During a interval when long-term rates of interest are rising rapidly, you will note headlines that bonds are performing poorly, as a result of their market values should decline as rates of interest go up. But long-term traders who maintain bonds for revenue could have a unique opinion: If bond issuers are making their curiosity funds, the bonds are performing nicely. Still, it isn’t enjoyable to observe your market worth and your portfolio steadiness decline.

MarketWatch readers reacted in droves to Aarthi Swaminathan’s protection of the mortgage-lending market. She interviewed economists who imagine U.S. mortgage mortgage charges may climb to eight%, which now not appears to be a stretch, with Freddie Mac saying the nationwide common price for a 30-year mortgage was 7.09% as of Thursday. For 15-year mortgage loans, the common price was 6.56%, in response to Freddie.

Vivien Lou Chen appears to be like into the explanation why the yield on 10-year U.S. Treasury notes jumped to 4.31% on Thursday, the very best degree since November 2007, whereas additionally explaining how the Treasury Inflation Protected Securities (TIPS) market reveals how a lot larger traders count on the “real” price of borrowing — rates of interest minus the inflation price — to get.

One issue sending bond costs decrease — and charges larger — was the discharge on Wednesday of the minutes of the Federal Open Market Committee’s July 25-26 assembly. Most members within the Fed coverage assembly “continue to see significant upside risks to inflation, which could require further tightening of monetary policy,” in response to the minutes.

Market Extra: How higher-for-longer charges are taking part in out as 10-year yield hits 15-year excessive

Early on Friday, the yield on 10-year Treasury notes

BX:TMUBMUSD10Y

declined to 4.22%.

Joy Wilthermuth interviews Ryan Murphy, director of fixed-income enterprise improvement at Capital Group, who explains why bond traders ought to wait whereas getting paid their curiosity and “know this is going to work out in the end.”

From the day by day Need to Know column: Bond yields maintain the important thing to an emotional market that may change on a dime, says this strategist

A depressing sit up for 2025: Risky bonds are going through a ‘maturity wall’ that would sow extra panic in markets

Housing market evolves

With owners reluctant to promote their houses and quit their present low mortgage charges, the demand for brand spanking new houses has spiked.

Scott Olson/Getty Images

With mortgage mortgage charges at their highest degree in 21 years, owners are reluctant to promote in the event that they locked in low rates of interest earlier than March 2022, so builders have been ramping up development of recent houses.

Here’s extra protection of the housing and mortgage lending markets from Aarthi Swaminathan:

How bond funds navigate the turbulence

MarketWatch illustration/iStockphoto

For this week’s ETF Wrap, Christine Idzelis interviews Rick Rieder, the chief funding officer of worldwide mounted revenue at BlackRock, who talks concerning the agency’s methods for its actively managed exchange-traded bond funds.

Sam Reid co-manages the River Canyon Total Return Bond Fund RCTIX, which is rated 5 stars, the very best score, by Morningstar. He explains how the fund makes use of credit-investing methods employed by hedge funds managed by the identical agency.

From recession worry to ‘soft landing’ to ‘no landing’

Federal Reserve Chair Jerome Powell could must take a subdued strategy to combating inflation in the course of the election cycle.

Alex Wong/Getty Images

The annual U.S. inflation price was 3.2% in July, which is nicely above the Federal Reserve’s long-term goal of two%. But inflation has come down sufficient for economists to alter their tune, going from predictions {that a} recession would end result from the Fed’s cycle of interest-rate will increase that started in March 2022, to speaking a couple of “soft landing” state of affairs, with the Fed succeeding in tamping down inflation with solely a light recession ensuing, to a buzzy new “no landing” state of affairs, by which the U.S. economic system retains chugging together with inflation remaining elevated. That stands out as the worst of the three eventualities for the inventory market.

Greg Robb appears to be like into a sophisticated set of eventualities and attainable choices for the Fed, together with the ramifications for the 2024 election cycle.

Dividend shares

Getty Images/iStockphoto

Michael Brush makes the case for getting shares with excessive dividend yields proper now, partly as a result of a big portion of long-term returns for traders has come from the payouts.

Another strategy to dividend shares is to carry them long run to construct revenue streams over time. This means the preliminary dividend yields might not be very excessive. Here are 20 dividend shares which were one of the best revenue growers within the S&P 500 over the previous 5 years, amongst people who started with dividend yields of a minimum of 1.5%.

China’s trillion-dollar downside

The almost-daily news move out of China as massive property builders default on bond funds indicators the necessity for the nation’s authorities to step up with a $1 trillion rescue plan, in response to Marko Papic, the chief strategist at Clocktower Group, who spoke with Joy Wiltermuth.

But Isabel Wang spoke with economists who dig into a sophisticated set of causes that traders shouldn’t rely on China’s authorities to provide you with an enormous stimulus bundle.

More worries: Why U.S. stock-market traders must regulate a weak Japanese yen

Dollar roars again

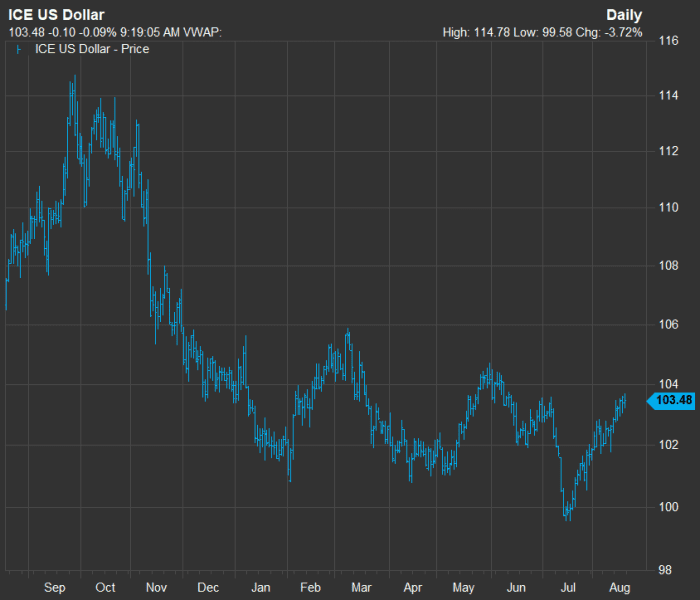

The ICE U.S. Dollar Index was up 4% early on Aug. 18 from its July low.

FactSet

After hitting a 20-year report in September, the ICE U.S. Dollar Index

DXY

fell to a low in July earlier than taking a 4% upward swing. Joseph Adinolfi opinions elements resulting in the greenback’s rise and appears forward at attainable implications.

More from Joseph Adinolfi: Same financial institution, two totally different stock-market calls. Why inside disagreements rage on Wall Street.

Retail ‘shrink’ and a worth comparability

Scott Olson/Getty Images

Retailers had blended news for traders this week, as typical, however there was additionally a number of consideration on shoplifting and different causes of stock “shrink.”

First, the earnings news and company outlooks:

James Rogers reviews on retailers feedback’ about theft and stock shrink typically:

-

Walmart Inc.

WMT,

+1.44%

CEO Doug McMillon indicated that shoplifting varies by area. -

Target Corp.

TGT,

+0.85%

CEO Brian Cornell stated the corporate was going through an “unacceptable amount” of theft, with some attributed to organized crime. -

Executives at Home Depot Inc.

HD,

+0.03%

are hoping a brand new federal legislation will assist curb shoplifting.

In the Financial Faceoff column, Leslie Albrecht compares costs for varsity provides at Walmart and Target.

Advice from the Tax Guy

Andrew Keshner — the Tax Guy — has recommendation for a reader who, together with two siblings, inherited a home six years in the past. One sibling desires to maintain the home and the opposite two don’t, however all three need to restrict their tax burdens. Here are varied eventualities for them to think about.

Keshner additionally reviews on the Internal Revenue Service’s new efforts to catch individuals who cheat on their taxes.

Taking off his tax hat, Keshner appears to be like on the outcomes of a research on client conduct that concludes that persons are spending some huge cash on subscription providers they don’t even use. A self-audit can prevent some huge cash.

Uber and the altering metropolis

andrew caballero-reynolds/Agence France-Presse/Getty Images

Uber Technologies Inc.

UBER,

has modified many city landscapes. We have gone from being unable to hail a taxicab in Midtown Manhattan 10 years in the past to having a minimum of three compete for your corporation should you increase your hand for service whereas standing outdoors the News Corp.

NWSA,

constructing on Sixth Avenue. Uber’s simple ride-hailing service has made a whole change to this facet of metropolis life.

But not everyone seems to be pleased with Uber. For the Book Watch column, Levi Sumagaysay interviews Kafui Attoh and Katie Wells, two of the authors of “Disrupting D.C.: The Rise of Uber and the Fall of the City.” They describe how Uber has managed to alter so many cities, how tough it may be to work for the corporate and why it’s nonetheless a compelling choice for its drivers.

Want extra from MarketWatch? Sign up for this and different newsletters to get the newest news and recommendation on private finance and investing.

Source web site: www.marketwatch.com