Let’s hear it for retail buyers, who don’t get sufficient credit score for taking good care of enterprise.

Citing Vanda Research, the Wall Street Journal studies that the common individual-investor inventory portfolio is up 150% for the reason that begin of 2014, versus round 140% for the S&P 500’s

SPX

throughout the identical interval.

All that’s largely thanks to like for tech biggies like Apple and Tesla, as savvy buyers picked up on their significance. And who wouldn’t need to hop on the subsequent huge theme and be sitting on huge features in a decade or two.

That brings us to our name of the day, from JPMorgan, which is flagging a “$100 billion plus opportunity” from rising weight-loss medication, or GLP-1s — glucagon-like peptide-1 intestine hormones that may assist management blood sugar ranges and decrease appetites.

“We forecast U.S. sales for the GLP-1 category to exceed $100 billion in annual sales over time, split roughly 50/50 in diabetes and obesity. Our global market estimate is [more than] $140 billion by 2032,” mentioned a crew led by analyst Nicholas Rosato, whose estimates crush the $77 billion in gross sales by 2030 predicted by Morgan Stanley this summer season.

His crew is bullish on U.S. and Europe picks Eli Lilly

LLY,

and Novo Nordisk

NVO,

NOVO.B,

they usually see loads of upside earnings surprises forward for that pair. Note, the WSJ factors out that Novo Nordisk, Europe’s most beneficial firm, is weak to promoting in Europe at occasions as Danish fund managers can’t maintain greater than 10% of the drugmaker.

Laying out different beneficiaries, they tamp down worries over medtech system makers — they’re bullish views on Insulet

PODD,

Dexcom

DXCM,

and Inspire Medical

INSP,

and Gerresheimer

GXI,

In life sciences, they like Thermo Fisher

TMO,

Catalent

CTLT,

and Avantor

AVTR,

which makes course of elements utilized in these diabetes/weight reduction medication, and see incremental features seen for Danaher

DHR,

Repligen

RGEN,

and Agilent

A,

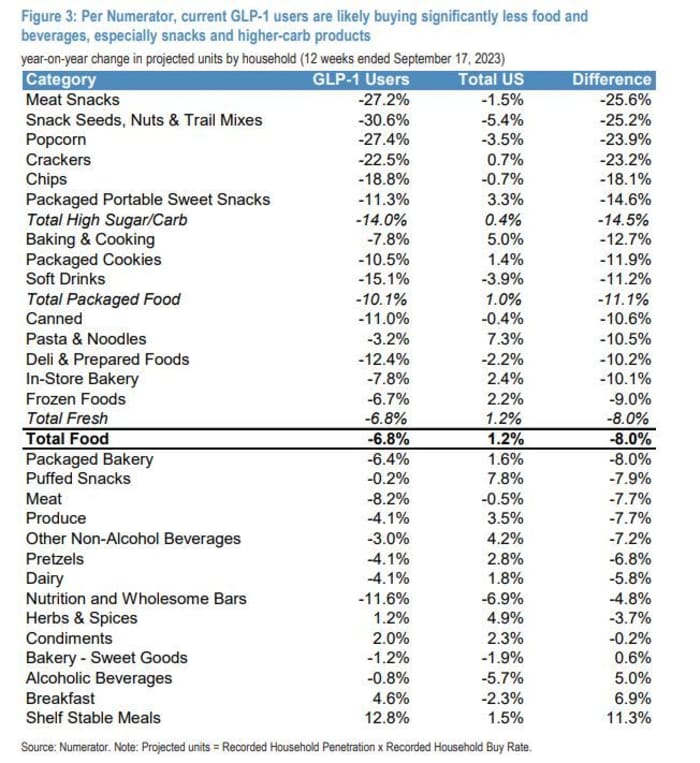

JPMorgan analysts then handle the hot-button matter — how these medication will reduce into the American love for snack meals and drinks.

Also learn: The darkish facet of the weight-loss-drug craze: consuming problems, treatment shortages, harmful knockoffs

Walmart

WMT,

CEO John Furner despatched shares of Coca-Cola

KO,

and PepsiCo

PEP,

tumbling a number of weeks in the past after he blamed GLP-drugs for decrease spending on groceries and high-calorie snacks. (Coke lifted steering because it reported forecast-beating outcomes on Tuesday and shares are up) Morgan Stanley has been amongst Wall Street banks flagging this possible fallout.

Echoing this, JP Morgan analysts say the impression is “real and potentially not small,” and share a survey exhibiting GLP-1 customers choose meat, produce and dairy to snacks, sugary drinks and excessive carb gadgets. Some caveats right here, slightly below 500 individuals had been surveyed they usually say it’s laborious to inform if these class shifts will persist, they are saying:

JPMorgan/Numerator

To this impact, Rosato and the crew are bullish on protein drink maker BellRing

BRBR,

and pure and natural grocery chain Sprouts Farmers Market

SFM,

(impartial rated). They are additionally bullish on Coca-Cola, which they see as “relatively more insulated” from GLP-1 fallout as round 80% of its volumes are worldwide and 19 out of its 20 high drinks supply sugar free alternate options. They additionally like Keurig Dr Pepper

KDP,

because it’s much less uncovered to sugary drinks.

What else? Within U.S. meals supply they’re choose the extra world participant Uber

UBER,

to DoorDash

DASH,

and Instacart

CART,

for its potential from secular development of on-line grocery supply.

Read: Equity strategist who referred to as inventory rally in first half says S&P 500 received’t resume climb till spring 2024

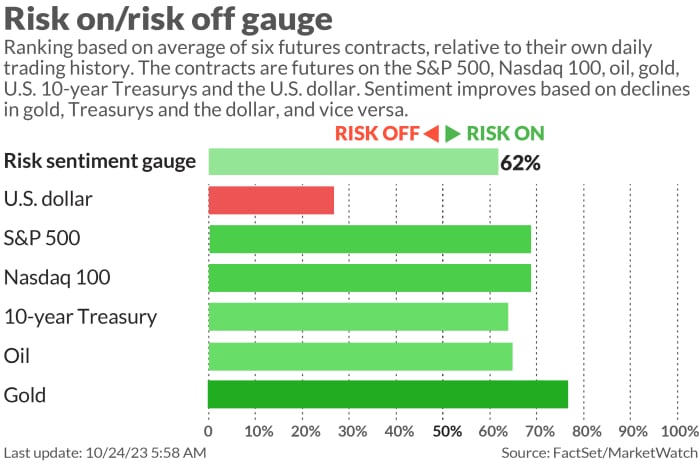

The markets

Stock futures

ES00,

YM00,

NQ00,

are larger as bond yields

BX:TMUBMUSD10Y

BX:TMUBMUSD02Y

regular, following Monday’s dramatic 5% run for the 10-year notice. Oil costs

CL.1,

are flat, and bitcoin

BTCUSD,

is climbing after reaching an almost 18-month excessive on Monday over optimism that an ETF primarily based on the crypto will quickly be authorised within the U.S.

The buzz

Earnings are rolling out from huge names on Tuesday — GE

GE,

lifted steering and the inventory is climbing, 3M

MMM,

is up on a better outlook and revenue beat and General Motors

GM,

reported blowout earnings and shares are up. Xerox

XRX,

is up after swinging to a revenue.

Alphabet

GOOGL,

(see preview), Microsoft

MSFT,

(see preview), Visa

V,

and Texas Instruments

TXN,

are due after the market shut.

Read: Big-tech outcomes will determine ‘where we go from here’ amid investor warning. They would fall if it weren’t for this one firm

The S&P flash U.S. manufacturing and providers buying managers indexes are due at 9:45 a.m.

Global demand for fossil fuels will peak earlier than the tip of the last decade, as geopolitics hasten the transfer to renewable vitality, says the International Energy Agency.

Best of the net

Israel-Hamas warfare sees buyers shun most conventional havens, apart from these two.

Microsoft and NBA supply menopause advantages to maintain ladies working.

The tickers

These had been the top-searched tickers on MarketWatch as of 6 a.m.:

| Ticker | Security identify |

|

TSLA, |

Tesla |

|

NVDA, |

Nvidia |

|

AMC, |

AMC Entertainment |

|

AAPL, |

Apple |

|

GME, |

GameStop |

|

MARA, |

Marathon Digital |

|

SPOT, |

Spotify Technology |

|

PLTR, |

Palantir Technologies |

|

MSFT, |

Microsoft |

|

NIO, |

NIO |

Random reads

Skeletal, Taylor Swift-inspired Halloween garden décor goes viral.

That 40 million year-old moon.

“Siren battles” blaring Céline Dion songs plague this New Zealand city.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your e-mail field. The emailed model will probably be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch monetary columnist James Rogers and economist Stephanie Kelton.

Source web site: www.marketwatch.com