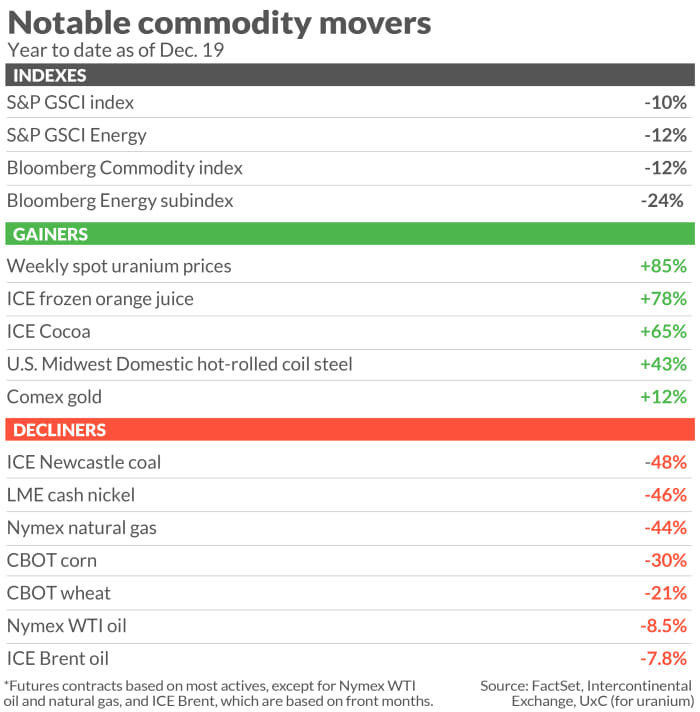

Numerous commodities made notable strikes in 2023, with gold and frozen orange-juice costs reaching report highs, however key commodities indexes are on observe to publish their largest losses in 5 years, pressured by declines in pure gasoline, coal, and grains.

The S&P GSCI

XX:SPGSCI,

a benchmark for investments within the commodity markets, traded 10% decrease yr so far as of Dec. 19, FactSet information present. The vitality sector posted the most important decline, with the S&P GSCI Energy index

XX:SPGSEN

down 12%.

The Bloomberg Commodity Index

XX:BCOM,

which tracks 24 commodities, has misplaced 12% this yr, with the Bloomberg Energy subindex down 24%.

Both indexes are on observe to publish their largest yearly share declines since 2018.

The commodity sector confirmed “its true nature as a collection of weather derivatives, for the most part, as 2023 unfolded,” mentioned Darin Newsom, senior market analyst at Barchart.

Based on that, and the transfer from the La Niña to El Niño climate patterns, he mentioned he wasn’t overly shocked by various commodity markets posting losses, however “there was much more to it than just weather.”

Gainers

The total losses in the important thing indexes got here in distinction to power in various commodities.

Gold futures costs

GC00,

GCG24,

climbed to an intraday record-high of $2,152.30 on Dec. 4 and have since pulled again. But as of Dec. 19, gold was nonetheless up 12% for the yr.

Read: Gold only a report excessive. Is it too late for buyers so as to add it to portfolios?

“With interest rates set to pause and eventually decline, the U.S. dollar falling, and disinflation continuing around the world, we have to throw all fundamentals to the wind when it comes to gold,” mentioned Adam Koos, president at Libertas Wealth Management Group. “At this juncture, the gold trade is all about all-time-highs, selling pressure, shorts, and breaking out above this multiyear level that has posed such a problem for the yellow metal in the past.”

If gold can escape above all-time-highs and maintain there, Koos mentioned he expects the metallic to have an excellent yr in 2024, “at a point when perhaps fundamentals might start to come back into play.” For now, he sees gold as “purely a technical trade.”

The Year Ahead: Silver’s window of alternative is closing, with costs poised for an ‘explosive move’ in 2024

Meanwhile, the so-called “soft” commodities, outlined as these which might be grown, not mined, have additionally rallied this yr.

While the softs are climate derivatives at coronary heart, “major growing areas around the world continued to have trouble,” offering assist to commodities within the sector, mentioned Newsom.

Frozen concentrated orange-juice futures

OJ00,

OJH24,

touched an all-time excessive of $4.258 a pound on Nov. 20, with costs up round 78% yr so far, and cocoa futures

CC00,

CCH24,

have rallied by 65% this yr.

“Cocoa prices are up on supply concerns due to unrest in West Africa,” whereas orange-juice costs have discovered assist on provide issues associated to climate, mentioned Roland Morris, commodities strategist for VanEck’s lively Natural Resources Equity Strategy.

In the vitality sector, uranium bucked the pattern amongst its friends as costs for the nuclear gasoline soared.

Weekly spot uranium costs had been at $86.35 a pound as of Dec. 18, based on UxC. Jonathan Hinze, president at UxC, identified {that a} deal at $89 a pound was seen on Dec. 20, which might be the very best spot transaction worth since January 2008.

If the year-end worth stays at round $89, that may mark a yearly rise of roughly 85%, he mentioned.

Read: Why the rally in uranium that lifted costs to a 15-year excessive might not be over

The greatest issue affecting the uranium market proper now could be the passage within the U.S. House of Representatives of a invoice that may ban Russian uranium imports, mentioned Hinze. The invoice is up to now held up within the Senate however there are indicators it might move as quickly as January, and that’s led a number of consumers to leap in, he mentioned.

“If the U.S. ban on Russian imports becomes law, this could spur additional upward moves in price,” mentioned Hinze.

Decliners

Among the commodity decliners, coal and pure gasoline had been standouts.

Newcastle coal futures

NCFF24,

have misplaced round 48% this yr as of Dec. 19, primarily based on information from ICE Futures Europe.

Demand for coal is forecast to say no amid a push all over the world for cleaner vitality.

In a latest month-to-month report, the Energy Information Administration mentioned it expects renewable vitality to tackle a larger function within the new yr, with photo voltaic and wind collectively anticipated to generate extra energy than coal for the primary time ever within the U.S.

And earlier this month, on the United Nations Climate Change Conference, often known as COP28, almost 200 events reached an settlement to section out fossil fuels.

Read: Here’s what the COP28 pact to section out fossil fuels means for oil

U.S. natural-gas futures, in the meantime, have misplaced 44% this yr as of Dec. 19. The commodity

NG00,

NGF24,

traded on the New York Mercantile Exchange (Nymex), had posted a acquire of twenty-two% for the month of October earlier than falling again sharply within the final two months of the yr.

Strong U.S. manufacturing, mixed with a “warm start to this winter heating season,” has pressured costs for pure gasoline, mentioned VanEck’s Morris.

In the grain advanced, corn and wheat led the declines, with wheat futures

W00,

WH24,

traded in Chicago down 21% and corn

C00,

CH24,

shedding 30% yr so far.

Morris mentioned that among the many huge surprises within the commodities market was the autumn in wheat and corn costs, notably with the Russia-Ukraine struggle.

“That region is so important to the world supply of corn and wheat I would have expected prices to remain higher on supply concerns,” he mentioned.

Production of crops this yr in North and South America elevated, usually talking, mentioned Barchart’s Newsom. Increased U.S. manufacturing, as a result of higher climate, alongside continued gradual demand led to losses for corn and soybeans, particularly, he mentioned.

Oil costs have additionally declined, regardless of dangers to world provides posed by the persevering with Russian-Ukraine and Israel-Hamas wars.

More lately, main transport corporations introduced a halt in shipments by means of the Red Sea due to latest assaults on ships by Iran-backed Houthi rebels, offering a lift to grease, however costs stay decrease total for yr.

Read: Attacks within the Red Sea add to world transport woes

U.S. benchmark West Texas Intermediate crude

CL.1,

CLG24,

was off 8.5% within the yr so far on Nymex as of Dec. 19, whereas world benchmark Brent crude

BRN00,

BRNG24,

on ICE Futures Europe has misplaced 7.8% this yr.

The Year Ahead: Why oil could not see a return to $100 a barrel in 2024

“If Iran and their proxies are successful in shutting down shipping in the Red Sea and through the Suez Canal for an extended period of time, I would expect higher prices for grains and crude oil,” Morris mentioned.

Outlook

Looking forward, subsequent yr might be a powerful one for commodities, analysts mentioned.

“The Fed will start cutting interest rates at some point and the U.S. dollar is likely to decline, possibly sharply,” mentioned Morris. “Emerging-market economies will also be able to lower interest rates stimulating growth in EM economies and increasing commodity demand.”

Libertas Wealth Management’s Koos additionally predicts a “positive year for commodities” in 2024.

He expects risk-on property to finish with exhausting property, primarily U.S. shares and bonds, as interest-rate shock hits the economic system.

“Compound that with strong potential geopolitical risks in an election year, and I think we’ll continue to see a bid in hard assets, overall,” mentioned Koos.

Source web site: www.marketwatch.com