Consumer spending has defied Wall Street expectations all yr, each by preserving shares afloat close to report ranges and by stopping the U.S. economic system from operating aground right into a recession.

That’s why sentiment round shares within the week forward might hinge on two associated financial knowledge factors: the consumer-price index (CPI) for August due on Wednesday and month-to-month U.S. retail gross sales slated for a day later.

“They are hanging in a lot longer than we all gave them credit for last year,” mentioned Jason Blackwell, chief funding strategist at The Colony Group, of the willingness of shoppers to spend, regardless of credit-card rates of interest eclipsing 20% and inflation nonetheless above the Fed’s 2% annual goal fee.

“Our view is that the consumer does remain fairly healthy and is able to keep up with prices increase,” he mentioned.

The yearly CPI bumped as much as 3.2% final month, however has declined from a peak of 9.1% final yr. Blackwell might be watching Wednesday’s financial replace for indicators of easing in shelter, a “sticky” sort of inflation, which in July was pegged at 7.7% yearly, though house costs prior to now yr have fallen. “There’s a disconnect that needs to narrow, at some point,” he mentioned.

The sharp rise in mortgage charges has been much less damaging to the housing market than it might need been in an earlier period. That’s as a result of most householders already refinanced at traditionally low pandemic charges, offering a buffer because the Fed raised its coverage fee to a 22-year excessive.

A decade of underbuilding additionally has stored costs from tumbling, whilst gross sales dropped, leaving many individuals with an enormous fairness cushion of their houses. At the identical time, wages have been rising and the economic system has refused to capitulate.

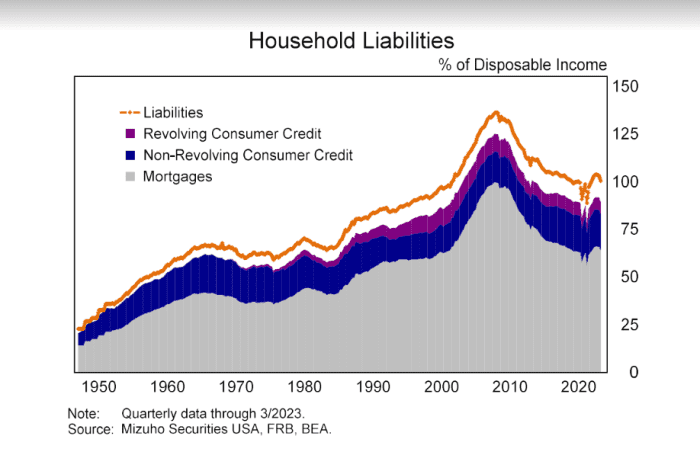

Putting all of it collectively suggests a recipe for continued spending, notably with family debt-to-incomes nonetheless close to a 20-year low of about 100%, in response to Mizuho Securities.

Household debt-to-income sits close to a 20-year low, translating to resilience in shopper spending.

Mizuho Securities, Federal Reserve Board, Bureau of Economic Analysis

“The market has been expecting a recession for the past year or so, and has been wrong,” mentioned Michael Rosen, chief funding officer at Angeles Investments. “In some sense, they probably are still looking for a recession. I think that’s also wrong.”

That’s as a result of Rosen views as we speak’s increased rates of interest as much less ominous than others may suppose, particularly with wage beneficial properties and powerful households stability sheets in a position to preserve the economic system buzzing, even when spending largely has exhausted pandemic financial savings.

“There has been some weakness in the manufacturing sector, but it’s the consumer that dominates our economy,” Rosen mentioned. That has been mirrored in current financial knowledge but additionally in jammed airports, eating places or at one in all Beyoncé or Taylor Swift’s bought out summer time concert events, he mentioned.

Related: There’s a brand new star of the U.S. economic system this summer time: ladies. ‘Is this how men have always felt?’

In July, gross sales at U.S. retailers mirrored the largest enhance in six months. Higher vitality costs might play a task in looming financial knowledge for August. But Rosen nonetheless views the backdrop for shares and short-term Treasury securities as favorable.

“The market climbs a wall of worry and that’s exactly what’s been happening here,” he mentioned, including that he expects shares to maneuver increased. “What drives markets is profits and corporate profits are strong.”

John Butters, FactSet’s senior earnings analyst on Friday mentioned he’s forecasting a web revenue margin for the S&P 500 index of 11.7% for the third quarter, which might be above the 11.6% determine for the earlier quarter and above the 11.4% five-year common.

“Investors tend to have short memories,” Rosen mentioned, pointing to a Fed funds charges that hit double-digits within the Eighties. however staying excessive because the economic system expanded for many of the decade. “Five percent is a pretty normal interest rate,” he mentioned. “I’d even go further and say zero interest rates are harmful for the economy.”

U.S. shares closed the week decrease, with the S&P 500 index

SPX

down 1.3% for the week, the Dow Jones Industrial Average

DJIA

0.8% decrease and the Nasdaq Composite Index

COMP

shedding 1.9% for the week, in response to Dow Jones Market Data.

Bigger image, the Dow ended Friday solely 6% away its report excessive set in January 2022, whereas the S&P 500 was 7% beneath its prior peak. Yields on 3-month

BX:TMUBMUSD03M

and 6-month

BX:TMUBMUSD06M

Treasurys have been above 5% since this spring.

Source web site: www.marketwatch.com