Economic danger is merely common proper now. I level this out to counter the various inventory market analysts who’ve warned of their 2024 forecasts that the U.S. economic system’s present danger degree have to be at or close to a document excessive.

And lots of you might be satisfied they’re proper.

The analysts’ recitation of present dangers can be acquainted: The struggle within the Middle East might escalate into World War III. The Ukraine struggle might spiral uncontrolled too. Then there’s the potential for greater U.S. inflation and rates of interest, together with a doable recession. The listing goes on.

The downside with this narrative is in pondering that danger isn’t at all times excessive. Our psyches play tips on us to make us assume that the dangers we’re dealing with proper now are off the charts. That’s as a result of, as soon as we all know how issues end up, we instantly rewrite historical past to inform ourselves that it was apparent that they might end up the way in which they did.

Take the vary of doable outcomes of the U.S. economic system being put into the practical equal of a medically induced coma within the wake of the Covid-19 pandemic. Today we inform ourselves that after all the federal authorities and the Federal Reserve would reply with large fiscal and financial stimulus, and that after all the inventory market would soar in response. But this was something however apparent upfront.

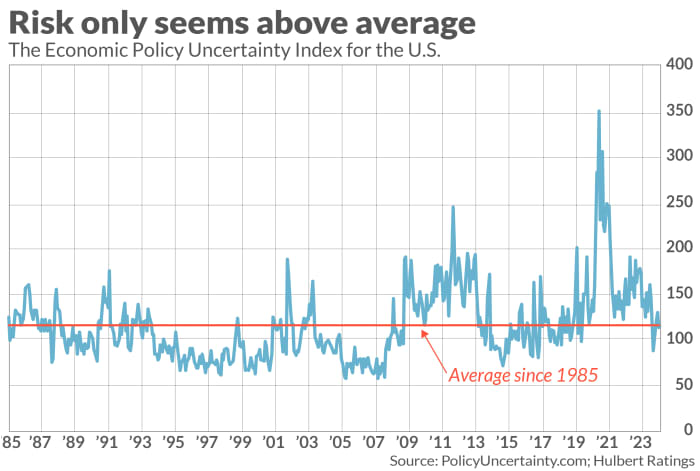

We know that due to an goal measure of financial uncertainty created a number of years in the past by finance professors Scott Baker of Northwestern University, Nick Bloom of Stanford University, and Steven Davis of the University of Chicago. Known because the Economic Policy Uncertainty index, it’s primarily based on month-to-month searches of 10 main U.S. newspapers “for terms related to economic and policy uncertainty” (EPU). The accompanying chart of the previous 4 many years reveals that the EPU peak in early 2020 was greater than thrice the present degree.

Furthermore, as you too can see from the chart, present uncertainty is nearly exactly equal to its four-decade common.

Compensation for danger

You might discover it discouraging that present danger ranges, scary although they might appear, are merely common. Remember, nonetheless, that danger is crucial if the inventory market is to supply future returns as spectacular as these up to now. Without future danger as excessive as its historic common, the market’s long-term future return could be a lot decrease. So watch out what you would like for (and cautious what you complain about).

You might want the market’s return to be excessive and danger to be low, however you may’t have it each methods.

Mark Hulbert is a daily contributor to MarketWatch. His Hulbert Ratings tracks funding newsletters that pay a flat payment to be audited. He may be reached at mark@hulbertratings.com

More: No charge cuts in 2024? Why traders ought to take into consideration the ‘unthinkable.’

Also learn: Funds pile into actual property, money and commodities to protect towards interest-rate reversal

Source web site: www.marketwatch.com