It doesn’t take lengthy when travelling in Ireland to understand the virtues of contrarian evaluation. That’s as a result of it’s exhausting to seek out traces of the financial system that was almost given up for useless in the course of the 2008 Global Financial Crisis (GFC). Fifteen years later there are traces outdoors most shops, and never simply in areas frequented by vacationers. Restaurants require reservations and pubs are packed.

How instances change. Ireland’s financial system was in such dangerous form 15 years in the past, saddled with seemingly insurmountable ranges of sovereign debt, that the nation was added to that group of 4 southern European international locations whose economies had been already basket instances — Portugal, Italy, Greece and Spain.

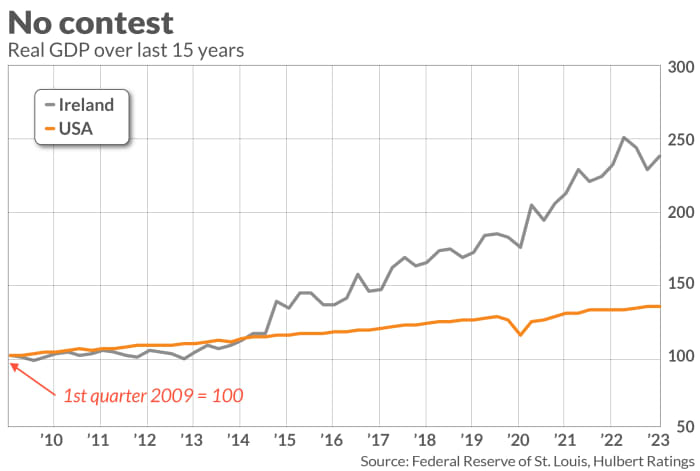

There’s extra than simply anecdotal proof of Ireland’s turnaround. Unemployment is the bottom it’s been for the reason that early 2000s. Since the primary quarter of 2009, the nation’s actual GDP has grown at an annualized tempo of 6.3%. In comparability, U.S. GDP development has been anemic, as you possibly can see from the accompanying chart.

Ireland’s gorgeous development in recent times got here within the wake of many dangerous years main as much as and together with the GFC. But that’s exactly the purpose that contrarians make: Bad instances don’t final ceaselessly, simply as bushes don’t develop to the sky.

This reversion-to-the-mean story implies that Ireland’s financial system received’t develop as quick in coming years because it has since 2009. The common (imply) inflation-adjusted development price for Eurozone economies over the previous three a long time has been 1.5% annualized. Reversion to the imply means that the yearly development price of Ireland’s financial system over the following 15 years will probably be nearer to that price than 6.4% annualized.

That doesn’t imply Ireland’s financial system will develop extra slowly in coming years than the U.S. financial system. U.S. GDP development for the reason that GFC has been barely beneath its long-term common, however not by sufficient for a reversion-to-the-mean prediction of a a lot greater development price in coming years. Contrarians are subsequently inclined to foretell that each economies will develop at related inflation-adjusted development charges over the following decade or so.

Factors within the Irish market’s favor

Two different reversion-to-the-mean elements will work within the Irish inventory market’s favor in coming years, each in its personal proper and relative to the U.S. market. One is the Ireland market’s P/E ratio, which has remained stubbornly low for the reason that GFC, in distinction to the S&P 500

SPX.

This is one motive why the S&P 500 has outperformed the Irish inventory market since 2009, regardless of the U.S. having a a lot slower financial development price.

Consider that each nation’s P/Es had been non-existent on the finish of the GFC, with trailing 12-month EPS adverse in each instances. Today, the MSCI All Ireland Capped Index sports activities a P/E of 12.6, barely half the 23.6 P/E of the S&P 500. If the U.S. inventory market had been buying and selling with the identical P/E ratio at present as Ireland’s, the S&P 500 would presently be beneath 2,400.

The U.S. market’s long-term common trailing 12-month earnings P/E ratio, primarily based on information for the U.S. inventory market again to 1871, is 16.0. On the idea that Ireland’s P/E ratio in coming years will probably be nearer to that imply than its present 12.6, it’s an excellent wager that the nation’s equities will produce spectacular efficiency even when its financial development slows from its blistering tempo for the reason that GFC. Just the other is implied for the U.S. market.

Another reversion-to-the-mean think about Ireland’s favor in coming years, a minimum of to a U.S.-dollar-based investor, is a weaker greenback

DX00,

The reverse has been true over the previous 15 years, because the euro

EURUSD,

has misplaced 20% of its worth in opposition to the greenback, creating vital headwinds for a U.S. investor in Irish equities. Reversion to the imply means that the euro’s worth is not going to proceed to say no at something near its price over the previous 15 years, staying even with the greenback or probably rising. If so, these headwinds might flip into tailwinds.

The backside line? In order for U.S. equities to outperform Irish equities in U.S. greenback phrases, not solely will the greenback must proceed to strengthen in opposition to the euro, however the hole between the 2 international locations’ P/E ratios must widen even additional. Contrarians are inclined in each instances to imagine the pattern will probably be in the other way.

If you might be persuaded by these arguments, maybe the best method to put money into the Irish fairness market is through an ETF. The U.S.-based Irish inventory market ETF with probably the most property underneath administration is the iShares MSCI Ireland ETF

EIRL,

with an expense ratio of 0.50%.

If you’re eager about particular person shares, the desk beneath lists Irish-headquartered firms whose shares are presently advisable for buy by a minimum of one of many funding newsletters whose performances my auditing companies tracks.

| Stock | # newsletters recommending |

| Medtronic PLC (MDT) | 3 |

| Seagate Technology Holdings PLC (STX) | 2 |

| AerCap Holdings NV (AER) | 1 |

| Cimpress PLC (CMPR) | 1 |

| Eaton Corp PLC (ETN) | 1 |

Mark Hulbert is an everyday contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat charge to be audited. He could be reached at mark@hulbertratings.com

More: A rising U.S. greenback is ringing alarm bells abroad. Should stock-market traders fear?

Also learn: China ETFs fall sharply as they lag international shares in 2023

Source web site: www.marketwatch.com