And so we draw to the top of one other frantic week in markets.

The CBOE VIX index

VIX,

the gauge of fairness volatility, twice spiked as much as 30 earlier than tumbling again down.

The ICE BoAML MOVE index, a VIX for the Treasury market, jumped to its highest for the reason that nice monetary disaster of 2008, at one level up greater than 80% from simply the beginning of February.

Those strikes illustrate the whipsaw motion in shares and bond yields as merchants tried to work out the seriousness of the unfolding banking disaster and the way a lot it could compromise central banks’ potential to maintain their inflation combating methods.

Worries that monetary sector tremors would badly influence the worldwide financial system — and a few over-long positioning — additionally brought about a stoop in oil costs.

Still, the inventory market rallied on Thursday, and Friday’s tone, on the floor no less than, is calm as traders seem salved by the authorities arranging help for Credit Suisse

CS,

and First Republic

FRC

within the U.S..

But maintain on.

Source: Citi.

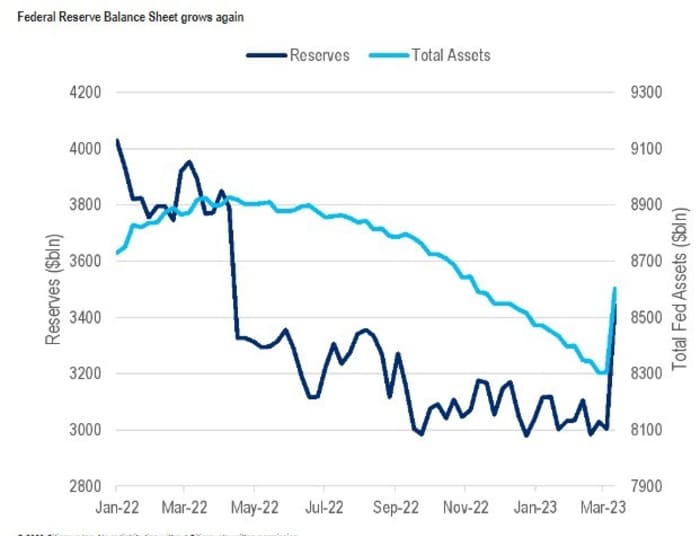

The Federal Reserve is having to develop its stability sheet once more after it reported late Thursday that banks this week used its new Bank Term Funding Program to borrow $11.9 billion. Also, $153 billion was borrowed by way of the Fed’s low cost window and $142.8 billion in bridge loans.

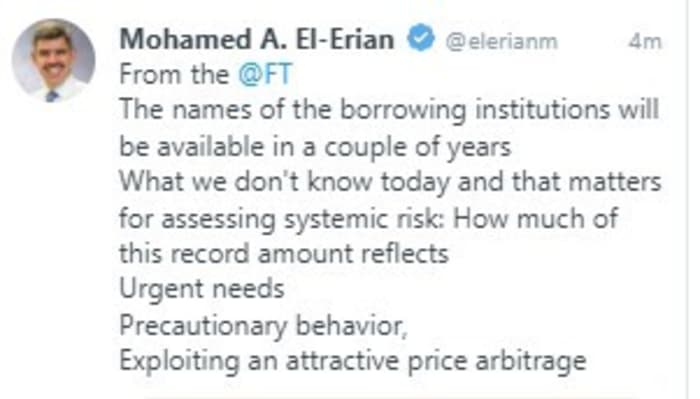

The market doesn’t know who, or how determined, these debtors could also be.

And others are frightened that current actions to assist the banking sector will not be simply papering over the cracks however probably making issues worse.

Hedge fund supervisor Bill Ackman will not be pleased that the systemically vital banks (SIBs) have been chivvied into recycling the deposits they acquired from First Republic Bank (FRB) again into the struggling lender.

“The result is that FRB default risk is now being spread to our largest banks. Spreading the risk of financial contagion to achieve a false sense of confidence in FRB is bad policy. The SIBs would never have made this low return investment in deposits unless they were pressured to do so and without assurances that FRB deposits would be backstopped if it failed,” Ackman wrote in a tweet late Thursday.

“The press release announcing the $30B of deposits raised more questions than it answers. Lack of transparency causes market participants to assume the worst. I have said before that hours matter. We have allowed days to go by. Half measures don’t work when there is a crisis of confidence.,” he added.

Ackman, who runs Pershing Square Capital Management, and isn’t averse to an apocalyptical outburst, stated the banking sector wanted a brief deposit assure instantly till an expanded authorities insurance coverage scheme is broadly obtainable.

“We need to stop this now. We are beyond the point where the private sector can solve the problem and are in the hands of our government and regulators. Tick-tock.”

Markets

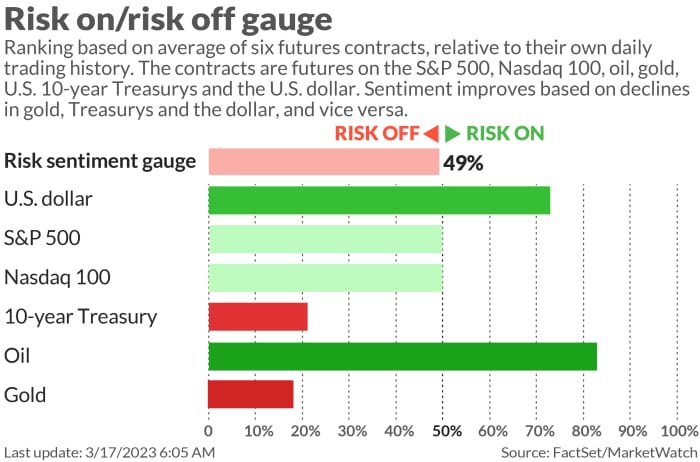

S&P 500 futures

ES00

rose 0.1% as 10-year Treasury yields

BX:TMUBMUSD10Y

fell 4.2 foundation factors to three.542%. The greenback index

DXY

misplaced 0.3%, serving to carry gold

GC00

by 0.7% to $1,936 an oz..

Try your hand on the Barron’s crossword puzzle and sudoku video games, now working every day together with a weekly digital jigsaw primarily based on the week’s cowl story. To see all puzzles, click on right here.

The buzz

U.S. financial knowledge due at this time embody February industrial manufacturing and capability utilization, printed at 9:15 a.m., adopted at 10 a.m. by the February main financial indicators index and client sentiment report for March. All occasions Eastern.

It’s one other quadruple witching Friday, with choice contracts value $2.8 trillion set to run out.

Anyone shopping for First Republic’s inventory

FRC

on the open on Thursday and promoting on the shut may have made about 60% for the day. The rebound got here after a consortium of huge banks pledged $30 billion of deposits for the lender. However, the shares are off 5% working as much as the opening bell on Friday after First Republic stated it must droop its dividend to preserve money.

FedEx shares

FDX

are up 11 % in premarket motion after the bundle deliverer delivered outcomes that confirmed value reducing and the power to boost costs was serving to its backside line.

Shares in Sarepta Therapeutics

SRPT

are tumbling 20% after the FDA stated it could maintain an advisory committee on the corporate’s Duchenne muscular dystrophy therapy.

Best of the online

Inside Elon Musk’s cost-cutting drive at Twitter.

The unbelievable tantrum VCs threw over SVB.

The chart

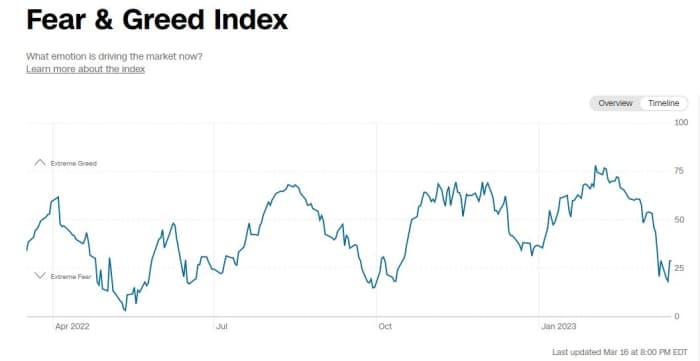

Here is Mahaz News’s Fear & Greed index. It’s a compilation of seven indicators: market momentum, inventory worth energy, inventory worth breadth, put and name choices, junk bond demand, market volatility and secure haven demand.

Eagle-eyed readers might be aware that this week it dropped into ‘Extreme Fear’ — under the 25 line — earlier than popping again into simply ‘Fear’. The final time the chart dipped that low, in October 2022, it marked a current backside for the S&P 500.

Source: Mahaz News

Top tickers

Here have been essentially the most lively stock-market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security identify |

| TSLA | Tesla |

| FRC | First Republic Bank |

| BBBY | Bed Bath & Beyond |

| GME | GameStop |

| AMC | AMC Entertainment |

| HUBC | Hub Cyber Security |

| NVDA | Nvidia |

| CS | Credit Suisse ADR |

| AAPL | Apple |

| TRKA | Troika Media |

Random reads

Rolls-Royce and the nuclear-powered Moon base.

Spanish princess to don camouflage for 3 years.

Rival Colorado cities battle over a frozen useless man.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e mail field. The emailed model can be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton

Source web site: www.marketwatch.com