The S&P 500 has been beating the remainder of the world for years, however diversifying geographically might now be “an inexpensive hedge” in opposition to a possible correction in U.S shares, based on Morgan Stanley Wealth Management.

The S&P 500

SPX,

a gauge of U.S. large-cap shares, has climbed 6.4% this yr based mostly on Monday afternoon buying and selling ranges, surpassing the remainder of the world’s positive factors yr thus far, FactSet knowledge present. Shares of the iShares MSCI ACWI ex U.S. ETF

ACWX,

which invests in worldwide shares whereas excluding the U.S., are lagging with only a 1.7% rise up to now this yr.

“The S&P 500’s extraordinary outperformance of non-U.S. stocks over the past 15 years has convinced many investors that the U.S. is the only game in town,” Lisa Shalett, chief funding officer at Morgan Stanley Wealth Management, stated in a notice Monday.

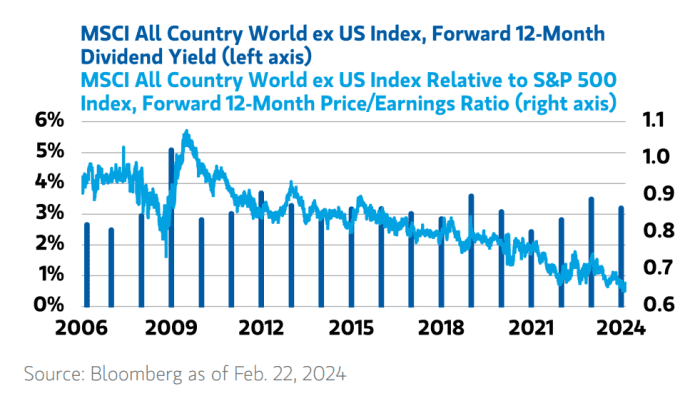

“To be clear, we believe in the potential of capex-driven, AI-enabled innovation and what we have termed the next American productivity renaissance,” she stated. “But valuations of non-U.S. equities versus the S&P 500 are at a 20-year low, and dividend yield differentials are also extreme.”

Shalett stated buyers ought to contemplate “rebalancing extreme overweights” to U.S. equities with some publicity to Japan, Europe and rising markets together with Brazil, Mexico and India.

“We see reason for optimism outside the U.S., given fiscal reform, stimulus and monetary accommodation that could catalyze profits in Europe, Japan and select EM countries,” she stated.

Read: India is successful over buyers as Chinese shares battle, these charts present

“With China in geopolitical isolation from the West, Japan’s leadership in Asia is being renewed,” based on her notice. Although “China is particularly challenging for investors,” different emerging-market international locations have development catalysts together with “structural drivers related to deglobalization of supply chains, constructive fiscal policies and stabilizing politics,” she stated.

Read: U.S. inventory valuations stick out in ‘tremendous way’ as S&P 500 beats remainder of world

U.S. shares have a lot larger valuations in comparison with worldwide equities, based on Shalett.

While the S&P 500’s ahead price-to-earnings ratio is over 20.4, the equal for the MSCI ACWI ex U.S. is round 13.5, her notice exhibits.

“That discount of nearly 35%, a 20-year low, is a two-standard-deviation event,” she wrote. Also, “dividend yields for non-US equities are running above 3% — more than double that of the U.S. benchmark,” stated Shalett.

MORGAN STANLEY WEALTH MANAGEMENT NOTE DATED FEB. 26, 2024

Stocks within the U.S. symbolize greater than 63% of the MSCI All Country World Index, “the country’s largest premium to its relative GDP weight in the history of the benchmark,” based on the Shalett. Yet the U.S. has a smaller share of world gross home product at 24%, she famous.

While the U.S. could also be heading for a “bright” financial future,” diversifying geographically might make sense as valuations of its inventory market “suggest significant optimism is baked in” when contemplating financial coverage, based on her notice.

“Over the next two years, U.S. growth and interest rates are likely to converge with global peers, just as relative valuations are extreme,” stated Shalett.

Meanwhile, the Federal Reserve has been holding its benchmark rate of interest regular at 5.25% to five.5% in an effort to deliver inflation down towards its 2% goal. Many buyers anticipate the Fed will start slicing charges this yr, as U.S. inflation has dropped considerably from its 2022 excessive.

Read: Should stock-market buyers care extra about Nvidia or the Fed? Inflation knowledge will present a check.

‘Hedge affordably’

The Morgan Stanley notice additionally cited “the swelling U.S. deficit,” with Shalett expressing concern over U.S. politics and debt.

U.S. “political and debt sustainability problems may not seem urgent to many, but even modest foreign rebalancing back to home markets could foster volatility that U.S. investors may now hedge affordably,” she stated.

Looking at completely different areas of the world, the iShares Europe ETF

IEV

has gained 1.8% up to now this yr based mostly on afternoon buying and selling ranges on Monday.

As for exchange-traded funds focusing on shares in particular person international locations, shares of the iShares MSCI Japan ETF

EWJ

have jumped 7.6% up to now this yr as of Monday afternoon.

Among ETFs targeted on rising markets, shares of the iShares MSCI India ETF

INDA

have climbed 5.6% yr thus far, whereas the iShares MSCI China ETF

MCHI

have slid 2.8% over the identical interval, based on FactSet knowledge, ultimately verify. Shares of the iShares MSCI Brazil ETF

EWZ

are down 4.6% up to now in 2024 based mostly on Monday afternoon buying and selling, whereas the iShares MSCI Mexico ETF

EWW

has fallen 2.4% this yr.

The U.S. inventory market was buying and selling principally decrease Monday afternoon, with the Dow Jones Industrial Average

DJIA

off 0.1% whereas the S&P 500 shed 0.2% and the technology-heavy Nasdaq Composite

COMP

rose 0.1%, based on FactSet knowledge, ultimately verify. The S&P 500 was slipping after closing Friday at a document excessive.

Source web site: www.marketwatch.com