Slowing U.S. inflation has sparked hopes of a giant turnaround for hard-hit elements of the $10.6 trillion U.S. company bond market.

Bonds issued by America’s most useful corporations, from Apple Inc.

AAPL,

to Amazon.com

AMZN,

to Microsoft Corp.

MSFT,

to Johnson & Johnson,

JNJ,

have been buying and selling at a few of their lowest costs in practically 20 years, a casualty of the Federal Reserve’s rate of interest hikes previously 18 months.

Prices for low-coupon, longer period bonds have been hit notably arduous because the Fed started rapidly lifting its coverage fee final 12 months from a 0%-0.25% pandemic vary.

Rate hikes make older, low-coupon bonds much less beneficial as a result of main companies and the U.S. authorities have been issuing newer bonds, usually at yields not seen because the 2007-2008 world monetary disaster.

“So many investors got blindsided by the drop in value, and there really wasn’t any place to hide,” stated Collin Martin, fastened revenue strategist at Schwab Center for Financial Research, in a cellphone interview.

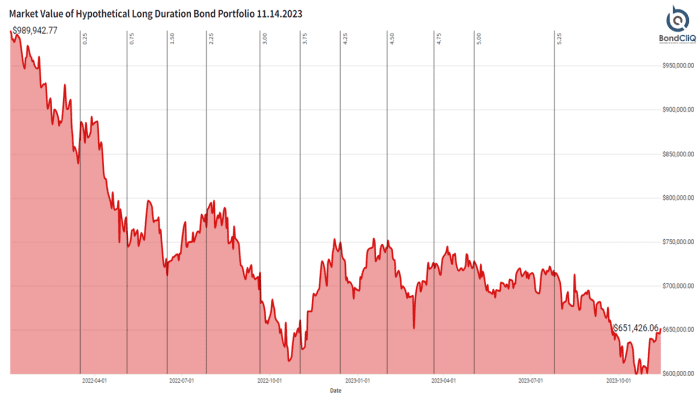

To assist gauge the carnage, BondCliq Media Services put collectively a hypothetical long-duration, top quality, U.S. company bond portfolio with a January 2022 beginning worth of just about $1 million. They additionally tracked the impact of Fed hiked charges (see black strains) because the Spring of 2022. While rising off the current October lows, its worth on Tuesday was pegged round $650,000.

Longer-duration U.S. company bonds have been hammered by larger charges, however the tide might be lastly turning

BondCliQ

“Given the Fed outlook, it’s more likely that prices rise over the next 12 months than fall,” Martin stated, including that Schwab expects the following transfer from the Fed to be an rate of interest minimize, moderately than a hike, on condition that inflation has continued to slowly recede from peak ranges.

The roughly 6.5-year ICE BofA US Corporate bond index was final pegged at a 87.31 worth, up from as little as 85 in October, however on tempo for a 1% complete return for the 12 months, in keeping with FactSet.

Lower bond costs matter for traders if they’re compelled to mark down their holdings or must promote at a loss, an element that contributed to the collapse of Silicon Valley Bank in March.

U.S. bond yields tumbled on Tuesday, and the stock-market

SPX

roared larger after the consumer-price index for October rose lower than anticipated, pegging inflation at an annual fee of three.2%, down from 3.7% in September.

While that’s nonetheless above the Fed’s 2% goal, merchants on Tuesday had been pricing in 50 foundation factors of cuts to the central financial institution’s coverage fee by July of 2024, in keeping with the CME FedWatch device.

“The broad market consensus is now in line with our own expectation that the least Fed rate hike of the cycle occurred this summer,” stated BCA Researchers, in a consumer observe Tuesday.

Price fluctuations for bonds matter much less if the debt is held to maturity, and totally repays at par, or $100, as promised. Like in shares, traders need to purchase bonds priced at steep reductions that look poised to rally.

The 10-year Treasury yield

BX:TMUBMUSD10Y

was decrease by 19.1 foundation factors on Tuesday to about 4.42%, after hitting a peak of about 5% in October. Bond costs transfer in the other way as yields.

Lauren Goodwin, economist and portfolio strategist at New York Life Investments, stated traders ought to seize any aid rallies to rebalance their portfolios to one thing they count on to be “more durable” for the lengthy haul, together with her advice to lastly add period as lengthy charges transfer decrease.

Read: Economists in hawkish camp don’t give up in wake of October consumer-inflation print

Beyond company debt, the favored iShares Core U.S. Aggregate Bond ETF

AGG

was up 1.3% on Tuesday, in keeping with FactSet, whereas the Dow Jones Industrial Average

DJIA

was on tempo for a 1.4% achieve.

Source web site: www.marketwatch.com