Neuberger Berman, an asset supervisor with eight many years beneath its belt, is looking out for cracks in credit score markets from the Federal Reserve’s rate-hiking marketing campaign.

Erik Knutzen, chief funding officer of multi asset, worries that a number of components may very well be a tipping level for the financial system, from an financial slowdown in China to U.S. shoppers lastly turning into exhausted by larger charges.

Yet Knutzen expects the high-yield, or junk bond, market to function the “canary in the coal mine” for broader market volatility, performing as “perhaps the most visible threat, and therefore one we think could be priced in sooner than later.”

The Bloomberg U.S. High Yield Bond Index has returned 6.4% by means of the tip of August, producing one of many yr’s highest beneficial properties in fastened revenue, helped alongside by a “resilient U.S. economy coupled with still-available financial liquidity,” in accordance with the Wells Fargo Investment Institute.

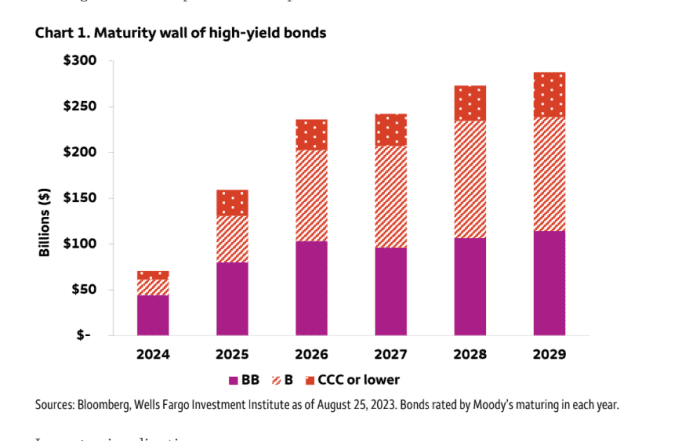

But Knutzen worries that because the high-yield maturity wall attracts nearer, “the first policy rate cuts get priced further and further out, raising the threat of expensive refinancings.”

The 10-year Treasury yield’s

BX: TMUBMUSD10Y

climb to a multidecade excessive in August of just about 4.4% left many main U.S. companies in early September hesitant to borrow past 10 years.

Starting subsequent yr, some $700 billion of high-yield bonds are set to mature by means of the tip of 2027, with an enormous slice of the refinancing want coming from corporations with riskier credit score rankings beneath the highest BB rankings bracket.

The junk-bond maturity wall.

Bloomberg, Wells Fargo Investment Institute, Moody’s Investors Service

The two huge U.S. exchange-traded funds linked to junk bonds are the SPDR Bloomberg High Yield Bond ETF

JNK

and the iShares iBoxx $ High Yield Corporate Bond ETF

HYG,

each up 1.8% and 1.5% on the yr by means of Monday, respectively, whereas providing dividend yields of greater than 5.8%, in accordance with FactSet.

Of word, fixed-income strategists on the Wells Fargo Investment Institute additionally mentioned they see dangers rising in junk bonds for corporations rated B and beneath, significantly with unfold within the sector buying and selling lower than 400 foundation factors above the risk-free Treasury price since July. Spreads are the premium that buyers are paid on bonds to assist compensate for default dangers.

Top company executives seem hopeful that the Federal Reserve will minimize charges before later. Fed Chairman Jerome Powell mentioned in Jackson Hole, Wyo., in August that the central financial institution is ready to maintain its coverage price restrictive for some time to get inflation all the way down to its 2% goal.

To that finish, Neuberger Berman, which has roughly $443 billion in managed property, sees a number of sources of volatility lurking by means of yr’s finish, and has a “defensive inclination” in fairness and credit score, favoring high-quality corporations with loads of free money circulation, excessive money balances and cheaper long-term debt.

U.S. shares booked beneficial properties on Monday after per week of losses, with the S&P 500 index

SPX

and Nasdaq Composite Index

COMP

scoring their greatest every day share beneficial properties in about two weeks. The Dow Jones Industrial Average

DJIA

superior 0.3%.

Source web site: www.marketwatch.com