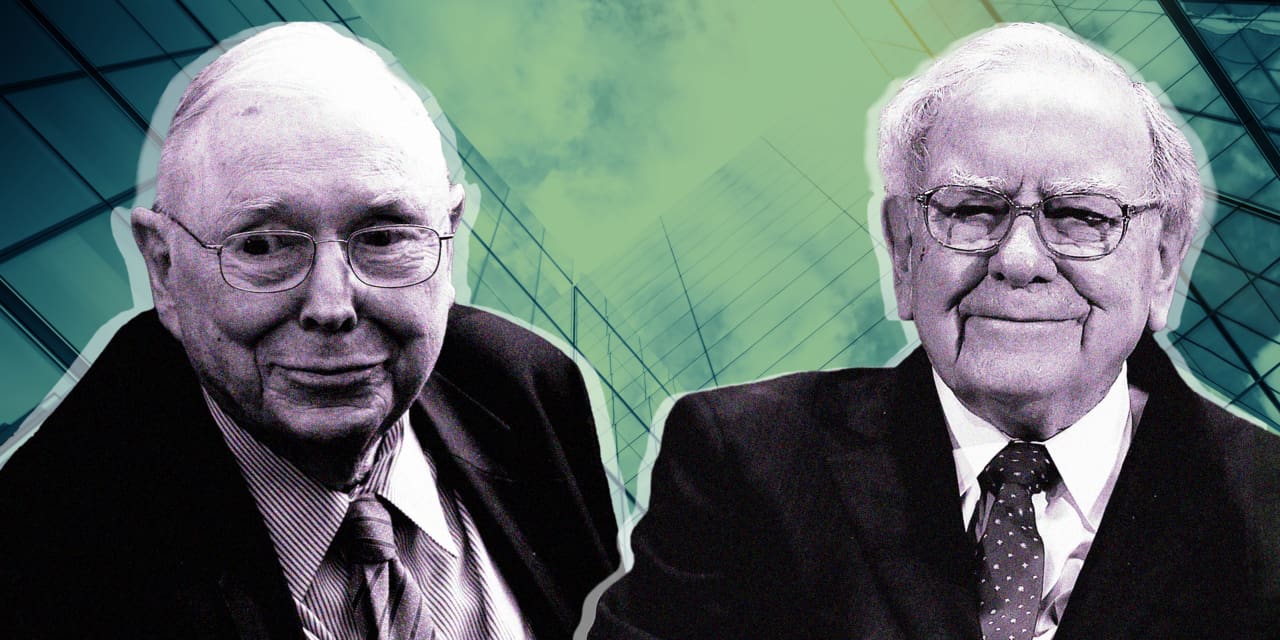

Charlie Munger’s loss of life will probably put strain on Berkshire Hathaway Inc. Chairman Warren Buffett to offer extra element concerning the investing exercise of two key understudies.

“You begin a pivot to Todd Combs and Ted Weschler,” Bill Smead, chief funding officer at Smead Capital Management, a longtime Berkshire shareholder, mentioned in a cellphone interview. Combs and Weschler collectively run about 10% of Berkshire’s $350 billion funding portfolio.

While Berkshire stays the 93-year-old Buffett’s present, a scarcity of element across the efficiency and strategy of Combs and Weschler has been a frustration, Smead mentioned. That will probably change as Munger’s absence leaves an enormous “void.”

“They will become Buffett’s alter ego rather than Munger,” he mentioned.

See: Charlie Munger’s loss of life ends partnership with Warren Buffett that constructed Berkshire Hathaway

Smead mentioned that would imply a job for the pair at Berkshire’s annual assembly in Omaha, the place Buffett and Munger famously held court docket every May in hourslong question-and-answer periods that knowledgeable and delighted shareholders and, in recent times, a worldwide viewers.

Buffett and Munger “were generous and open” about their investing course of, Smead mentioned. While Combs and Weschler look like glorious inventory pickers who share their mentors’ mindset, they continue to be one thing of a thriller, he mentioned.

A Berkshire Hathaway consultant mentioned it was too quickly to say what modifications could also be in retailer for the annual assembly.

Munger, 99, died Tuesday at a California hospital, Berkshire Hathaway introduced Tuesday afternoon. Buffett and Munger have been identified to speak by cellphone for hours a day. Buffett, 93, usually described Munger as his “right-hand man,” who helped form Berkshire’s investing strategy.

Berkshire shares have been little modified Wednesday. Class A shares

BRK.A,

have been up 0.1% on Wednesday, whereas Class B shares

BRK.B,

rose 0.2%. Berkshire shares are up practically 17% to this point in 2023, versus a acquire of greater than 18% for the S&P 500

SPX.

Munger’s loss of life didn’t take Berkshire Hathaway shareholders abruptly, however the finish of maybe essentially the most important partnership within the historical past of contemporary investing inevitably raises essential questions for buyers.

“My feeling is that Berkshire is not going to be able to replace Charlie Munger and nor do I anticipate they’re going to try,” mentioned Cathy Seifert, an analyst at CFRA Research, who has a purchase ranking on Berkshire Hathaway.

But the long-serving vice chairman was such an important factor to the success of Berkshire Hathaway that buyers within the near-term will probably be on the lookout for any signal the loss is having an affect on Buffett, she mentioned in a cellphone interview.

Seifert, in a consumer observe late Tuesday, mentioned that Munger’s passing “could test (to a degree) transition plans Berkshire established several years ago, though we do not expect any significant issues to arise.”

Berkshire in 2021 confirmed that Greg Abel, who oversees Berkshire’s noninsurance operations, will probably be Berkshire’s post-Buffett CEO. Aijit Jain is predicted to proceed working the insurance coverage companies after Buffett leaves the scene, whereas Combs and Weschler are anticipated to go up funding operations, based on Barron’s.

Investors also needs to take note of appointments to Berkshire’s board after a lot of current departures, Seifert mentioned. She expects there to be strain so as to add extra numerous members to the board.

Opinion: Who will say no to Warren Buffett now that Charlie Munger is gone?

Source web site: www.marketwatch.com