UBS economists usually are not, it needs to be stated, predicting an asteroid to hit the planet.

But their view on rates of interest is wildly completely different than the remainder of Wall Street and displays a depressing forecast for the U.S. economic system subsequent yr. They anticipate the federal funds fee, now between 5.25% and 5.5%, to fall all the best way to 2.75% by the top of subsequent yr, after which additional down to only 1.25% within the first quarter of 2025.

There isn’t actually some other agency even shut. TD Securities expects charges to fall to three.5% by the top of subsequent yr after which to three% within the first quarter of 2025. The median, per Bloomberg News knowledge, is for charges to fall to 4.5% on the finish of 2024 and additional right down to 4% within the first quarter of 2025. There are a couple of companies, notably Bank of America and Goldman Sachs, forecasting the Fed fee to be above 5% by the top of 2024, as does the Federal Open Market Committee itself.

The UBS group led by Jonathan Pingle say the large increase from COVID-era financial savings is carrying off. “Households’ excess savings are thinning out and balance sheets look less solid with every passing month,” they are saying. The individuals who nonetheless do have financial savings are upper-income households, who’re prone to deal with extra financial savings as wealth relatively than earnings, “suggesting a much slower spend out rate that adds little to consumption.”

Credit is tightening too — with credit-card balances rising, and banks lifting the charges they cost from 14.5% to 21.2% because the begin of the mountaineering cycle. The share of private curiosity funds in private earnings has climbed greater than 1 share level because the begin of 2022, near multi-decade highs. Income progress, they are saying, will gradual, because the nation is already at full employment.

The enterprise facet of the economic system doesn’t look very robust both, they are saying. Rig counts have been contracting, manufacturing output internet of strikes has fallen over the previous yr, and temp assist employment has fallen sharply, whereas forward-looking knowledge on enlargement seems to be weak and inventories are comparatively excessive. “Those features—weak new orders and lack of inventory tailwind—imply a vulnerable business sector of the economy. In addition, credit is also tightening for businesses,” they are saying.

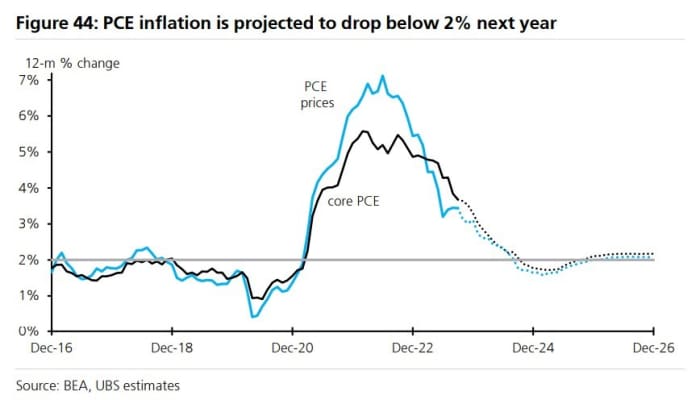

Okay, however does that add as much as huge fee cuts? Here’s the usforecast on inflation — they are saying the Fed’s most popular PCE value index will fade progressively over the subsequent yr, with the core PCE falling to 1.8% by the top of the fourth quarter. That’s not a lot under the Fed’s 2% goal although it’s a lot decrease than different Wall Street forecasts.

The UBS group say that’s vital as a result of the Fed is calibrating its fee coverage to actual — that’s, inflation-adjusted, charges. They observe Chair Jerome Powell stated in September “the time will come at some point, and I’m not saying when, that it’s appropriate to cut. Part of that may be that real rates are rising because inflation is coming down.” According to UBS, that point will are available in March, when the unfold between the nominal Fed fee and core PCE inflation might be almost 2.5 share factors.

That’s nonetheless not sufficient nevertheless to get the Fed fee right down to 2.75% by the top of the yr. UBS additionally thinks the unemployment fee — already a 0.5 level above its cycle low — will steadily rise by way of the yr, reaching 4.9% within the fourth quarter of 2024 and 5.2% on the finish of the primary quarter of 2025.

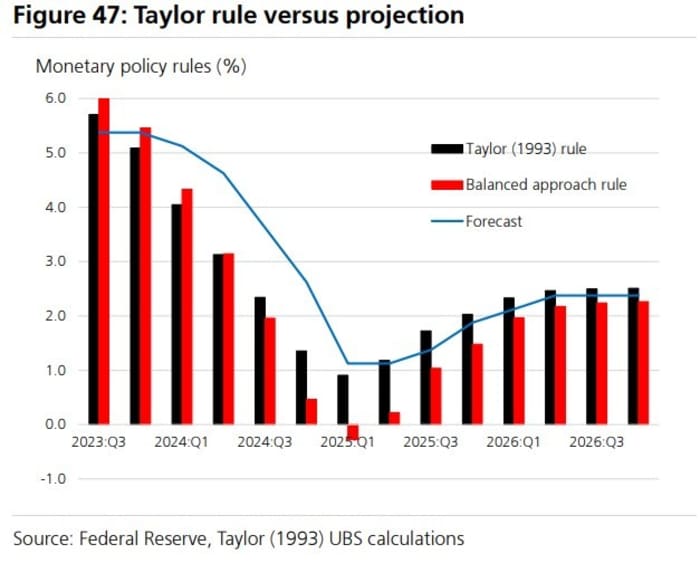

“A rising unemployment rate and labor market slackening tend to imply more disinflationary forces to come. We expect retaining very restrictive policy would be pretty untenable in the face of outright job loss. If inflation is at or below 2.0% and the unemployment rate is rising as we expect, even a so-called Taylor Rule would suggest rate cuts that are both swift and deep, as shown above,” they are saying.

The yield on the financial policy-sensitive 2-year Treasury

BX:TMUBMUSD02Y

has been holding above 5%, although it’s down by almost 1 / 4 level since its peak in mid-October. The S&P 500

SPX

has gained 15% this yr.

Source web site: www.marketwatch.com