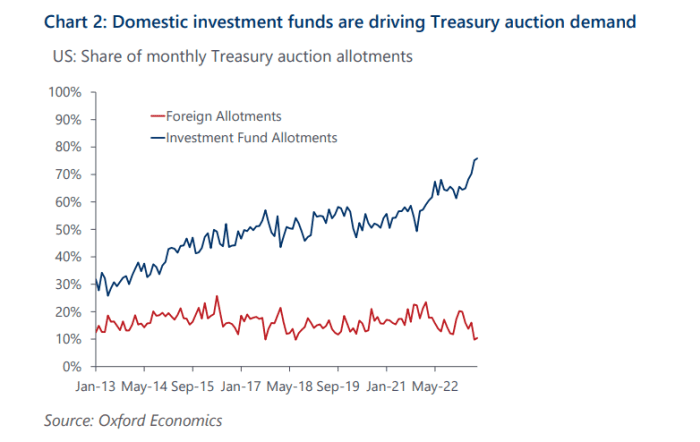

The current deluge of Treasurys bought at public sale has gone principally to home funding funds, in response to Oxford Economics.

Domestic funds snapped up about 76% of July’s Treasury public sale provide, marking the fourth straight month in a row of a report share, in response to an Oxford tally, whereas international allotments have been weaker.

Domestic funds are snapping up most Treasury auctions

Oxford Economics

“Investment funds have been the primary, and growing, source of demand for Treasury coupon auctions, particularly since auction sizes began to decline in late 2021,” stated John Canavan, lead analyst at Oxford Economics.

“But the main question mark for the market’s ability to absorb the increased Treasury coupon issuance will be whether or not the increasing demand from domestic investment funds continues.”

Treasury invoice issuance is anticipated to complete $728 billion within the third quarter, and $402 billion within the fourth-quarter, in response to a forecast by BofA Global’s charges crew on Friday. That’s largely to assist refill the Treasury money account run low by the lengthy debt-ceiling battle.

The tally would put issuance for the second half of 2023 at $1.13 trillion, an enormous quantity but in addition a bit beneath the Treasury’s $1.3 trillion forecast, in response to BofA Global.

Appetite for secure, high-yields

“I think it will be digested relatively well,” stated BMO Wealth Management’s Yung-Yu Ma, chief funding officer, in a telephone interview, including that U.S. charges versus different developed nations stay excessive.

“I think there is quite large appetite for safe, high-yield debt, and short-term Treasury securities certainly offer a nice yield.”

Yields on short-term Treasury securities that mature in lower than a yr have been comparatively regular previously week, with the 1-month invoice charge

BX:TMUBMUSD01M

at 5.34% on Friday, in response to FactSet.

Bigger strikes have been seen this week within the 10-year Treasury yield,

BX:TMUBMUSD10Y

which briefly traded above 4.2%, marching greater within the wake of Fitch stripping the U.S. of its high AAA ranking, and a $1 trillion funding estimate from the Treasury for the third quarter.

“The 10-year above 4% is telling us there’s some stickiness to the upside for rates,” BMO’s Ma stated. “I think rangebound is good,” he stated, including {that a} 3.8% to 4.2% vary for the 10-year yield most likely works properly for equities, however an enormous drop within the benchmark yield might sign better financial weak spot.

Stocks have been greater Friday, however with the S&P 500 index

SPX,

Dow Jones Industrial Average

DJIA

and Nasdaq Composite Index

COMP

remained on tempo for weekly declines, in response to FactSet.

Bigger image, a recession isn’t one thing Ma thinks is probably going. “We were talking about a soft landing when it was very unpopular,” he stated. “The elements of a soft landing should still be in place because the labor market is providing a buffer from Fed interest rates.”

Read: U.S. provides 187,000 jobs in July and factors to hiring slowdown. Wages nonetheless excessive

Source web site: www.marketwatch.com