up by round 7% as of Monday, buying and selling between a low of $74 and a excessive of $84.

The geopolitical threat premium stays modest, with solely a $2-a-barrel enhance to Brent from Red Sea transport disruptions and unaffected crude manufacturing, mentioned analysts at Goldman Sachs.

Read: ‘Fear alone is not enough’ to drive oil costs larger. Here’s why.

Attacks on ships within the Red Sea by Iran-backed Houthi rebels have led to larger prices for transport an insurance coverage, and longer transport occasions, however haven’t resulted in massive disruptions to provides, the analysts have mentioned.

The Goldman Sachs analysts additionally identified that the “OPEC put,” has restricted draw back threat, whereas spare manufacturing capability limits upside worth threat.

Non-OPEC provide progress, in the meantime, has been “robust” and is more likely to “nearly keep pace with solid global demand growth,” the analysts mentioned.

Goldman Sachs expects Brent oil costs to stay to a $70 to $90 worth vary in 2024 to 2025.

ICE, Goldman Sachs Global Investment Research

Given all that, the Goldman Sachs analysts mentioned they’re sticking to their $70 to $90 Brent “range call” for this 12 months and subsequent, with a possible summer season peak this 12 months of $87 and the worldwide oil benchmark forecast to common $80 in 2025.

OPEC+ output

Production cuts by OPEC and its allies, collectively generally known as OPEC+, present that the group can set a ground for Brent oil costs at $70 a barrel, wrote strategists at BofA Securities, in a word dated Monday.

At the identical time, a rise in spare manufacturing capability to round 5 million barrels a day, on account of quantity cuts, and substantial non-OPEC+ provide progress over the following few years may also help cap oil costs under $100 a barrel, they mentioned.

That means oil costs ought to keep “anchored near term,” the strategists mentioned, reiterating their forecast that Brent will common $80 a barrel or so this 12 months and subsequent, down from $82 in 2023.

Further out, they see Brent averaging $60 to $80 by way of 2029, with the oil image over the medium time period not anticipated to alter considerably, they mentioned.

Against a backdrop of slowing world demand, annual non-OPEC provide progress ought to common 700,000 barrels a day in 2024 to 2029, down from the historic common of 900,000 barrels a day in 2017 to 2022, the BofA strategists mentioned.

Breakout potential

Analysts have pointed a variety of elements that might lead oil costs to lastly get away of their buying and selling vary.

In phrases of the potential for oil to interrupt out of Goldman Sachs’ $70 to $90 Brent worth vary name, geopolitical shocks to OPEC’s capability or want to deploy its spare manufacturing capability pose the ”sharpest” upside dangers, its analysts mentioned.

An extended extension of OPEC+ cuts implies reasonable upside, they mentioned, whereas a sustained drop under $70 would require a lot weaker demand and a shift in Saudi technique.

Strategists at BofA mentioned refilling strategic oil reserves may assist costs for the oil within the subsequent 5 years.

The U.S. Energy Department on Monday introduced plans to purchase about 3 million barrels of oil for supply to the nation’s Strategic Petroleum Reserve in August. That marked a continuation of its efforts to refill the reserve following a historic drawdown of the emergency reserve in 2022 within the wake of Russia’s invasion of Ukraine.

Looking at world oil inventories, nonetheless, authorities shares among the many Organization for Economic Cooperation and Development industrialized nations stay close to the bottom ranges in many years, and low authorities stockpiles “reduce the buffer against upside price risks,” together with “sticky inflation” that lifts oil manufacturing prices, sturdy OPEC+ cohesion, and a serious slowdown in electric-vehicle gross sales, strategists at BofA mentioned.

Downside dangers for oil costs, in the meantime, embrace an prolonged interval of structural weak spot in world financial progress, “unforeseen” enhancements in U.S. shale productiveness, and a “faster-than-expected” transfer away from thermal fuels,” they mentioned.

Source web site: www.marketwatch.com