Welcome again to Distributed Ledger. This is Frances Yue, reporter at MarketWatch.

The crypto house has seen a number of circumstances the place the favored technique “buy the rumor, sell the news” was relevant, that means the value of a digital asset would rise as merchants bought it in anticipation of a optimistic news occasion, however fall after the precise occasion occurs, as many consumers already exhaust themselves and develop into pure sellers.

However, it received’t be the case for the potential launch of bitcoin

BTCUSD,

exchange-traded funds, based on Dan Morehead, founder and managing companion at Pantera Capital, and Jeff Lewis, product supervisor of hedge funds on the agency. If a bitcoin ETF is permitted, it might solely enhance bitcoin costs additional, they stated.

Optimism round bitcoin ETFs have contributed to a 30% acquire of bitcoin over the previous 30 days, based on CoinDesk knowledge.

Market contributors anticipate the Securities and Exchange Commission to approve a spot bitcoin ETF by January 10 subsequent 12 months. The company has repeatedly rejected such purposes previously, citing their vulnerability to market manipulation.

A fast programming observe: There might be no Distributed Ledger subsequent Thursday, Nov. 23, because of the Thanksgiving vacation within the U.S. This e-newsletter will then shift to being printed on Wednesdays, with the following version out on Nov. 29.

Find me on Twitter at @FrancesYue_ to share any ideas on crypto or this article.

Buy the news?

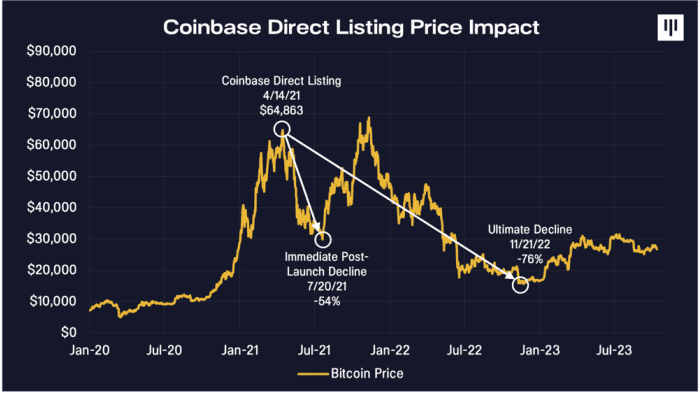

Bitcoin jumped over 2,000% within the 12 months earlier than the CME Group launched bitcoin futures in December, 2017, however later fell 84% to a cycle low. The crypto additionally rose 848% within the 12 months earlier than crypto alternate Coinbase went public in 2021, whereas seeing a 54% decline afterwards.

Pantera Capital

However, don’t search for a repeat if a spot bitcoin ETF is permitted, Morehead and Lewis stated in a Thursday observe.

Neither the bitcoin futures launch nor the Coinbase public itemizing had any affect on “real world access to bitcoin,” the analysts wrote. Bitcoin futures have been solely attention-grabbing to a small area of interest of buyers, principally arbitrageurs, whereas for Coinbase, “the change in who owned stock did nothing to increase access to bitcoin,” the analysts famous.

However, as soon as a spot bitcoin ETF is permitted, it may “fundamentally change access to bitcoin,” famous the analysts.

“The existence of an ETF is a very important step in becoming an asset class. Once an ETF exists, if you don’t have exposure, you’re effectively short,” famous the analysts.

BlackRock applies for Ether ETF

BlackRock has filed an software with the U.S. Securities and Exchange Commission for its iShares Ethereum Trust, an alternate traded fund to instantly spend money on ether

ETHUSD,

It follows the asset supervisor’s software for a spot bitcoin ETF in June.

Who are the crypto buyers?

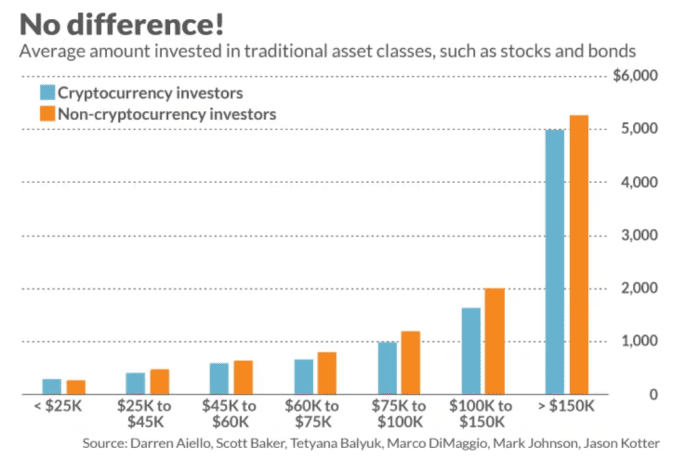

A current examine by the National Bureau of Economic Research confirmed that “crypto investors are not as dissimilar from equity investors as some might believe,” MarketWatch’s Mark Hulbert reported.

The examine, entitled “Who invests in Crypto? Wealth, Financial Constraints, and Risk Attitudes,” was carried out by Darren Aiello, Mark Johnson and Jason Kotter of Brigham Young University, Scott Baker of Northwestern, Tetyana Balyuk of Emory University, and Marco DiMaggio of Harvard.

The researchers separated buyers primarily based on whether or not they do or don’t spend money on crypto, and calculated the typical quantity folks in numerous revenue cohorts invested in conventional asset courses, equivalent to shares and bonds. The outcomes confirmed that the quantities are barely distinguishable.

Read extra right here.

Crypto in a snap

Bitcoin edged up 0.7% previously seven days and was buying and selling barely beneath $35,800, based on CoinDesk knowledge. Ether rose 1.2% throughout the identical interval at round $1,950.

Must-read

- How a Bay Area man misplaced $260K in crypto texting rip-off (San Francisco Chronicle)

Source web site: www.marketwatch.com