The Biden administration’s announcement Friday that it’s pausing liquefied pure gasoline export approvals sparked political backlash, drew cheers from local weather activists and stoked uncertainty in power markets, however is unlikely to see the U.S. quit its title because the world’s prime LNG exporter.

The U.S. will delay its choices on new LNG exports to non-free commerce settlement international locations, permitting time for the Energy Department to replace the underlying analyses for LNG export authorizations, the White House stated.

Those analyses are roughly 5 years outdated and “no longer adequately account for considerations” corresponding to potential price will increase for American customers and producers or the “latest assessment of the impact of greenhouse gas emissions,” it stated.

The Biden administration doubtless “realizes the role of LNG in foreign policy, but at the same time it needs to show the Democrat base that it is doing something for climate change,” stated Anas Alhajji, an impartial power knowledgeable and managing associate at Energy Outlook Advisors, mentioning that the announcement comes throughout a presidential election yr.

“Delaying one project or stopping it may not be a big deal, but it is a problem if it becomes a trend,” he stated in emailed commentary.

Environmental teams, which have pushed for motion, cheered the choice.

The 12 impacted initiatives within the U.S. “would spew out as much climate-warming pollution as 223 coal plants per year, and they present explosion risks to the communities where they’re located and emit other health-harming chemicals,” the Sierra Club, an environmental group, stated in an announcement welcoming the choice.

Top exporter

The announcement is especially essential for a nation that grew to become the world’s largest LNG exporter within the span of lower than a decade.

The U.S. grew to become the world’s largest LNG exporter throughout the first half of 2022 on the again of will increase in LNG export capability, worldwide pure gasoline and LNG costs, and world demand, significantly in Europe, based on the Energy Information Administration.

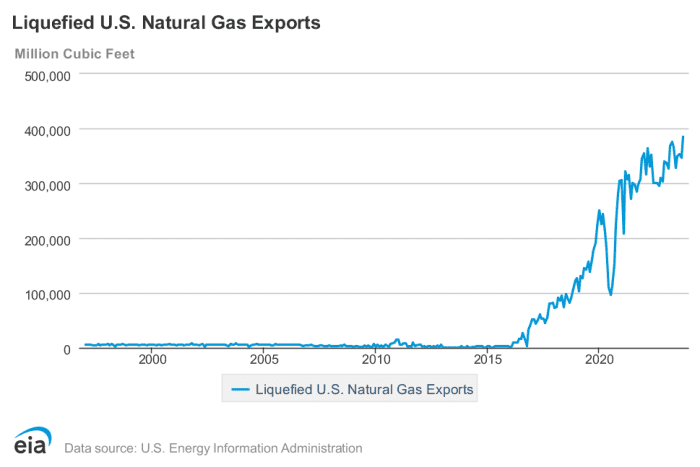

Less than a decade in the past, U.S. LNG exports had been negligible. The nation had solely began exporting LNG from the Lower 48 states in 2016, the EIA stated.

The nation’s exports of LNG climbed to a contemporary report in November 2023, with the EIA reporting home exports of 386.2 billion cubic ft, up from 384.4 bcf a month earlier. Exports in December 2016 had been at simply 41.8 bcf.

U.S. LNG exports soared after 2016.

EIA

With 90% of U.S. LNG going to non-free commerce settlement locations, withholding licensing successfully “halts project development,” John Miller, managing director, ESG and sustainability coverage at TD Cowen wrote in a Friday notice.

Equities

LNG equities with working services doubtless received’t profit from the administration’s announcement, no less than not instantly, till the impacts of this pause in export approvals to non-FTA international locations turns into extra clear, Jason Gabelman, director, sustainability & power transition at TD Cowen stated.

U.S. corporations with authorities approvals that haven’t been sanctioned, “could have a higher probability of moving forward this year, albeit modestly” as offtakers could also be hesitant to enroll to new U.S. initiatives with LNG improvement getting “politicized,” he stated. Among these, he identified approvals for proposed liquefaction models at NextDecade Corp.’s

NEXT,

Rio Grande LNG export facility mission in Brownsville, Texas.

At the identical time, it might not be a shock if U.S. LNG corporations pursuing development that don’t but have non-FTA approval see draw back stress, stated Gabelman.

LNG initiatives take round 4 years to construct and any delays to mission sanctions at present will take “multiple years to manifest in the market,” he stated.

Still, the U.S. announcement “introduces the risk of more stringent oversight that could limit new U.S. capacity” greater than 4 years out, Gabelman stated.

Companies that offer gear to LNG liquefaction initiatives embody Baker Hughes Co.

BKR,

and Chart Industries Inc.

GTLS,

stated Marc Bianchi, a senior power analyst at TD Cowen.

Any slowing of approval would create “overhand on order growth,” he stated.

Climate change

The White House stated Friday that its choice won’t impression the power of the U.S. to proceed supplying LNG to its allies within the close to time period but additionally acknowledged environmental issues.

“I think we’ve got to be clear eyed about the challenges that we face. The climate crisis is an existential crisis, and we’ve got to be, I think, really forward leaning into making sure that we’re taking that head on,” stated Ali Zaidi, the White House nationwide local weather adviser, informed reporters Friday.

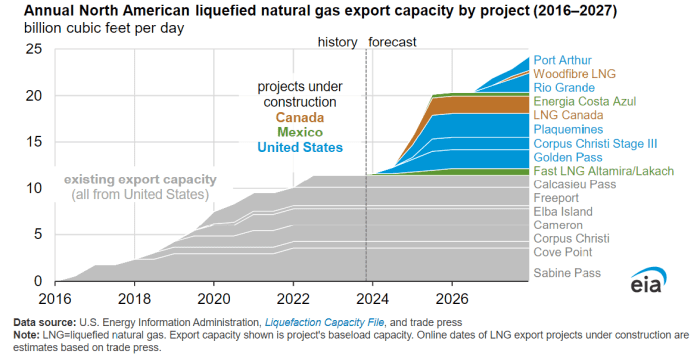

He added that given the variety of approvals already accomplished, the variety of initiatives underneath development are set to double current capability with approvals past that set to double capability but once more.

“So there’s a long runway here, and we’re taking a step back and thinking, OK, let’s take a hard look before that runway continues to build out,” he stated.

Rob Thummel, senior portfolio supervisor at Tortoise, argued that U.S. LNG exports truly scale back world carbon emissions as pure gasoline usually “displaces coal to generate electricity in countries such as China and India.”

They additionally enhance world power safety as U.S. pure gasoline is changing into Europe’s major power provider, changing Russia, he stated.

In an announcement Friday, Sen. Joe Manchin, a West Virginia Democrat and chairman of the U.S. Senate Energy and Natural Resources Committee, stated that if the Biden administration has information to show that further LNG export capability would damage Americans, it must make that data public. But if the pause is “another political ploy to pander to keep-it-in-the-ground climate activists,” he stated he would “do every thing in my energy to finish this pause instantly.

Manchin plans to carry a listening to on the choice within the coming weeks.

Market impression

The U.S. choice to delay new LNG export permits is unlikely to have an effect on home natural-gas provides or costs, stated Energy Outlook Advisors’ Alhajji.

Still, the EIA famous in its Annual Energy Outlook launched in March of final yr that it stays unsure as to how LNG export capability will have an effect on home costs, consumption and provide.

LNG costs and the speed at which new LNG export terminals will be constructed assist decide LNG export volumes, the EIA stated, and better LNG exports may end up in upward stress on U.S. natural-gas costs, whereas decrease U.S. LNG exports can stress costs.

On Friday, pure gasoline for February supply

NG00,

NGG24,

settled at $2.71 per million British thermal models, up 7.7% for the week.

Meanwhile, the U.S. is more likely to preserve its place because the world’s prime LNG exporter, based on Tortoise’s Thummel.

The U.S. is the presently the most important LNG exporter at virtually 12 bcf per day, with Qatar coming in second, he stated.

Qatar is increasing its LNG export capability and is anticipated to have the power to export virtually 20 bcf per day by 2028, he stated. The EIA reported just lately that Qatar has averaged 10.3 bcf per day in exports over the last 10 years.

That would mark sizable development. But the EIA reported in November that LNG export capability from North America is more likely to greater than double from round 11.4 bcf per day to 24.3 bcf per day by the tip of 2027.

The EIA stated North America’s LNG export capability is more likely to greater than double by 2027.

EIA

Given anticipated development in U.S. LNG export capability, the U.S. is more likely to “remain the largest exporter of LNG in the world” regardless of the U.S. announcement, stated Thummel.

—Victor Reklaitis contributed.

Source web site: www.marketwatch.com