Don’t count on a red-hot January jobs report back to be adopted by a February chill when an much more eagerly awaited than traditional month-to-month employment report is launched on the finish of subsequent week.

That’s as a result of warmer-than-usual climate seemingly contributed to January’s blowout jobs studying — a phenomenon that historical past exhibits tends to not get reversed the following month, mentioned economist Jens Nordvig, founder and chief govt of analysis agency Exante Data.

Temperature knowledge, which the agency had beforehand used to forecast European demand for pure fuel, was discovered to additionally turn out to be useful in analyzing near-term labor market developments. In a video clip shared with MarketWatch, Nordvig advised purchasers that the connection between temperatures and payroll development is actual, although it’s not getting a lot consideration.

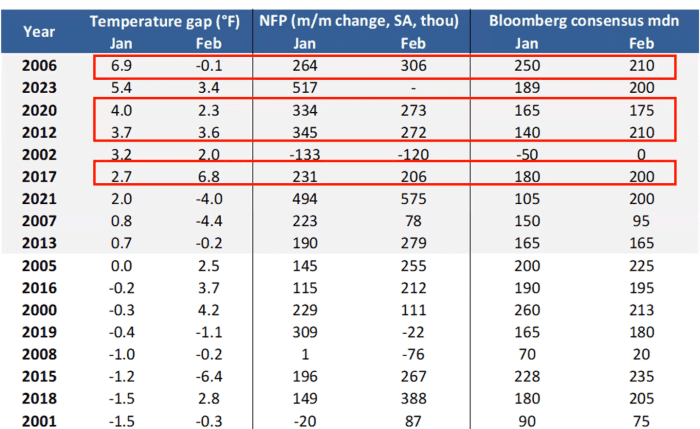

The chart beneath tracks the deviation in U.S. temperatures from regular in January and February. The highlighted rows present that in years with higher-than-normal January temperatures, payrolls exceeded forecasts for each January and February.

Exante Data

As the chart exhibits, January 2023 was 5.4 levels hotter than regular, whereas payrolls noticed a 517,000 rise, obliterating forecasts for a a lot smaller enhance.

Warm climate might have added as much as 200,000 jobs to January payroll development, merely on account of seasonal employees not being laid off, he mentioned.

“So construction workers that normally have a hard time working in New York or other places where it’s typically cold in January, they stayed on,” he mentioned, an impact that was seemingly seen in different sectors as properly.

So what about February? The chart exhibits temperatures remained warmer-than-usual, to the tune of three.4 levels, however not as heat relative to the typical as in January. That means the climate in February is unlikely to have the identical impression on the February jobs report, set for launch on March 10, that heat January climate had on that month’s knowledge, Nordvig mentioned.

But the necessary takeaway from the info is that robust weather-enhanced January positive aspects prior to now haven’t been adopted by February reversals, he mentioned. In 2006, January temperatures have been 6.9 levels above regular however fell largely again in line in February. Payroll development in February 2006, for instance, blew away forecasts and outpaced January’s rise, coming in at 306,000.

The conclusion, Nordvig mentioned, is that buyers shouldn’t count on to see a reversal of the robust January figures within the February knowledge. If so, meaning the transferring averages that Federal Reserve coverage makers pay shut consideration to will stay strong.

Economists surveyed by The Wall Street Journal, on common, count on February payrolls to have grown by 225,000.

The employment report is commonly seen as probably the most market-sensitive knowledge of the month. Investors will probably be significantly targeted on the February figures after the blowout January studying on Feb. 3, accompanied by a drop within the unemployment price to its lowest since 1969, helped spark final month’s speedy reassessment of how excessive the Federal Reserve should take rates of interest to rein in inflation.

See: Inflation knowledge pushed the 10-year Treasury yield above 4%. How a lot greater can rates of interest go?

Treasury yields, which had pulled again in January, pushed again to the upside, whereas shares trimmed an early 2023 rally. Yields pulled again modestly on Friday, whereas shares noticed a powerful rally. The S&P 500

SPX,

snapped a run of three straight weekly losses, whereas the Dow Jones Industrial Average

DJIA,

ended a stretch of 4 straight weekly declines that had seen it briefly erase its early 2023 acquire.

Read subsequent: Key query for stock-market buyers: Take income or sit tight in ‘make or break’ March

Source web site: www.marketwatch.com