Welcome again from a three-day break honoring America’s founding father, which one congresswoman determined to have a good time by proposing a nationwide divorce. Would a blue and crimson state cut up be good for shares? Bad in all probability for protection contractors however there could be entire new asset courses opening up, so who is aware of. Investors are inclined to reward spinoffs, in spite of everything.

What is actual are the rising tensions between the U.S. and China, and particularly the know-how sector. At the middle of those tensions is satirically sufficient, a Dutch firm. Microchip gear maker ASML

ASML,

has been restricted by the U.S. from promoting probably the most up-to-date gear to China, and now has disclosed theft of mental property by China.

Peter Tchir, head of macro technique at Academy Securities, dubs a possible warfare over semiconductors World War 3.1. He cites a retired lieutenant normal, Robert Walsh, in noting why chips are so vital. For one, the U.S. needs to forestall China from getting the highest-end chips that can be utilized in superior navy methods throughout a battle with the U.S.

Walsh additionally notes the U.S. operational idea for future warfare is the Joint All-Domain Command & Control Strategy, whereas China’s idea is the Multi-Domain Precision Warfare — each needing high-end semiconductors. Walsh provides that China goals to be the worldwide synthetic intelligence chief by 2030 and on par with the U.S. navy by 2035, and that high-end chips are wanted for AI, supercomputing and weaponizing know-how.

Tchir divides the present semiconductor house into 4 — leading edge, which is dominated by Taiwan; excessive tech, which is one to a few generations behind and the place Taiwan is a frontrunner however the U.S. is aggressive; mid-to-low tech, which is international in nature; and commodity chips. And he says there’s an actual danger that the U.S. pushes too exhausting, that Washington blocks know-how that’s not as important, crippling gross sales by U.S. firms to China. “From a commerce standpoint, there is a balancing act that needs to be executed by D.C. So far, so good, but it is something that needs to be watched closely,” says Tchir.

According to FactSet, 29% of the income from firms within the iShares Semiconductor ETF

SOXX,

come from China.

The different main danger from a semiconductor perspective is that China invades Taiwan, or, from its perspective, reunites a renegade province by drive. That would run the danger that the factories could be broken to the purpose they’re inoperable, although the flip facet is that in that situation, the West wouldn’t be capable of get these chips both.

What could be the funding implications of World War 3.1 breaking out? Tchir says in that situation, he would cut back China publicity. The iShares China Large-Cap ETF

FXI,

and the KraneShares CSI China Internet ETF

KWEB,

have been faltering of late as a result of the reopening isn’t going nice, however extra stress from U.S. would additionally harm. He additionally says that there’s an opportunity China decides to provide arms to Russia — a degree U.S. officers have been making loudly of late — which might additional pressure the U.S.-China relationship, already broken by the balloon that flew over the U.S. Tchir mentioned he would additionally watch the U.S. semiconductor house carefully if there have been elevated sanctions.

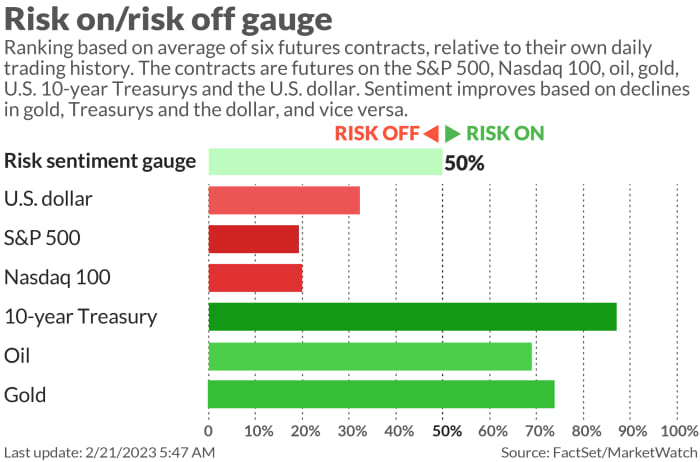

The market

U.S. inventory futures

ES00,

NQ00,

have been weaker as charge fears, in addition to geopolitical tensions, weighed on sentiment. The yield on the 10-year Treasury

TMUBMUSD10Y,

was 3.87%.

For extra market updates plus actionable commerce concepts for shares, choices and crypto, subscribe to MarketDiem by Investor’s Business Daily.

The buzz

Retailers Walmart

WMT,

and The Home Depot

HD,

headline Tuesday’s earnings slate. Home Depot mentioned it expects flat gross sales this yr because it mentioned it was pouring an extra $1 billion into paying retailer associates. Walmart shares slipped 2% because the U.S. retailing large beat on fourth-quarter earnings and gross sales whereas guiding for a fiscal 2024 earnings per share decline on gross sales progress between 2.5% and three%.

Credit Suisse

CS,

shares slumped after Reuters reported a regulatory probe into feedback made by the financial institution’s chairman that outflows had stopped in December, when the financial institution later mentioned they’d continued. HSBC

HSBC,

shares slipped amid 2023 steerage that analysts seen as cautious.

The U.S. economics calendar options flash buying managers indexes and present house gross sales knowledge, forward of Wednesday’s launch of Fed minutes.

President Joe Biden made a shock go to to Ukraine, after which traveled to Eastern Europe. Russian President Vladimir Putin was delivering his state-of-the-nation deal with after a yr of warfare in Ukraine, and pinned the battle’s blame on the West.

Best of the net

Lithium shares crashed — now we all know why.

Ray Dalio will get billions extra to retire.

The man blamed for $577 million of alleged phony nickel shipments.

Top tickers

Here probably the most lively inventory market tickers on MarketWatch as of 6 a.m. Eastern.

| Ticker | Security title |

|

TSLA, |

Tesla |

|

BBBY, |

Bed Bath & Beyond |

|

AMC, |

AMC Entertainment |

|

GME, |

GameStop |

|

AAPL, |

Apple |

|

TRKA, |

Troika Media |

|

NIO, |

Nio |

|

MULN, |

Mullen Automotive |

|

AMZN, |

Amazon.com |

|

APE, |

AMC Entertainment preferreds |

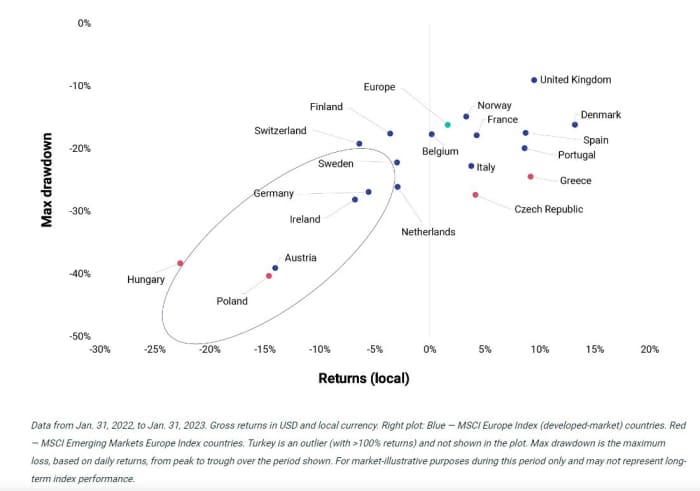

The chart

MSCI

A yr on from Russia’s invasion of Ukraine, it’s seems European equities have dealt with the warfare in their very own yard moderately nicely, as this chart from MSCI reveals. Hungary, Poland and Germany are exceptions, owing to their reliance on Russian vitality.

Random reads

A fond if not-safe-for-work memory of the Nineties.

In the Bahamas, a canine took on a hammerhead shark, and emerged victorious.

Need to Know begins early and is up to date till the opening bell, however join right here to get it delivered as soon as to your electronic mail field. The emailed model shall be despatched out at about 7:30 a.m. Eastern.

Listen to the Best New Ideas in Money podcast with MarketWatch reporter Charles Passy and economist Stephanie Kelton.

Source web site: www.marketwatch.com